Reetu | May 10, 2020 |

How to Add Delete salary TDS details: Online correction of Salary TDS Return

1. Important Information on Online Correction – Add/Delete Salary Details- Annexure-II.

2. Most Common Error While filing Online Correction.

3. Brief Steps for Online Correction – Add/Delete Salary Details- Annexure-II.

4. Status of Online Correction Requests.

5. Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II.

1. Important Information on Online Correction

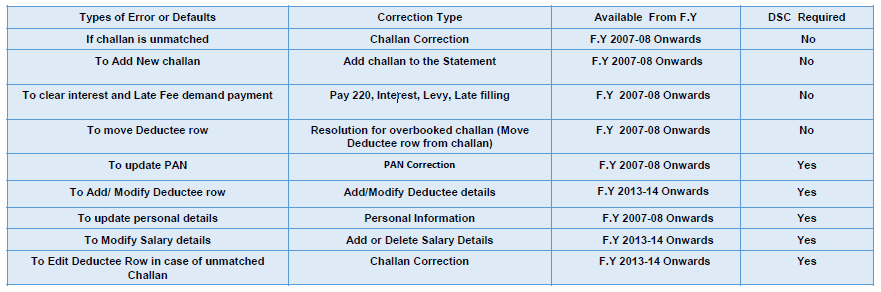

All type of corrections like “Personal information , Deductee details and Challan correction” can be made using Online correction functionality available from FY.2007-08 onwards depending upon the type of correction.

How to Add Delete salary TDS details: Online correction of Salary TDS Return

This feature is extremely useful as it is :

Free of Cost : TRACES does not charge any fee for doing online correction

Time saving: No need to request for Conso file and wait for file availability. Just raise a request and you can select the type of correction you wish to proceed with. Correction gets processed in 24hrs

Effort saving: No need of any software/ CD/PEN drive , just login and file the correction

Enhance efficiency: Error specific correction is possible

Note: For paper return online correction cannot be done

2.Most Common Error While filing Online Correction

2.1 Most Common Error While filing Online Correction (Contd.)

3.Brief Steps for Online Correction – Add/Delete Salary Details-Annexure-II

4. Status of Online Correction Requests

How to Add Delete salary TDS details: Online correction of Salary TDS Return

5. Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 1 : Login to TRACES website with your “User ID”, “Password”, “TAN of the Deductor” and the “Verification Code”

5.1 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Welcome Page

5.2 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 2 : Click on “Request for correction” under “ Defaults“ Tab

5.3 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 3 : Enter relevant Financial Year, Quarter, Form Type and Correction category should be “Online” and Click on “Submit Request” button

5.4 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 3(Contd.): Request Number will be generated

5.5 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 3(Contd.): Request will be available under “Track Correction Request”

5.4 Pictorial guide for Online Correction – Add/Delete Salary Details-Annexure-II

Step 4: Validate KYC using DSC supported KYC option.

5.5 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Step 4 (Contd.): Validate KYC using DSC supported KYC option

5.6 Pictorial guide for Online Correction – Add/Delete Salary Details Annexure-II

Step 5: After KYC validation, select the Type of Correction Category from the drop down as “Add/Delete Salary Details- Annexure-II”

5.7 Pictorial guide for Online Correction – Add/delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Default Deductee

5.8 Pictorial guide for Online Correction – Add/delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Default Deductee

5.9 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Default Deductee:- After clicking on “Delete Deductee Row” button a Confirmation pop-up will be displayed on screen

5.10 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Default Deductee

5.11 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : All Deductee

5.12 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : All Deductee:- Deductee rows will appear on the screen

5.13 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : All Deductee

5.14 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Important Information on Add /Delete Salary Detail – Annexure II : Add New Deductees

5.15 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Add New Deductees

5.16 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Add New Deductees

5.17 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Add New Deductees

5.18 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Newly introduced columns from F.Y 2018-19 (contd..)

5.19 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Newly introduced columns from F.Y 2018-19 (contd..)

5.20 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Newly introduced columns from F.Y 2018-19 (contd..)

5.21 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Newly introduced columns from F.Y 2018-19 (contd..)

5.22 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Newly introduced columns from F.Y 2018-19 (contd..)

5.23 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Add New Deductees (contd..)

5.24 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Add /Delete Salary Detail – Annexure II : Add New Deductees (contd..)

5.25 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

After submitting correction below message will display on screen

5.26 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Select a row and click on „View Statement‟ button to view Action Summary

5.27 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Action Summary- Sub-User log in

5.28 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Action Summary – Admin-User log in

5.29 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

After confirmation of correction click on “Submit for Processing” button

5.30 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

Web signer window will be displayed to validate the DSC

5.31 Pictorial guide for Online Correction – Add/Delete Salary Details- Annexure-II

“Correction statement submitted successfully” message will appear on the screen after final submission correction

Tags: Income Tax, TDS

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"