A GST return is a document that contains information about all income/ sales/expenses/purchases that a GST registered taxpayer is expected to report to the tax authorities. Tax authorities use this to compute net tax liability.

Reetu | Aug 24, 2023 |

GST Return Filing: Interplay of GSTR-1, GSTR-3B, GSTR-2B and Tax Payment

A GST return is a document that contains information about all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is expected to report to the tax authorities. Tax authorities use this to compute net tax liability.

GST return filing in India is required for all organisations with a valid GST registration, regardless of business activity, sales, or profitability during the period of filing the returns. As a result, even an inactive firm with a valid GST registration is required to file GST returns.

GSTR-1 filing to be stopped if you have mismatch in your GSTR-Returns: Brief Analysis

In this article we are going to see the conditions comes in the process of filing GST Return.

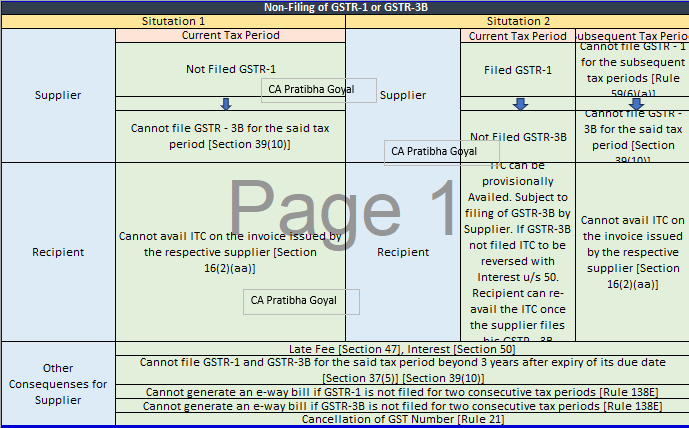

When there is a case of non-filing of GSTR-1 or GSTR-3B. There are two type of situation arise. Let’s look into this situation.

Situation 1:

Current Tax Period

If the Supplier has not Filed GSTR-1, then he cannot file GSTR – 3B for the said tax period [Section 39(10)].

And then the Recipient Cannot avail Input Tax Credit [ITC] on the invoice issued by the respective supplier [Section 16(2)(aa)].

Situation 2:

Current Tax Period

If Supplier has Filed GSTR-1 but he does not Files GSTR-3B. Then, the Recipient can avail ITC provisionally. This is subject to the filing of GSTR-3B by the Supplier. If GSTR-3B is not filed by the supplier by the 30th day of September following the end of the financial year, ITC is to be reversed by the recipient on or before the 30th day of November following the end of such financial year with Interest u/s 50. The recipient can re-avail the ITC once the supplier files his GSTR – 3B [Section 16(2)(C) read with Rule 37A].

Subsequent Tax Period

If the Supplier has not filed GSTR-3B of the Previous Tax period, he Cannot file GSTR-1 for the subsequent tax periods [Rule 59(6)(a)].

And in that case, Recipient Cannot avail ITC on the invoice issued by the respective supplier [Section 16(2)(aa)].

Other Consequences for Supplier in both Situations:

All the above situations are explained by the table given below.

When there is a case, where GSTR-1 and GSTR-3B filed, but Output Tax Liability in GSTR-1 is more than Output Tax Liability in GSTR-3B [Rule 88C]. Following Consequences needs to bear by supplier and recipient as well. Let’s look into it.

Current Tax Period

If tax payable by Supplier as per FORM GSTR-1 or IFF > FORM GSTR-3B, then Intimation to be sent in Part A of FORM GST DRC-01B.

Within 7 days, supplier needs to-

Pay the differential tax liability, along with interest under section 50 [FORM GST DRC-03].

OR

Explain the aforesaid difference.

AND When,

Where any amount specified in the FORM GST DRC-01B remains unpaid and where no reasonable explanation is furnished, the said amount shall be recoverable in accordance with the provisions of section 79.

In above mentioned case, the Recipient Cannot avail of ITC [Section 16(2)(c)], ITC availed to be reversed.

Subsequent Tax Period

The Supplier, Cannot file GSTR – 1 for subsequent tax period unless differential tax has either been deposited by him or reply has been furnished with reasons [Rule 59(6)(d)]. Accordingly, he Cannot file GSTR – 3B also for the said tax period [Section 39(10)].

Then, in this case, the Recipient will also be not able to avail ITC on the invoice issued by the defaulter supplier [Section 16(2)(aa)].

Other Consequences for Supplier:

In a case of where Input Tax Credit in GSTR-3B is more than ITC available in GSTR-2B. The following Consequences needs to bear by supplier and recipient as well. Let’s look into it.

Current Tax Period

If ITC availed by Supplier in GSTR-3B > ITC available in GSTR-2B.

Then within 7 Days Pay the differential tax liability, along with interest under section 50 [FORM GST DRC-03].

OR

Explain the aforesaid difference.

AND When,

Where any amount specified in the FORM GST DRC-01C remains unpaid and where no reasonable explanation is furnished, the said amount shall be recoverable in accordance with the provisions of section 73/74, [SCN to be issued].

In that case, Section 16(2)(ba) comes into the picture but currently, there is no mechanism to communicate of Recipient of this default.

Subsequent Tax Period

If Supplier, Cannot file GSTR – 1 for subsequent tax period unless differential tax has either been deposited or reply has been furnished with reasons [Rule 59(6)(e)].

Then he Cannot file GSTR – 3B for the said tax period [Section 39(10)].

And Recipient Cannot avail ITC on the invoice issued by the respective supplier [Section 16(2)(aa)].

Other Consequenses to be bear Supplier:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"