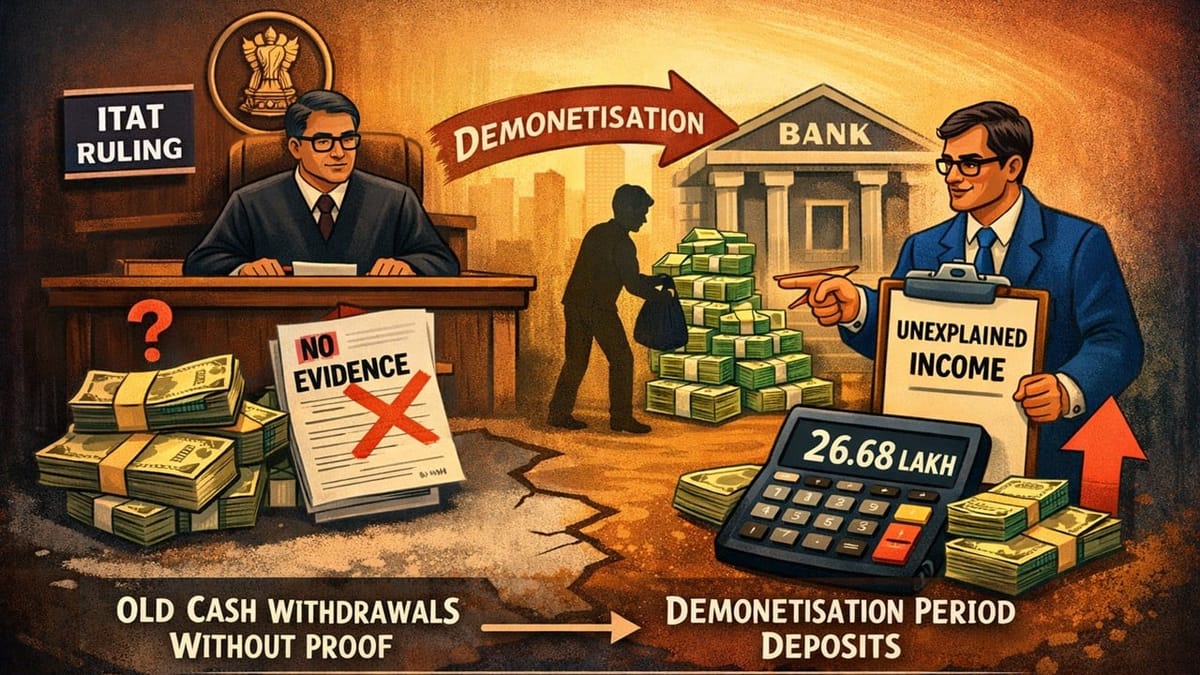

ITAT Kolkata ruled that withdrawals were old and unsupported by evidence, hence confirmed the addition of Rs. 26.68 lakh as unexplained income.

Saloni Kumari | Dec 21, 2025 |

ITAT Upholds Rs. 26.68 Lakh Addition on Unexplained Demonetisation Cash Deposit

ITAT Kolkata ruled that old cash withdrawals without supporting evidence cannot explain demonetisation-period deposits and upheld the addition of Rs. 26.68 lakh as unexplained income.

Tapas Kundu has filed the present appeal before the ITAT Kolkata, challenging an order passed by the CIT(A)/NFAC Delhi on June 18, 2025. Tapas filed his Income Tax Return (ITR) for the Assessment Year 2017-18, declaring the total income of Rs. 9,50,070. The return was successfully processed and was later selected for scrutiny through CASS for examination of the Rs. 39.22 lakh cash deposit made during the period of demonetization. In conclusion, the tax authorities issued notices against Tapas asking him to furnish relevant documents explaining the source of income. Tapas submitted all the relevant documents via both electronic and physical modes, indicating his gross total income at Rs. 11,00,070, out of which Rs. 10,24,370 was generated from salary and Rs. 75,700 from other sources.

Tapas argued that he did not receive any cash during the year in question. Records indicate that Tapas’s total income from the last 8 years is Rs. 46,12,693, excluding the year in consideration, and he had paid a tax of Rs. 3,87,560 on that income. Tapas further stated that all the cash withdrawals were taken in used for domestic purposes and meeting unforeseen medical needs and

emergencies. The AO accepted only Rs. 6.54 lakh as available cash and treated the balance of Rs. 32.68 lakh as unexplained money under Section 69A and made an addition of the same to Tapas’s income. In the end, AO assessed the total income of Tapas at Rs. 42,18,070.

The aggrieved Tapas filed an appeal before CIT(A), where the CIT(A) favoured Tapas and agreed that the expenses estimated by the AO were much higher and hence reduced them. Accordingly, Rs. 6 lakh relief was granted. Still, Rs. 26.68 lakh was held as unexplained cash and taxed under Section 115BBE at a higher rate.

Tapas was still not satisfied with the directions of CIT(A) and therefore filed an appeal before ITAT Kolkata. Wherein, Tapas claimed that he had withdrawn his salary regularly due to a divorce and fear of future claims by his estranged wife. He claimed the cash was kept at home and later deposited during demonetization. He requested the deletion of the remaining addition. The tribunal rejected the claims of Tapas and noted that the cash withdrawals were made many years before demonetization, there was no proof that the same cash was kept and redeposited, and the explanation was not supported by evidence. The Tribunal found the CIT(A)’s order reasonable.

The ITAT dismissed the appeal and confirmed the addition of Rs. 26.68 lakh as unexplained cash. Tapas did not get any further relief.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"