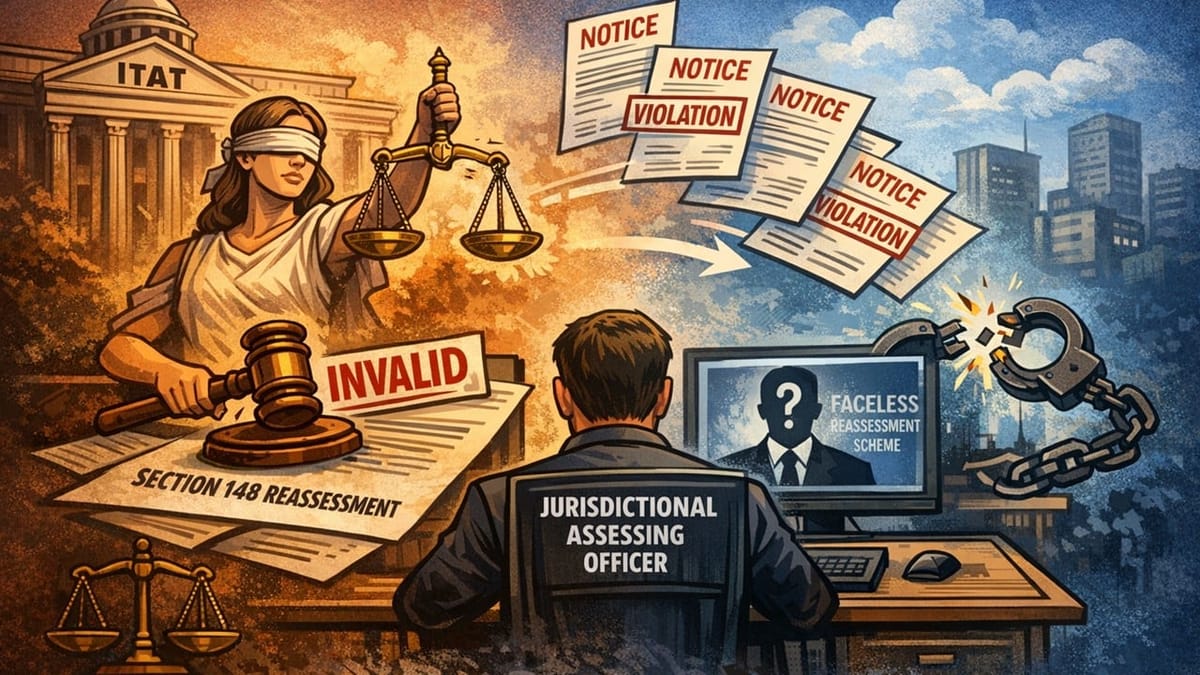

ITAT rules Section 148 reassessment proceedings as invalid after holding that notices issued by the Jurisdictional Assessing Officer violated the mandatory faceless reassessment scheme.

Saloni Kumari | Dec 28, 2025 |

ITAT Quashes Section 148 Reassessment Orders Issued by JAO After Faceless Scheme CBDT Notification

Four appeals have been filed in the ITAT Hyderabad by four different taxpayers named Smt. Lingamgunta Adilaxmi, Shri Raghu Alekh Barli, Sanzyme Private Limited, and Shri Bikaram Pushpender. The cases are related to three different assessment years, i.e., 2015-16, 2018-19, and 2019-20. All the appeals challenged orders passed by the CIT(A), NFAC Delhi. The legal issue challenged in all four appeals was the same; hence, the tribunal heard all of them together and issued one common order.

One among these appeals was filed 21 days late before the ITAT. The petitioner gave the reason that she was suffering from dengue fever and was advised to be on complete rest by the doctors; hence, she could not take part in the assessment proceedings. She also furnished medical proof for the same. The tribunal noted that the delay was not intentional, hence condoned it and accepted the appeal to be heard on its merits.

The key issue in all four appeals was about the reopening of assessments under section 148 of the Income Tax Act. The assessees argued that the notice under section 148 and the order under section 148A(d) were incorrectly issued by the Jurisdictional Assessing Officer (JAO). The assessee argued that these notices should be issued only through the Faceless Assessing Officer (FAO), according to the CBDT Notification dated March 29, 2022. Since the notices were issued after this date, issuing them by the JAO was illegal.

On this claim, the tax department argued that the assessees did not challenge the jurisdiction within the time limit given under section 124(3) and therefore could not raise this issue later. However, the tribunal did not accept this argument of the tax authorities. It held that section 124 applies only to territorial or administrative jurisdiction, not to cases where the officer lacks inherent legal authority. If an officer has no jurisdiction under law, the defect cannot be cured by delay or participation of the assessee.

The tribunal, to announce its final decision, cited earlier judgements of ITAT Hyderabad and the Telangana High Court, especially the case of Kankanala Ravindra Reddy. These judgments all favoured assessees and clearly ruled that notices issued by JAO after the date of CBDT Notification, i.e., March 29, 2022, are invalid as they violate the scheme of mandatory faceless reassessment. As a result, all the following assessment orders suo moto become invalid.

In all four cases, the tribunal discovered that the notices under Section 148 and the order under Section 148A(d) were issued by the JAO and all others on March 29, 2022; hence, as per the law, all became invalid, and accordingly, all reassessment proceedings became illegal. In conclusion, the tribunal set aside all the impugned assessment orders and allowed all the appeals.

Since the appeals were decided purely on this legal issue, the Tribunal did not examine other grounds raised by the taxpayers. However, it gave liberty to both sides to seek revival of the cases if the Supreme Court later decides the issue differently in pending matters.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"