This year, Income Tax Rebate u/s 87A has become a new topic of discussion for taxpayers. The ITR Filing Utility has been updated again to give rebate under Section 87A.

CA Pratibha Goyal | Jan 7, 2025 |

Income Tax Rebate u/s 87A: New Update in ITR Utility

This year, Income Tax Rebate u/s 87A has become a new topic of discussion for taxpayers. The Income Tax Return (ITR) Filing Utility has been updated again to allow users to modify and update the rebate under Section 87A.

The whole issue started on 5th July 2024 when an update was made in the ITR Filing Utility, which did not allow income tax rebates in the New Tax Regime on special incomes like Short Term Capital Gain.

Now the ITRs filed before 5th July 2024 allowed income tax rebates under New Tax Regime on special rate incomes and the same were processed with the Income Tax Demand.

In this matter a Public Interest Litigation (PIL) is filed by the The Chamber of Tax Consultants against the modification in the Income Tax return utility with effect from 5th July 2024, which prevented the resident individuals from claiming the rebate under section 87A of Income Tax, 1961.

Bombay High Court Judgment

The Bombay High Court ordered the Central Board of Direct Taxes (CBDT) to issue the requisite notification under Section 119 of the Act extending the due date for e-filing of the ITR from December 31, 2024, at least to January 15, 2025, to ensure that all taxpayers eligible for the rebate under Section 87A are allowed to exercise their statutory rights without facing procedural impediments.

Due Date Extension

As a result, the ITR filing due date for filing belated/ Revised Return for Financial Year 2023-24 was extended by the CBDT from December 31, 2024, to January 15, 2025.

ITR Utility Update

Latest update of Excel Utility for ITR-1 and ITR-4 were released on 01-Jan-2025

Latest update of Excel Utility for ITR-2 and ITR-3 were released on 04-Jan-2025

Latest update of Common Offline Utility for filing Income-tax Returns ITR 1, ITR 2, ITR 3 and ITR 4 is still not released.

