The Tribunal agreed with the assessee company, observing that the CIT(A) did not decide the matter on merits and dismissed the appeal for want of prosecution.

Nidhi | Dec 24, 2025 |

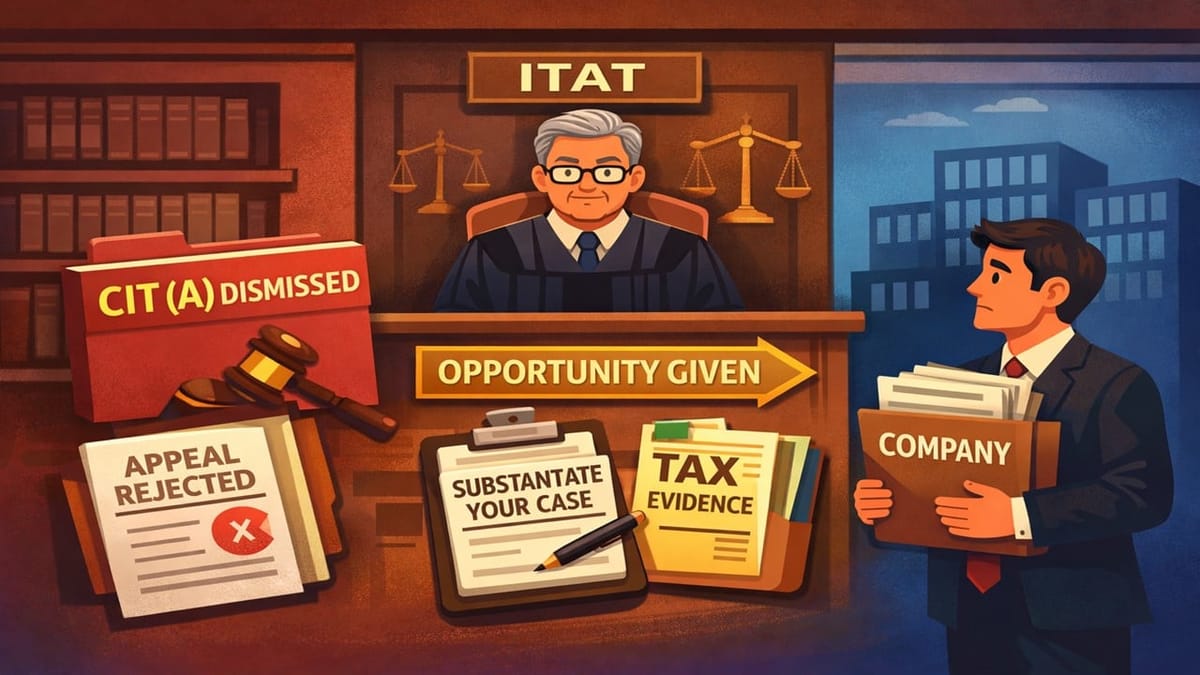

ITAT Gives One More Opportunity to Company to Substantiate its Case After CIT(A) Dismissed Appeal Without Merit

The assessee, Nimblelogik Pvt. Ltd filed its return declaring nil income. The company’s case was selected for scrutiny, and the assessing officer completed the assessment, making several additions to the income of the assessee, including additions towards receipts of share premium and for trade payable, etc.

The assessee challenged these additions before the CIT(A), seeking adjournments, which were granted by the CIT(A). However, when the assessee filed another adjournment stating that the company is preparing a detailed written submission, the CIT(A) passed the order without giving any further opportunity to the assessee. Therefore, the assessee approached the Income Tax Appellate Tribunal (ITAT), Pune, requesting the tribunal for one more opportunity to prove its side by filing the required details.

The Tribunal agreed with the assessee company, observing that the CIT(A) did not decide the matter on merits and dismissed the appeal for want of prosecution. The Tribunal also cited section 250(6) of the Income Tax Act, which requires that any order passed by the Commissioner (Appeals) must be in writing and state the points for determination, the decision reached, and the reasons for that decision.

Based on these facts, the Tribunal Set Aside the order, giving the assessee company one more opportunity to substantiate its case by submitting the requisite details before the CIT(A).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"