There is not chance for extension of applicability of Section 43B(h) of Income Tax Act. Thus it's implentation should be done in advance to ensure smooth compliance at later stage.

CA Pratibha Goyal | Mar 27, 2024 |

Late MSME Payment section 43B(h) now reality: What to do in this case

To safeguard the interest of MSMEs, the Government in Finance Act 2023, introduced clause (h) in Section 43B of the Income Tax Act. As per this clause, if payment to MSMEs is not made within the required timeline as per the MSME Act, the deduction of Expense in Income Tax is allowed on a Payment basis instead of an Accrual Basis. Micro and Small Businessmen are not very happy with this provision as the big business houses might not give them business because of this provision. Many representations were made to the Government for deferment of this clause, but now it’s final that no extension in its applicability will be made and section 43B(h) of Income Tax is now a reality.

The Provision of this section is applicable on the purchase of goods or services from Micro and Small Enterprises registered as Manufacturers or Service Providers. This section is applicable on transactions of FY 2023-24, that will be assessed in Assessment Year 2024-25. This Provision is not applicable on Payments made to Medium Enterprises. Payments made to Traders are also not covered in these provisions.

Assessee opting for the Presumptive Taxation Scheme are not required to fulfill the restriction of this section.

I have delayed payment to MSME as per MSME Law. The Due Date of Payment was 27th March 2024 but the payment was made on 3rd April 2024. Since I have made the payment before the due date of filing the Income Tax Return, will I be eligible for the deduction?

The answer is no. Even if payment is made before the due date of ITR filing, the deduction of expense will be allowed only in the year of payment i.e. FY 2024-25 and not FY 2023-24.

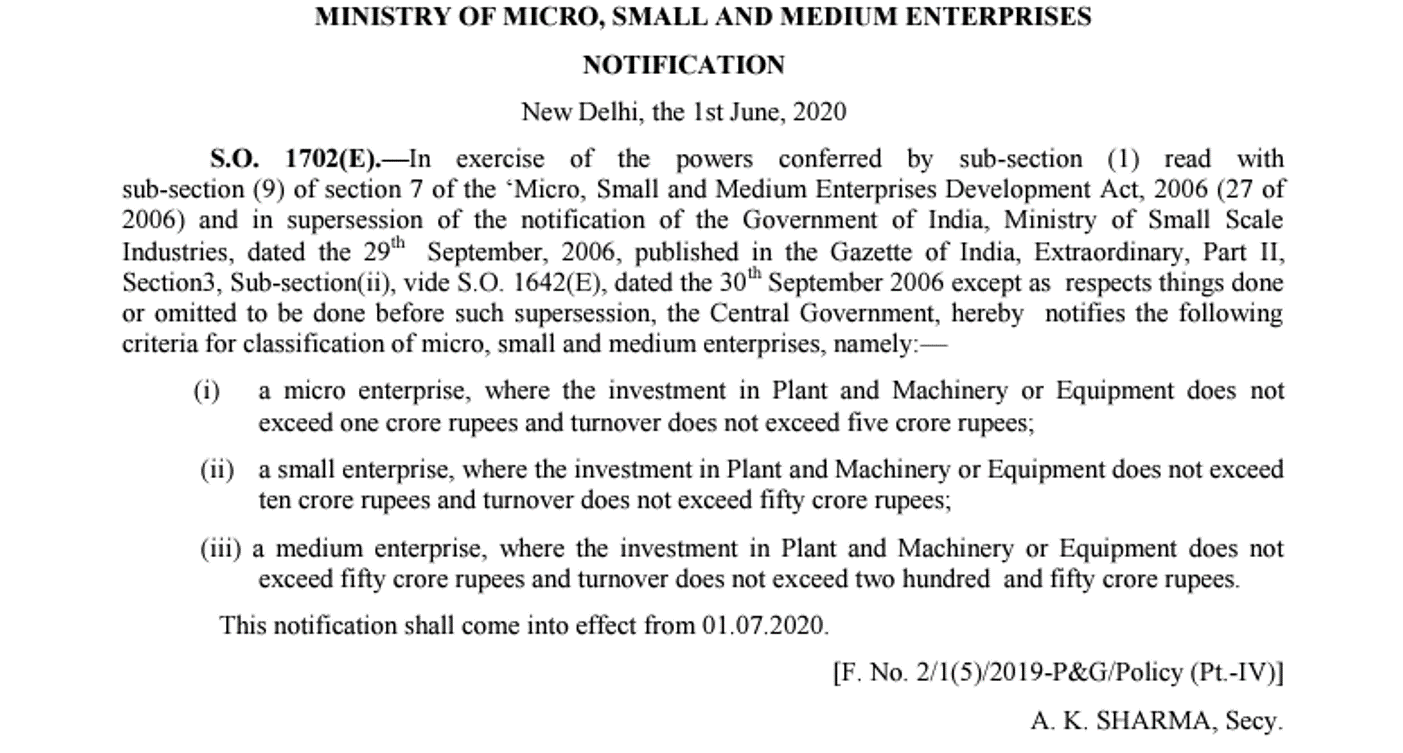

What is a Micro, Small Enterprise, and Medium Enterprise?

Notification:

Now when the provisions of Section 43B(h) are applicable, what steps should be taken by us to ensure compliance of this section?

Step 1: Identify Payments to be made to the suppliers.

Step 2: Out of these suppliers identify those from MSME Sector. We need to obtain Udyam Registration Certificate from the supplier in order to identify the type of enterprise (Micro/ Small/ Medium) and Major Activity (Manufacturer/ Service Provider/ Trader). [Refer: Format for Seeking confirmation of MSME Registration for applicability of Section 43B(h)]

Step 3: Make a List of Micro and Small Enterprises, Manufacturers, and Service providers pending for the payment. See if an agreement is executed with the vendor. If the Agreement is executed, check the payment timeline as per the agreement. The same cannot exceed 45 Days. Where no agreement is executed then the payment has to be made within 15 days of purchase.

Step 4: Accordingly calculate the Due Date of Payment.

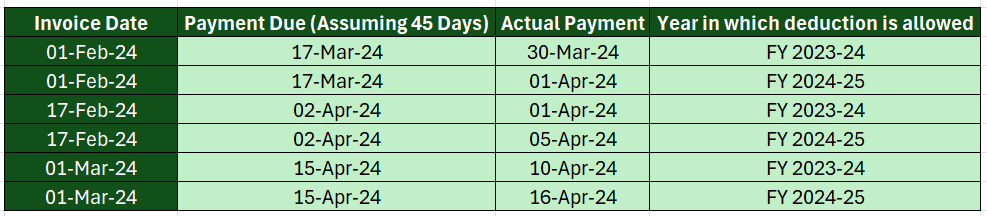

Step 5: The Amount that is unpaid after the due date is gone as per the MSME Act, and after 31st March will be disallowed in FY 2023-24. The same can be explained through below given example.

Also Read: Late Payment to MSME: Decoding Section 43B(h) of Income Tax

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"