ITR Filing: Income Tax Department Keep Sending Warning Messages to File ITR for AY 22-23

Reetu | Jul 28, 2022 |

ITR Filing: Income Tax Department Keep Sending Warning Messages to File ITR for AY 22-23

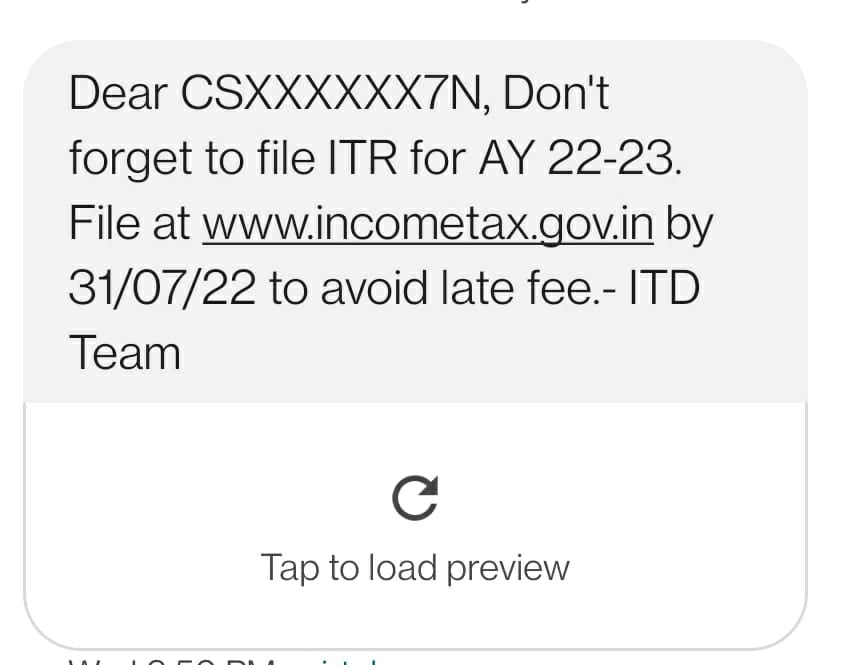

Income Tax Department keep sending warning messages to the Assessee to File ITR for Financial Year 2020-21 [ Assessment Year 2022-23]. In the SMS being sent by the Income Tax Department to the taxpayers, the language of the department seems to be warning/threatening.

In the message that the Income Tax Department is sending to the taxpayers, an warning is being made to the taxpayers to file the income tax return before 31 July 2022 to avoid paying late fees.

Income Tax Department sending the below messages to the Assessees.

“Dear (PAN Number) Don’t forget to file Income Tax Return for AY 22–23. File at www.incometax.gov.in by 31/07/2022 to avoid late fees.”

The actual deadline for submitting income tax returns for the financial year 2021–2022 and assessment year 2022–2023 is July 31, 2022. The Income Tax Department continuously reminds people of the deadline via text messages sent to their mobile devices.

One the one hand, Income Tax Department is working to include a larger and larger population in its purview. Tax payment motivation is increasing. The payment of tax has been related with nation building. In this case, a tax department SMS with such a menacing tone may give the wrong impression to the taxpayers.

Extend Due Date Immediately is trending on Twitter as Tax payers and Tax Professionals are asking for a date Extension due to various reasons.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"