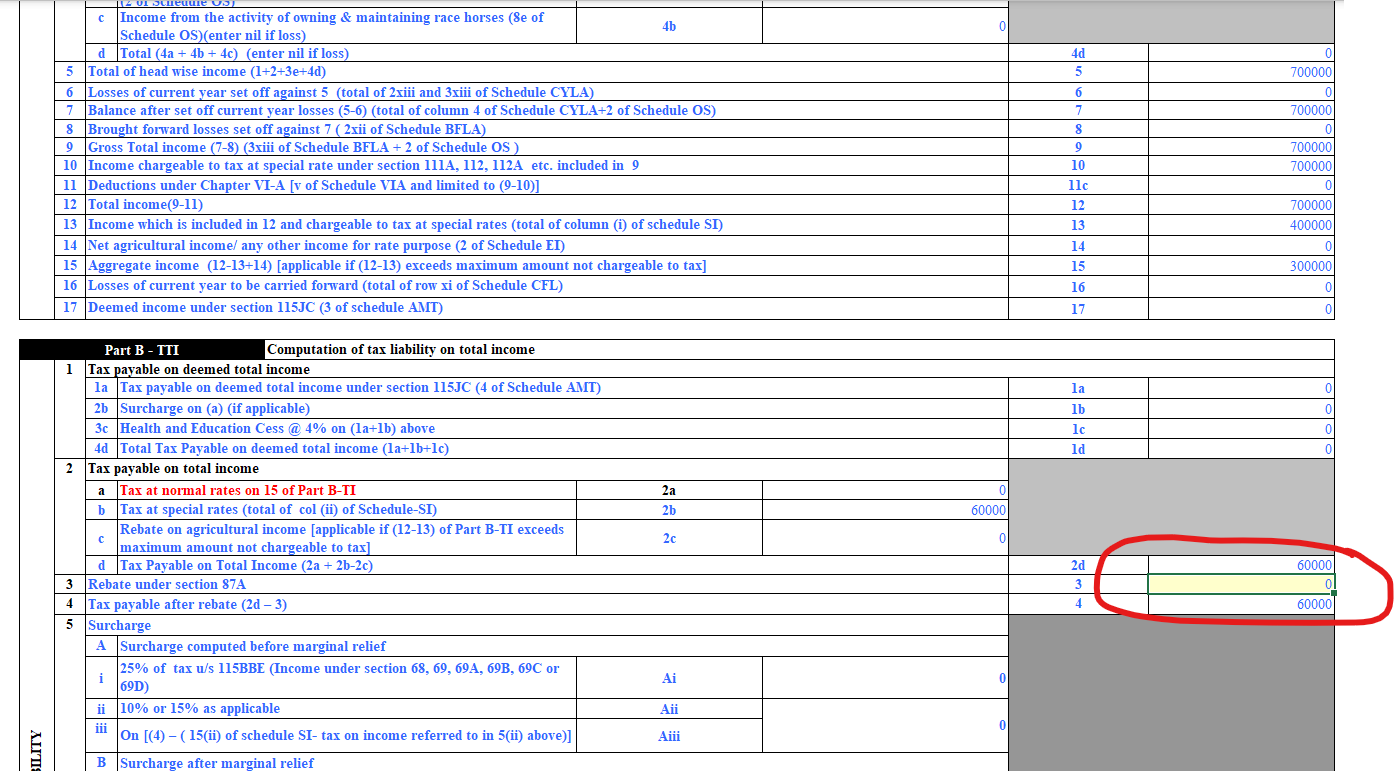

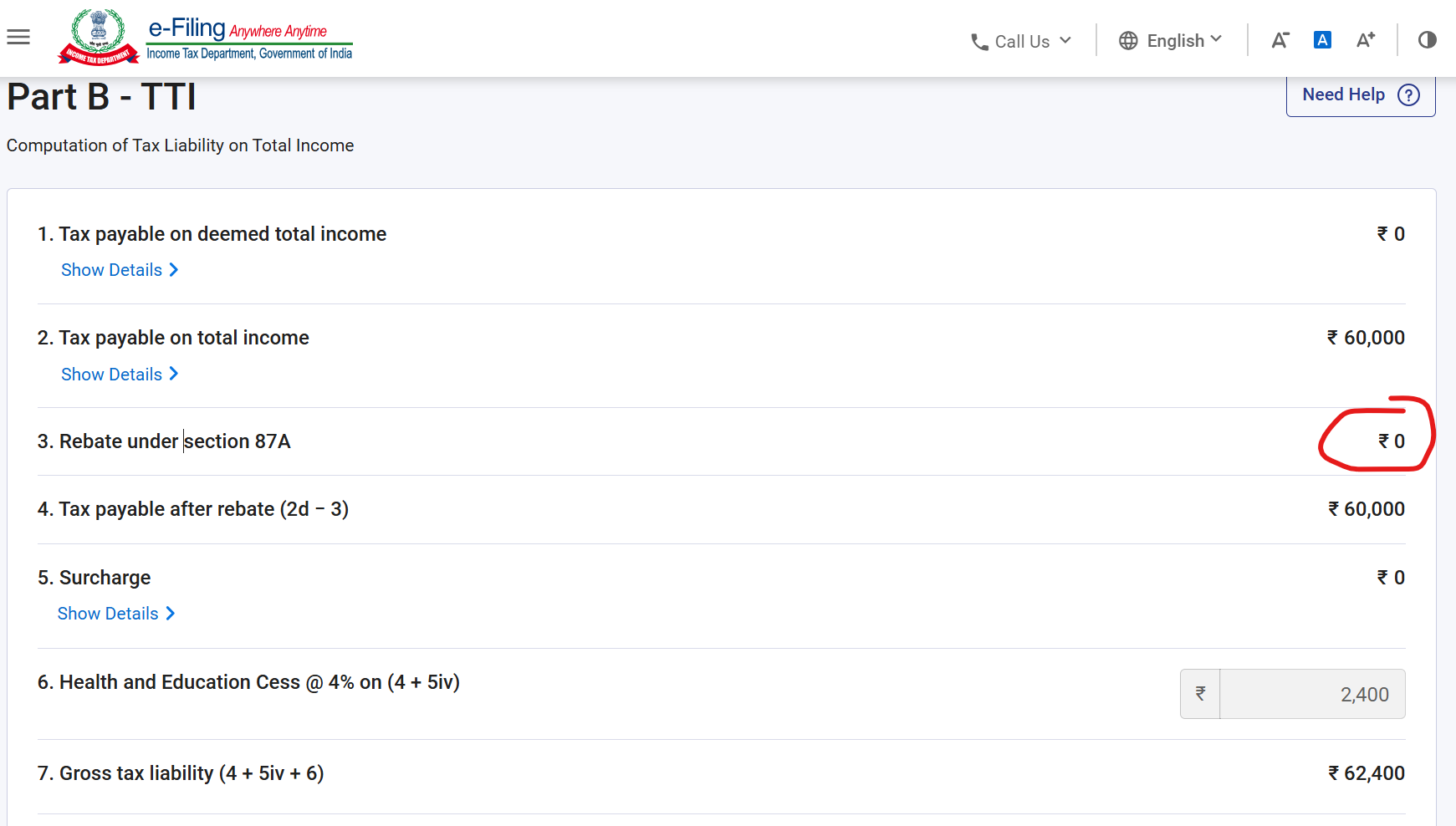

The latest version of the Excel utility now allows users to modify and update the rebate under Section 87A. However, the default tax calculation still does not provide the rebate on special rate income.

Users can manually modify the relevant field to avail of the Section 87A rebate on such income. This field was un-editable in earlier version of excel utility.

However, the Income Tax Return (ITR) Filing portal is still not showing the option to edit the rebate if you file the ITR via online mode.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"