In the latest development, many income tax taxpayers now receiving intimation orders with demands from the income tax department in the last 4 to 5 days.

Reetu | Sep 24, 2024 |

ITRs filed under New Tax Regime get demand notice for taking Section 87A Rebate

In the latest development, many income tax taxpayers now receiving intimation orders with demands from the income tax department in the last 4 to 5 days.

Recently, the tax department issued demand notices to taxpayers on capital gain income without providing a section 87A rebate after processing their income tax returns.

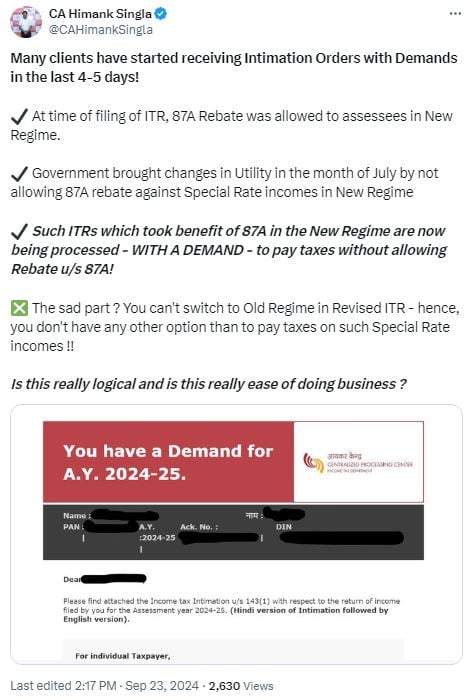

CA Himank Singla tweeted on this matter, “Many clients have started receiving Intimation Orders with Demands in the last 4-5 days! At the time of filing of ITR, 87A Rebate was allowed to assessees in the New Regime. Government brought changes in Utility in the month of July by not allowing 87A rebate against Special Rate incomes in the New Regime Such ITRs which took benefit of 87A in the New Regime are now being processed – WITH A DEMAND – to pay taxes without allowing Rebate u/s 87A! The sad part? You can’t switch to Old Regime in Revised ITR – hence, you don’t have any other option than to pay taxes on such Special Rate incomes !! Is this really logical and is this really ease of doing business ?”

Earlier a Delhi-based Chartered Accountant said, “A good number of people are getting demand notices simply because they have capital gain incomes only. The benefit of an unexhausted threshold limit is not being provided to them. Only rebate u/s 87A is being considered of 25000. Nothing else. A simple ITR with just capital gain income of 300000 income is getting a demand after processing of ITR.”

CA Himank Singhla tweeted earlier as well on this issue. He wrote, “INCOME TAX RETURNS PROCESSING: CPC has started raising demand on capital gain income, by not giving the benefit of 87A Rebate! Moot question is “Why portal allowed filing ITR by allowing the rebate on the capital gain if your intention was not to allow it.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"