How to Link PAN & Aadhar on Income Tax Portal 2.0

Deepak Gupta | Jun 17, 2021 |

How to Link PAN & Aadhar on Income Tax Portal 2.0

As you know that as per section 139AA in case of failure to link PAN with the Aadhaar number the Permanent Account Number [PAN] allotted to the person shall be made inoperative. As of now the due date for linking PAN & Aadhar is 30th June 2021.

You May Also Refer: What will happen if you Don’t Link your PAN with Aadhar?

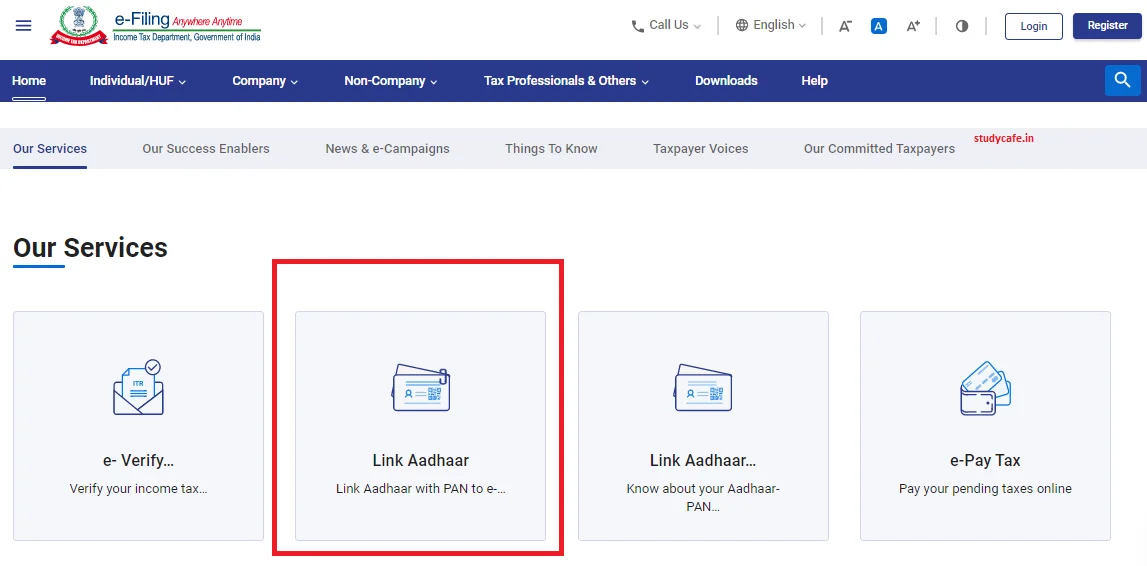

This article discusses the process of linking PAN & Aadhar on Income Tax Portal 2.0.

Visit Link: https://www.incometax.gov.in/

How to Link PAN & Aadhar on Income Tax Portal 2.0

1. Name, Date of Birth, and Gender as per PAN will be validated against your Aadhaar Details

2. Please ensure that ‘Aadhaar Number’ and ‘Name as per Aadhaar’ are exactly the same as printed on your Aadhaar card.

3. UIDAI Circular F.No. K-11022/631/2017-UIDAI with regard to discontinuation of the partial match in Demographic Authentication w.e.f 1-2-2017 by UIDAI.

How to Link PAN & Aadhar on Income Tax Portal 2.0

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"