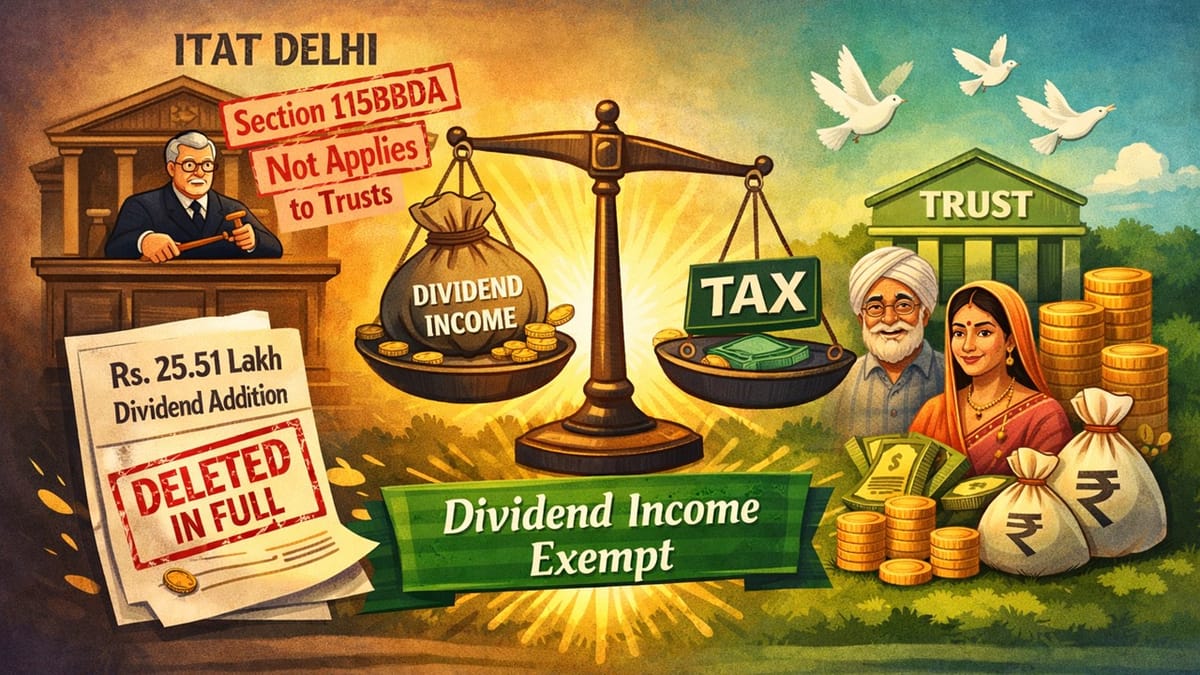

ITAT Delhi rules that Section 115BBDA does not apply to trusts, deletes Rs. 25.51 lakh dividend addition in full, and holds the dividend income as exempt.

Saloni Kumari | Dec 20, 2025 |

Section 115BBDA Not Applicable to Trust’s Dividend Income: ITAT Rules

ITAT Delhi rules that Section 115BBDA applies only to individuals, HUFs, and firms, not trusts. Hence, the dividend income of a trust cannot be taxed under Section 115BBDA.

Jasmina Trust has filed the present appeal in the Income Tax Appellate Tribunal (ITAT) in New Delhi, challenging an order passed by the CIT(A)/NFAC on January 31, 2025, under Section 250 of the Income Tax Act, 1961.

The trust is registered under Section 12A and filed its income tax return (ITR) for the Assessment Year 2017-18, declaring its total income at nil, i.e., zero. The tax department chose the case for scrutiny and completed the assessment by making an addition of Rs. 25,51,286 to the trust’s income towards the dividend income as unexplained and also disallowed expenses, and in the end assessed the total income of the trust at Rs. 55.56 lakh.

The dissatisfied trust filed an appeal before CIT(A) challenging the aforesaid decision of the AO. The CIT(A) partially ruled in favour of the assessee, deleted the expense disallowance, and partly upheld the dividend addition. The CIT(A) allowed a basic exemption of Rs. 10 lakh and directed that the remaining dividend income be taxed at 10% under Section 115BBDA.

Thereafter, the assessee approached ITAT Delhi, where it raised the key question of “whether dividend income received by a trust in AY 2017-18 is taxable and whether Section 115BBDA applies to a trust.”

The tribunal, after analysing the arguments of both sides, concluded that although the amendments to Section 10(34) apply from Assessment Year 2017-18, Section 115BBDA applies only to individuals, HUFs, firms, etc., and trusts are not included under the said section. Therefore, the dividend income of a trust cannot be taxed under Section 115BBDA. Therefore, on the final decision, the tribunal deleted the complete dividend addition amounting to Rs. 25.51 lakh, held the dividend income as exempt, and allowed the appeal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"