The Goods and Services Tax Network (GSTN) has issued an advisory on GST REG-07 related to GST Registration for Metal Scrap Buyers.

Reetu | Oct 23, 2024 |

GSTN issues Advisory on GST REG-07 related to GST Registration for Metal Scrap Buyers

The Goods and Services Tax Network (GSTN) has issued an advisory on GST REG-07 related to GST Registration for Metal Scrap Buyers.

GSTN has introduced an update to facilitate the registration compliance for buyers of metal scrap through form GST REG-07. This update corresponds to the new GST provisions for metal scrap buyers indicated in the advisory issued on October 13.

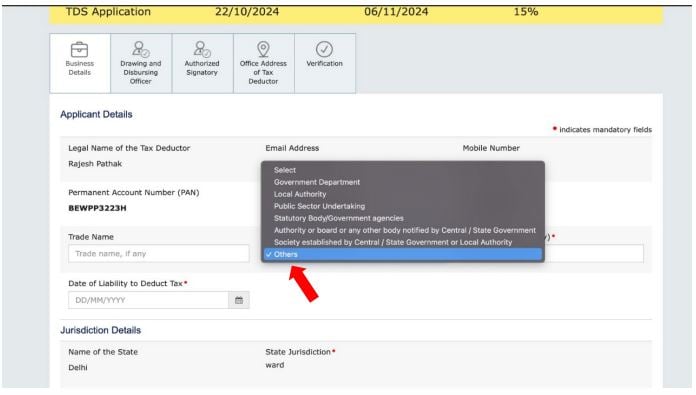

Taxpayers in this category are required to select “Others” in Part B of Table 2 under the “Constitution of Business” section.

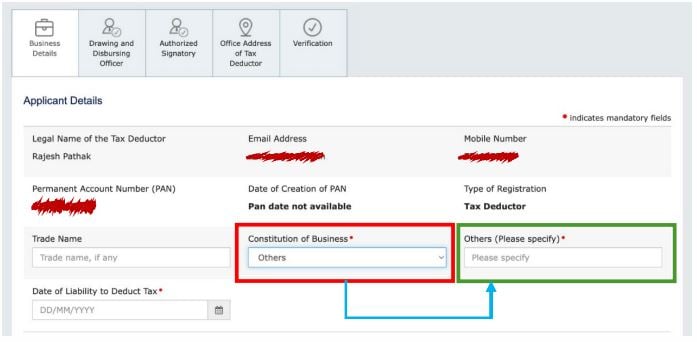

A text box will appear where the taxpayer must enter “Metal Scrap Dealers”.This entry is mandatory for those selecting the “Others” option in Table 2. Once this is completed, the remaining details in form GST REG-07 should be filled and submitted on the common portal to meet the registration requirements as per Notification No. 25/2024 – Central Tax, dated October 9, 2024.

A screenshot of the form GST REG-07 is enclosed below with the relevant sections highlighted:

GSTN urged metal scrap buyers to finish this process as soon as possible in order to comply with the updated GST provisions and prevent non-compliance issues.

The advisory offers visual guidance and highlighted sections of the new Form GST REG-07 to help taxpayers navigate the registration procedure smoothly.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"