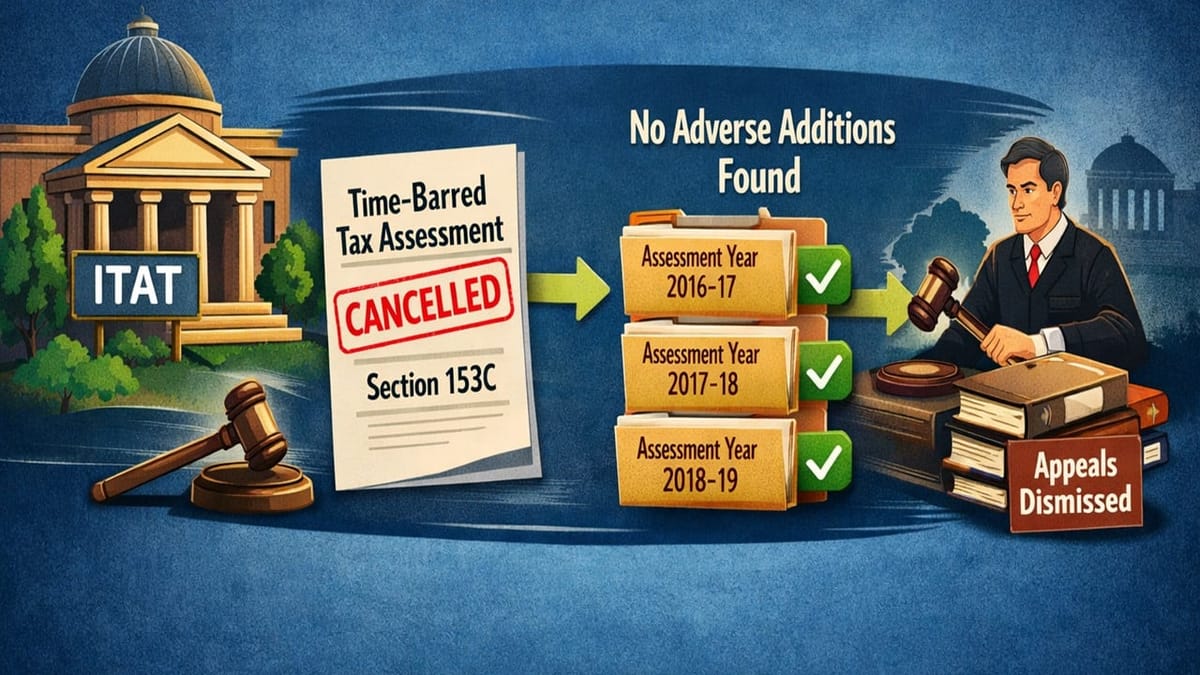

ITAT cancels time-barred tax assessment under Section 153C and dismisses appeals for later years after no adverse additions were found.

Saloni Kumari | Jan 30, 2026 |

ITAT Delhi Holds 2012-13 Assessments Invalid in Search-Based Reopening Case

Rajesh Gandhi and Ramesh Gandhi have filed multiple appeals for different assessment years in the Income Tax Appellate Tribunal (ITAT) Delhi. The case is related to the assessment years 2019-20, 2019-20, 2021-22, 2012-13, and 2012-13. The appeals were related to the common issue; hence, the tribunal heard them all simultaneously and released a common order.

The key dispute relates to income tax assessments made by the Assessing Officer (AO) under Section 153C of the Income Tax Act following a search and seizure operation conducted in October 2020 on third parties connected to alleged unaccounted transactions.

For the Assessment Year 2012-13, the AO had made an addition of Rs. 68 lakh to the assessee’s income on the grounds of a seized property payment receipt that suggested a flat had been sold by the assessees for Rs. 98 lakh. The aggrieved assessee challenged this assessment before the tribunal, claiming the said assessment proceedings conducted under Section 153C were time-barred (initiated beyond the legally allowed ten-year block period) and hence should be held as invalid. It was further highlighted that no valid satisfaction note had been recorded or shared, which is an obligatory requirement as per the law.

The tribunal endorsed the arguments of the assessee and ruled that the relevant ten-year block period should begin from Assessment Year 2023-24, meaning the earliest year that could be assessed was Assessment Year 2014-15. To support this ruling, the tribunal cited earlier judgments of the Supreme Court and the Delhi High Court. Since Assessment Year 2012-13 fell outside this period, the Tribunal ruled that the tax department had no legal authority to reopen or assess that year. In conclusion, the tribunal held the assessment order for Assessment Year 2012-13 as invalid and time-barred for both Rajesh Gandhi and Ramesh Gandhi.

For Assessment Years 2019-20, 2020-21, and 2021-22, the Tribunal observed that the CIT(A) had already held the earlier assessments as invalid and remanded the cases to the Assessing Officer (AO) for fresh consideration. After reassessment, no adverse additions were made against the assessee. Therefore, the Tribunal dismissed these appeals, as they had become irrelevant.

In conclusion, the Tribunal allowed the appeals related to Assessment Year 2012-13 and dismissed the appeals for Assessment Years 2019-20 to 2021-22.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"