To ease the compliance burden, the government has proposed an amendment to Section 397(1)(c) by exempting resident individuals and HUFs from obtaining a TAN.

Nidhi | Feb 1, 2026 |

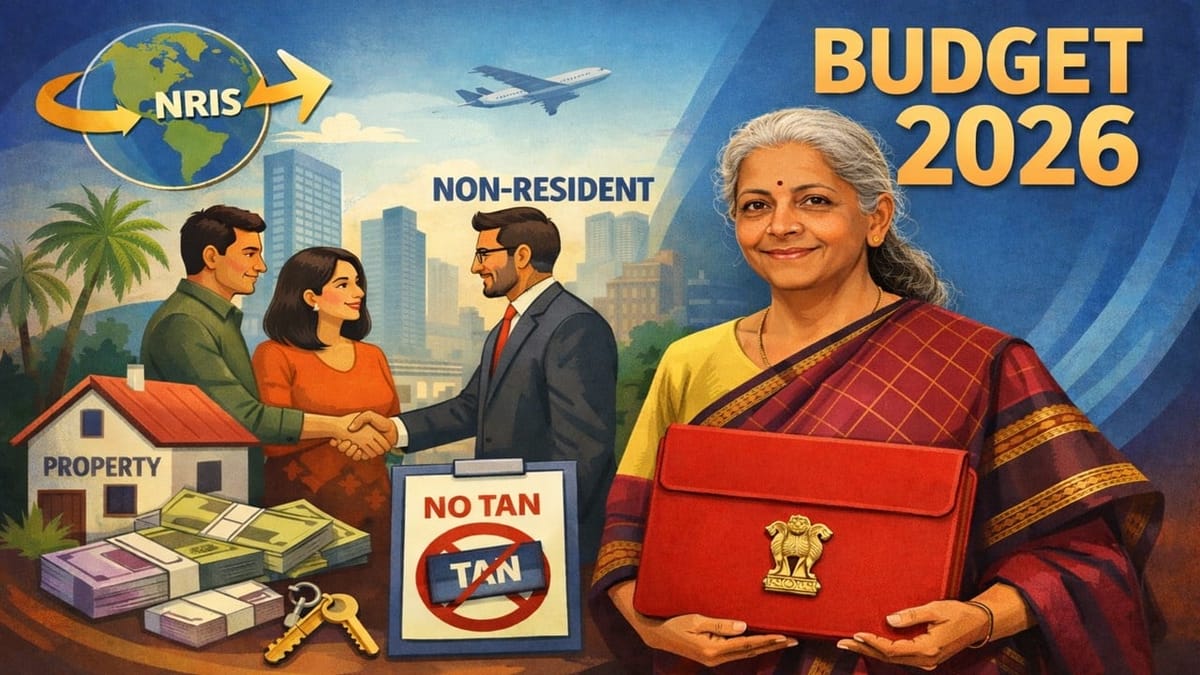

Major Relief for Resident Buyers in Budget 2026: No Need for TAN on Property Transactions with Non-Residents

The Union Finance Minister Nirmala Sitharaman has proposed a major relief for resident individuals and Hindu Undivided Families (HUFs) in the Budget 2026. The proposal will reduce the compliance burden for the resident buyers if they are buying immovable property from a non-resident seller.

At present, if a resident buyer purchases immovable property from a resident seller, the buyer does not need to have a TAN to deduct TDS. However, when the resident buyer purchases immovable property from a non-resident seller, the buyer is required to obtain a TAN to deduct tax at source. This increases extra paperwork for the buyer just for a single transaction.

Section 397(1)(a) of the Income Tax Act requires every person who deducts or collects tax at source to apply for a Tax Deduction and Collection Account Number (TAN).

To ease the compliance burden, the government has proposed an amendment to Section 397(1)(c) by exempting resident individuals and HUFs from obtaining a TAN for buying immovable property from non-resident sellers. The buyer will be allowed to deduct tax using their PAN and deposit it with a PAN-based challan, simplifying the entire process.

With this proposal, the resident buyer no longer needs to apply for TAN, removing the unnecessary compliance burden.

The amendment will come into effect from 1st October 2026.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"