ICAI released FAQs on Know Your Member (KYM)

The Institute of Chartered Accountants of India (ICAI) has released Frequently Asked Questions on Know Your Member (KYM).

ICAI Know Your Member (KYM) is a newly developed Form in which members are required to provide certain information as desired in the KYM Form on an annual basis online through Self Service Portal login.

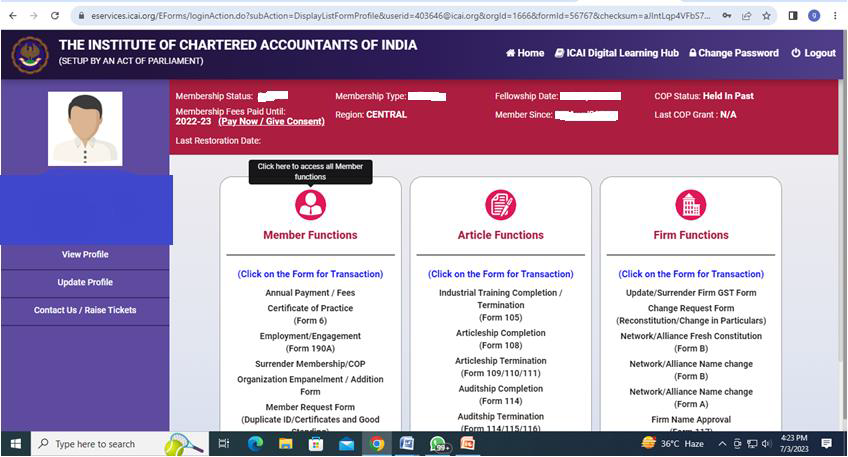

KYM form is available in Self Service Portal under ‘Member Functions’.

Kindly note that Member can make the Annual Fees payment only after submission of KYM Form. However, Member need not wait for approval of KYM for Annual Fees Payment.

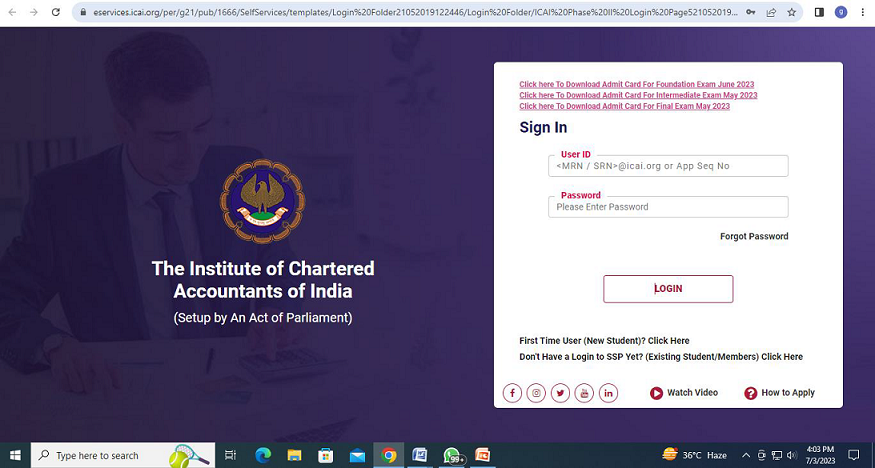

Login in Self Service Portal (SSP)

KYM Form is available in Member Function Option – Step 1

KYM Form is available in Member Function Option – Step 2 – after clicking on Member Function this page will appear

