As per the amended GST Law, now your GSTR-1 Filing would be stopped if you have Mis-match in GST Returns like the Outward Tax Liability Disclosed in GSTR-1 is more than in GSTR-3b

CA Pratibha Goyal | Aug 23, 2023 |

GSTR-1 filing to be stopped if you have mismatch in your GSTR-Returns: Brief Analysis

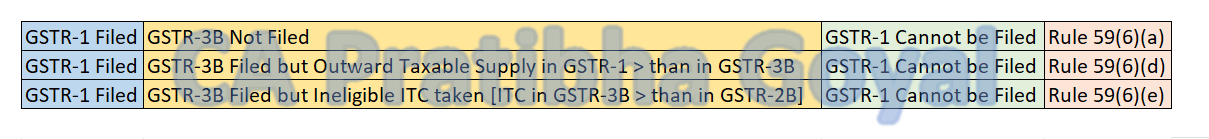

As per the amended GST Law, now your GSTR-1 Filing would be stopped if you have Mis-match in GST Returns. Taxpayers may note that now, if the Outward Tax Liability Disclosed in GSTR-1 is more than in GSTR-3b or the Input Tax Credit Availed in GSTR-3B is more than that available in GSTR-2B, then your GSTR-1 Filing would be stopped.

This is being done to curb the menace of Bogus Billing, Fake Invoicing, and passing on Fake Input Tax Credits (ITC) where mainly ITC was passed by Filing GSTR-1 and GSTR-3B was not filed, or Tax Liability was not disclosed in GSTR-3B or Ineligible ITC was availed in GSTR-1.

GSTR-1 Filled for passing Fake ITC; No GSTR-3B Filed

As per GST Rules, a registered person shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1, if he has not furnished the return in FORM GSTR-3B for the preceding month;

GSTR-1 Filled for passing Fake ITC; GSTR-3B Filed with Outward Taxable Supply in GSTR-1 > than in GSTR-3B

Seller to get Intimation in Part A of FORM GST DRC-01B. As per GST Rules, a registered person, to whom an intimation has been issued on the common portal under the provisions of sub-rule (1) of rule 88C [Form DRC-01B] in respect of a tax period, shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or using the invoice furnishing facility for a subsequent tax period, unless he has either deposited the amount specified in the said intimation or has furnished a reply explaining the reasons for any amount remaining unpaid, as required under the provisions of sub-rule (2) of rule 88C

GSTR-1 Filled for passing Fake ITC; GSTR-3B Filed with ITC in GSTR-3B > than in GSTR-2B

Seller to get Intimation in Part A of FORM GST DRC-01C. As per GST Rules, a registered person, to whom an intimation has been issued on the common portal under the provisions of sub-rule (1) of rule 88D [Form DRC-01C] in respect of a tax period or periods, shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or using the invoice furnishing facility for a subsequent tax period, unless he has either paid the amount equal to the excess input tax credit as specified in the said intimation or has furnished a reply explaining the reasons in respect of the amount of excess input tax credit that still remains to be paid, as required under the provisions of sub-rule (2) of rule 88D;

Impact on Buyer

Now if the Seller has not Filed GSTR-1 and furnished the B2B Invoice correctly, the Buyer cannot avail ITC as per Section 16(2)(aa) of the CGST Act 2017.

Ultimately this is going to impact the menace of Fake Billing in GST to a large extent. But the genuine buyer and sellers are going to face the real heat because of these provisions.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"