Nidhi | Feb 11, 2026 |

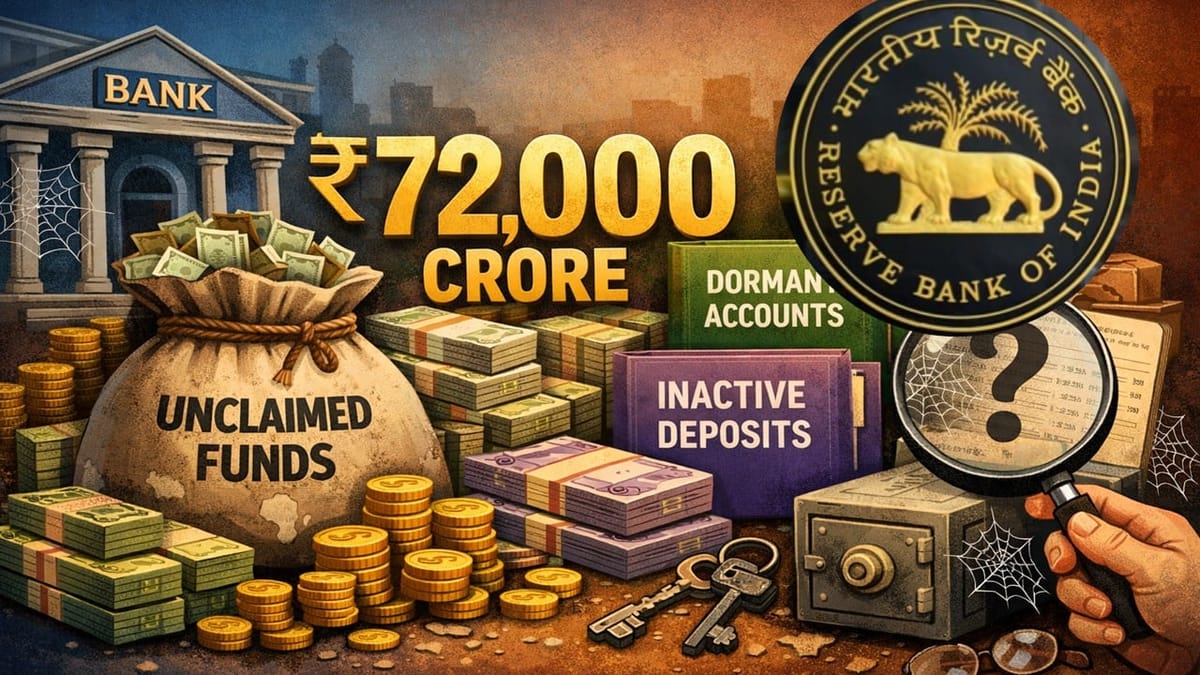

Over Rs 72,000 Crore Unclaimed Bank Deposits with RBI: MoS Finance Pankaj Chaudhary

The government has informed the parliament that as of January 28, 2026, the Depositor Education and Awareness (DEA) Fund maintained by the Reserve Bank of India (RBI) holds around 72,454 crore unclaimed deposits of banks, including foreign lenders.

In a written reply to a question, the Minister of State for Finance, Pankaj Chaudhary, explained that the unclaimed bank deposits are the funds in savings, current, or fixed deposit accounts that have remained inactive or unclaimed for 10 years or more. These funds are transferred by the banks to the Depositor Education and Awareness (DEA) Fund, which is handled by the RBI.

Out of the total amount, public sector banks had the highest outstanding unclaimed deposits of Rs 60,571.02 crore as of January 28, 2026, while the private sector bank and the foreign lenders had Rs 9,607.76 crore and Rs 2,275.01 crore, respectively.

He said that the RBI and the government have introduced several measures to help the citizens track and reclaim their deposits as well as reduce the stock of unclaimed deposits. These measures include the Centralized Web Portal UDGAM (Unclaimed Deposits-Gateway to Access Information), which allows users to search their unclaimed deposits across various banks in one place. Other financial assistance included the programs conducted to improve financial literacy, seminars held for the depositors regarding safe and secure banking, and funding projects and research activities related to the depositors’ education.

Apart from this, the Banking Laws (Amendment) Act, 2025, enabled multiple nominations for the bank customers.

In addition, he also highlighted RBI’s initiatives to strengthen cooperative banks. From January 19, 2026, the loans approved by the National Cooperative Development Corporation (NCDC) for on-lending to cooperative societies will now be treated as priority sector lending.

Chaudhary also replied to another question, saying that the total corpus of the National Investment and Infrastructure Fund (NIIF) as of December 2025 is Rs 33,249 crore. This includes the contributions from the government, sovereign wealth and other investors.

He also informed that the unsecured personal loans of scheduled commercial banks (SCBs) stood at Rs 7,72,025 crore as of March 31, 2023; Rs 9,10,673 crore as of March 31, 2024; and Rs 9,53,181 crore as of March 31, 2025.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"