How To Verify TDS Certificate Online; know the Details Here

Reetu | May 16, 2022 |

How To Verify TDS Certificate Online; know the Details Here

TDS was implemented with the goal of collecting tax from the source of income. According to this notion, a person (deductor) who is required to make a defined payment to another person (deductee) must deduct tax at source and send it to the Central Government. The deductee whose income tax has been deducted at source is entitled to credit for the amount deducted on the basis of the deductor’s Form 26AS or TDS certificate.

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Tax Payers.

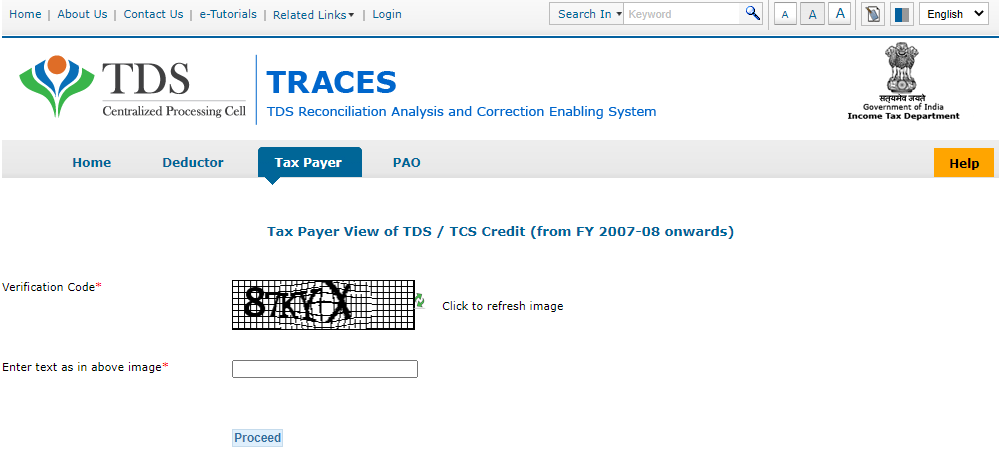

Visit https://www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml

Enter the Captcha code and click on Proceed

Fill the requisite details such as “TAN of Deductor”, “PAN of Tax Payer”, “TDS Certificate Number”, “Financial Year”, “Source of Income” and “TDS Amount Deducted as per Certificate” and click on “Validate”

TDS/TCS credit can also be checked by giving some details like “PAN of Deductee”, “TAN of Deductor”, “Financial Year” “Quarter” and “Type of Return” and click on “Go”.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"