Revenue Appeals Partly Allowed, Licence Fee Amortisable u/s 35ABB; SUC, KYC Penalties and Distributor Discounts Allowed

Meetu Kumari | Dec 20, 2025 |

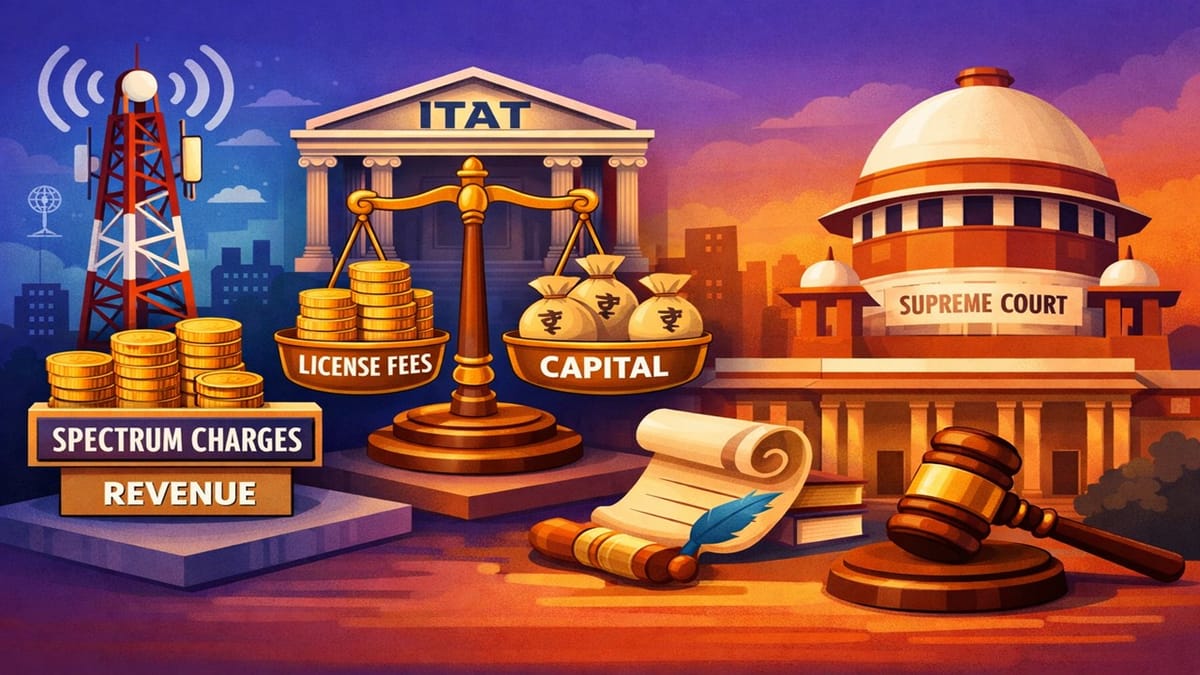

ITAT: Spectrum Charges Revenue in Nature, Licence Fees Capital per the Supreme Court

Bharti Hexacom Ltd.’s assessments for AYs 2016-17 to 2019-20 were completed under Section 143(3). The Assessing Officer treated variable license fees and spectrum usage charges (SUC) as capital expenditure, allowing amortisation under Section 35ABB. He also disallowed subscriber verification penalties under Explanation 1 to Section 37(1) and disallowed discounts/free airtime given to prepaid distributors under Section 40(a)(ia) for alleged non-deduction of TDS under Section 194H.

The CIT(A) deleted all additions, following earlier decisions in the assessee’s own case. The Revenue appealed.

Issues Before Tribunal: Whether variable license fees are capital or revenue, SUC is revenue expenditure, subscriber verification penalties are disallowable under Section 37, and distributor discounts attract TDS under Section 194H.

Tribunal’s Decision: The ITAT held that, in light of the Supreme Court judgment in CIT v. Bharti Hexacom Ltd., variable licence fees paid under the New Telecom Policy, 1999, are capital in nature and must be amortised under Section 35ABB. To this limited extent, the Revenue’s appeals were allowed.

The Tribunal clarified that the Supreme Court ruling did not cover spectrum usage charges. The ITAT held that SUC is allowable as revenue expenditure. Subscriber verification penalties were also held to be compensatory and contractual in nature, and therefore allowable under Section 37(1). The ITAT followed Bharti Cellular Ltd. to hold that no TDS is required under Section 194H, and hence no disallowance under Section 40(a)(ia) could be made.

Therefore, the Revenue’s appeals were partly allowed only in respect of variable license fees; all other disallowances were rejected.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"