CA Pratibha Goyal | May 16, 2023 |

GSTN News: GST Annual Return for 2022-23 Enabled

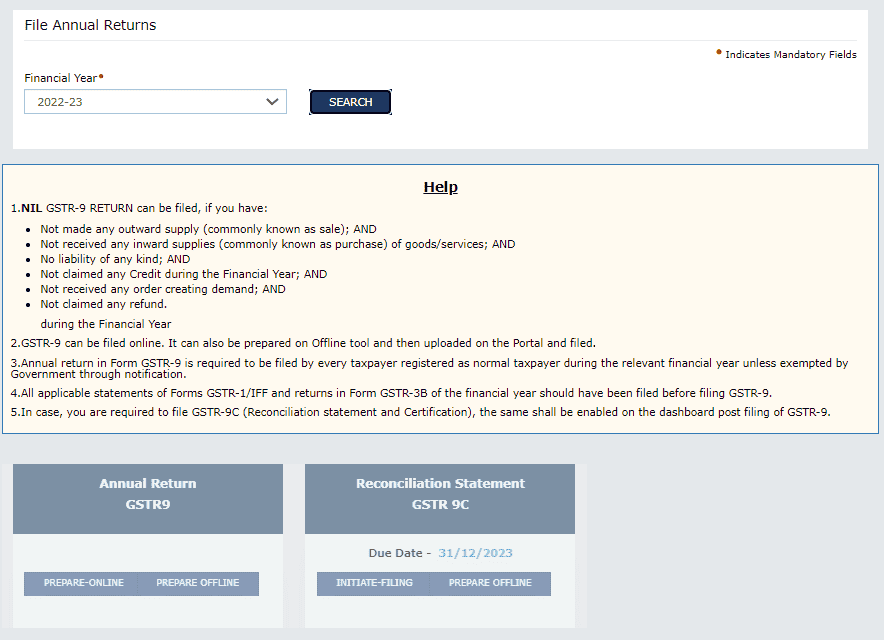

The Goods and Service Tax Network (GSTN) has enabled GST Annual Return (GSTR-9) and GST Reconcilliation Statement (GSTR-9C) for FY 2022-23 on GST Portal.

The Due Date of Filing GSTR-9 and GSTR-9C for FY 2022-23 is 31st December 2023.

To file your GSTR-9, filing of all applicable returns/statements (GSTR-1 and GSTR-3B) are mandatory. GSTR-9C can be filed once filing of GSTR-9 is complete.

GSTN News: GST Annual Return for 2022-23 Enabled

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"