The Income Tax Department has issued a reminder to taxpayers regarding the validation of bank accounts for tax refunds.

Reetu | Jun 6, 2024 |

Income Tax Reminds: Validated Bank Account necessary for Tax Refund

The Income Tax Department has issued a reminder to taxpayers regarding the validation of bank accounts for tax refunds.

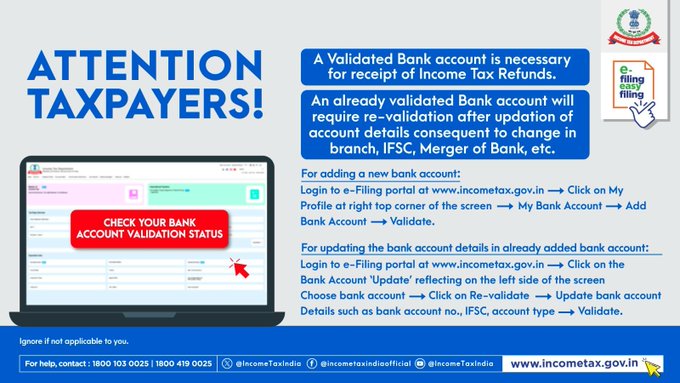

On his official Twitter account tax department wrote, “Kind Attention Taxpayers! ✅Having a validated bank account is essential for receiving of refunds. ✅An already validated bank account will require re-validation after the updation of account details consequent to change in the branch, IFSC, Merger of the bank, etc.”

Please visit the income tax e-filing portal ➡️Login ➡️ Profile ➡️ Choose Bank Account ➡️ Revalidate ➡️Update Bank Account Details such as a/c No., IFSC, a/c type ➡️Validate.

Please visit the income tax e-filing portal ➡️ Login ➡️ Profile ➡️ My Bank Account ➡️ Add Bank Account ➡️Validate.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"