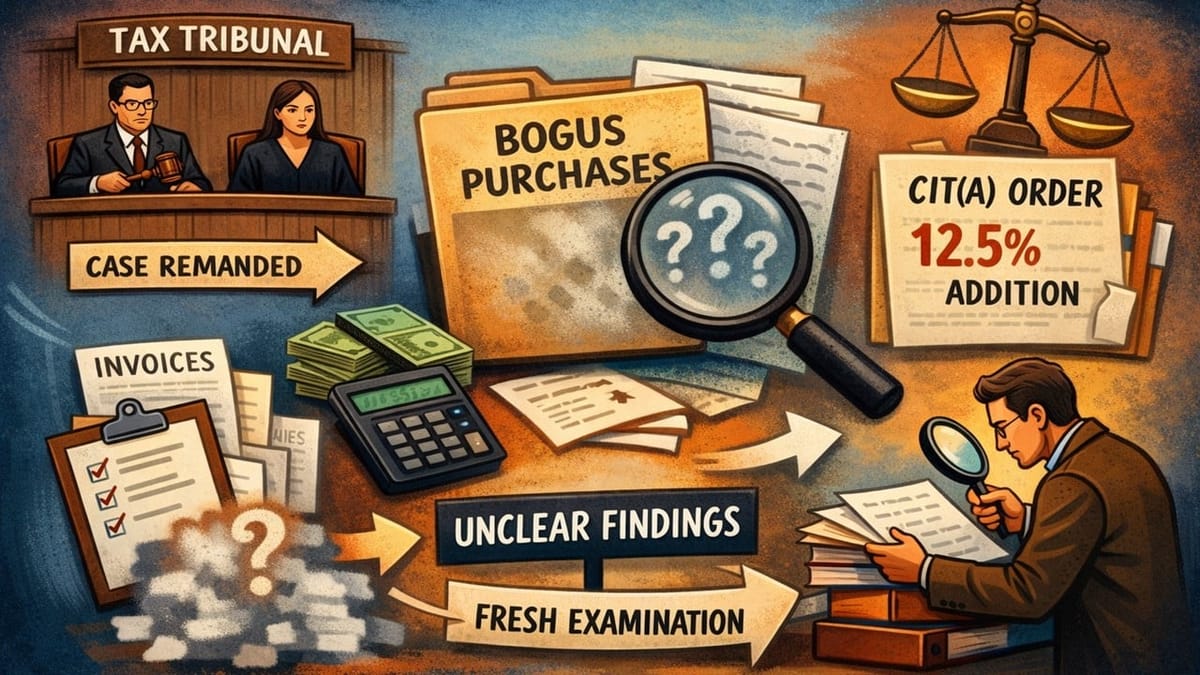

The ITAT remanded the alleged bogus purchase case for fresh examination after finding unclear factual findings in the CIT(A)’s order restricting the addition to 12.5%.

Saloni Kumari | Feb 16, 2026 |

ITAT Sets Aside Order Restricting Addition to 12.5% on Alleged Hawala Purchases; Remands Matter for Re-Verification

The Income Tax Department challenged the CIT(A)’s order restricting addition to 12.5% of alleged bogus purchases of Rs. 48.32 lakh for AY 2010-11. The ITAT Mumbai remanded the matter to the tax authorities for fresh examination due to unclear factual findings.

The Income Tax Department has filed an appeal in the Income Tax Appellate Tribunal (ITAT) Mumbai “C” Bench against a taxpayer named Pravinchandra B. Dedhia, challenging an order dated March 14, 2025, passed by the CIT(A)/NFAC Delhi. The case belongs to the Assessment Year 2010-11.

The income tax authorities had reopened the assessment based on the information received from the Investigation Wing alleging the assessee had obtained bogus purchase bills amounting to Rs. 48.32 lakh from three alleged hawala dealers. Notices under Sections 148, 143(2), 142(1), and 133(6) of the Income Tax Act, 1961, were issued against the assessee; however, the assessee did not respond to any of them. In conclusion, the Assessing Officer (AO) considered the entire purchase as unexplained expenditure under Section 69C and made an addition of the same to the assessee’s income.

The aggrieved assessee filed an appeal before the CIT(A) challenging the aforesaid addition. The CIT(A), when analysing the facts of the case, restricted the addition to 12.5% of the alleged bogus purchases instead of 100%. The tax authorities aggrieved with the CIT(A)’s order thereafter filed an appeal before the ITAT Mumbai, arguing that the assessee had not produced proper documentary evidence and that the CIT(A) himself had observed failures on the part of the assessee to prove the genuineness of the transactions.

When the tribunal examined the case, it noted inconsistencies in the findings of the CIT(A), particularly regarding the availability of supporting documents, stock records, and corresponding sales. Since relevant factual details were not clearly examined, the Tribunal remanded the matter back to the CIT(A) for fresh consideration after giving the assessee a proper opportunity of hearing. The appeal of tax authorities was allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"