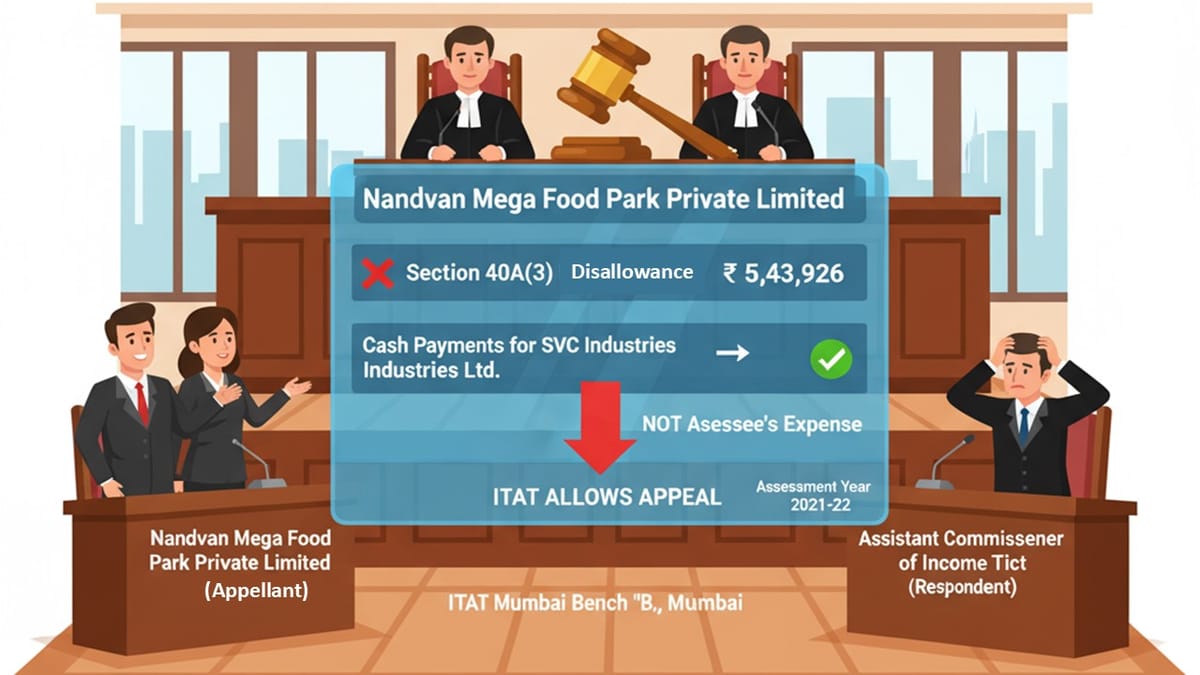

ITAT Mumbai ruled that cash payments made on behalf of another company cannot be disallowed under Section 40A(3), deleting the Rs. 5.43 lakh addition.

Saloni Kumari | Nov 11, 2025 |

ITAT Deletes Disallowance Under Section 40A(3) for Cash Payments Made on Behalf of Third Party

The assessing officer (AO) recently made a disallowance on a company of Rs. 543,926 under section 40A(3). The ITAT ruled that since the cash payments were made for another company and were not claimed as the assessee’s own business expenses, Section 40A(3) did not apply. Hence, the addition made by the tax officer was dismissed.

The present appeal has been filed by a company named Nandvan Mega Food Park Private Limited (Appellant) against the Assistant Commissioner of Income Tax, Central Circle – 6(2) (Respondent) in the Income Tax Appellate Tribunal (ITAT) “B” Bench, Mumbai, before Shri Vikram Singh Yadav (Accountant Member) and Shri Sandeep Singh Karhail (Judicial Member). The case is related to the assessment year 2021-22.

The appeal has been filed challenging an order dated 29.03.2025, issued under section 250 of the Income Tax Act, 1961, by the learnt Commissioner of Income Tax (Appeals) [CIT(A)]. When the hearing was scheduled on this case, no one attended the hearing in person and no application was even furnished seeking any postponement or adjournment. Also, the notice sent to the assessee informing them of the scheduled date of the hearing via registered post was returned unserved. Therefore, the present case has been decided by only hearing one side, i.e., the learnt Departmental Representative (DR), not the assessee, meaning the present order is an ex parte order.

Background of Case:

The company is involved in the business of manufacturing, trading, and deemed manufacturing, including the processing of agro-based products, including packing or non-packing. A search and seizure operation under Section 132 of the Income Tax Act was carried out in the case of M/s Overseas Infrastructure Alliance (India) Private Limited. Following this, a notice under Section 148 was issued to the assessee on March 09, 2023.

In response to this notice, on May 05, 2023, the assessee filed its income tax return (ITR), declaring a total loss of Rs. 45,65,949. Thereafter, the assessee was issued statutory notices under section 143(2) and section 142(1) of the Act for further assessment.

During the review of records, the Assessing Officer (AO) noticed from the books of M/s SVC Industries Ltd. that the assessee had made cash payments exceeding Rs. 10,000 per day, totalling Rs. 543,926 during the year. The AO asked the assessee to explain why these payments should not be disallowed under Section 40A(3), which restricts large cash payments.

Since the AO was not satisfied with the explanation given by the assessee, the AO added Rs. 543,926 to the assessee’s income under Section 40A(3).

CIT(A)’s Decision:

Assessee dissatisfied with the action of the assessing officer (AO), then filed an appeal before the Commissioner of Income Tax (Appeals) [CIT(A)]; however, the CIT(A) endorsed the arguments served by the assessing officer and dismissed the appeal vide the present impugned order dated 29.03.2025.

ITAT Mumbai’s Decision:

Thereafter, the assessee filed an appeal challenging the CIT(A)’s order by the Commissioner of Income Tax (Appeals) [CIT(A)] confirming a disallowance of Rs. 543,926 under Section 40A(3) of the Income Tax Act. This section disallows cash payments exceeding Rs. 10,000 made for business expenses.

The ITAT noted the following:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"