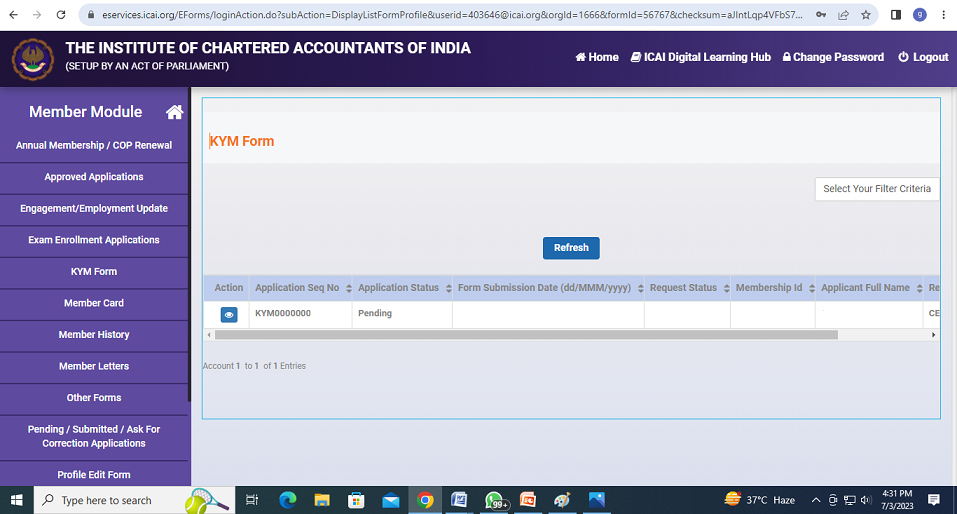

How to open the KYM Form after first time seeing it

Once the KYM Form is opened but not successfully submitted, the same will be available under Member Module option. Follow the following path:

- Login into Self Service Portal

- Click on Member functions

- KYM Form

Information/ Documents required for KYM

- PAN No. along with Proof (If already not updated).

- GST No. along with Proof (If already not updated).

- Latest passport size official Photograph along with Id proof.

- Permanent Address along with supporting document.

- Designation in Employment If applicable.

- Self-Employed Details (Those who are neither in practice nor in employment).

- Professional Address along with supporting document.

- Independent Directorship details (Details of Director Simpliciter not required).

- Details of pending cases with Professional Bodies or any court/authority if applicable.

- Declaration for its correctness and Section 8 compliance.

PAN CARD Details

Members can update their PAN card and attach Scanned copy of Original PAN Card.

In case, any member do not have PAN Card of India, they may skip this option.

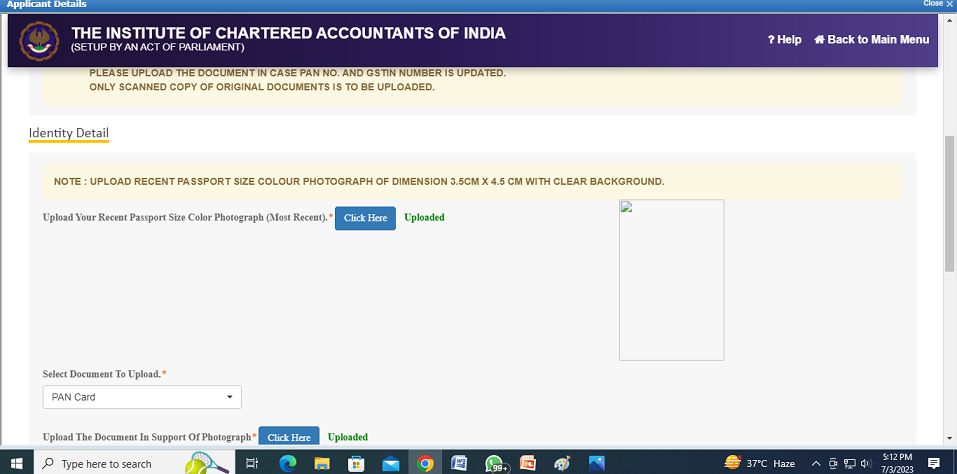

Latest Photograph and ID Proof

Member’s need to upload his latest photographs and can upload any one of the following documents-

- Driving License (Having Validity)

- Passport (Front and Back Copy and having validity),

- Voter Id (Election Card Front and Back Copy),

- Pan Card

Note: Before uploading the document, kindly select the type of document.

Screen Shot of Photo and ID update

Prescribed Documents of Permanent Address proof

Any one of the following documents-

- Driving License (Having Validity),

- Passport (Both Front and Back Page and having validity),

- Voter Id (Election Card – Both Front and Back Page),

- Electricity/ Water/ Gas Bill (not more than 3 months old)

- Property Tax Receipt

- Rent Agreement (Should be on Stamp Paper and not expired)

- Bank Statement not older than 3 months (Statement of your Individual name only)

- In case, you are residing with your parents or relatives, you can upload the electricity/water/Gas Bill/ Property Tax Receipt Documents of your close relatives along with permission letter from them. (Format Attached).

To Read More Download PDF Given Below:

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"