Nidhi | Feb 1, 2026 |

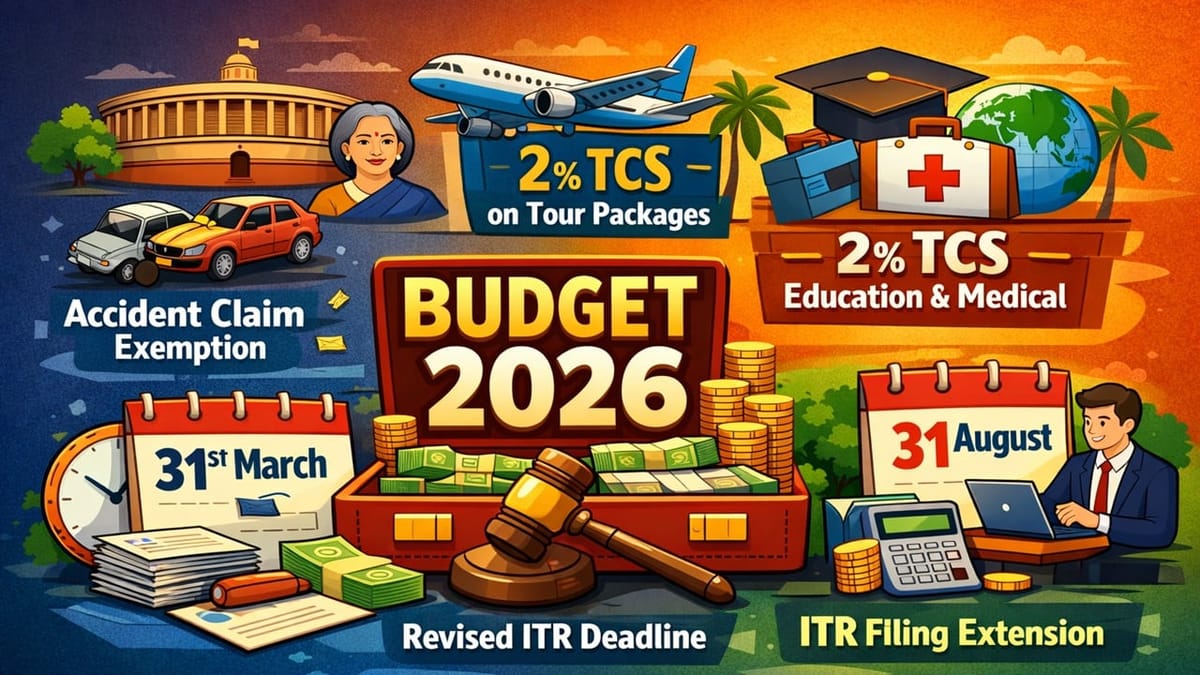

Union Budget 2026: Key Direct Tax Proposals for Ease of Living

In an effort to simplify the tax system in India, the Union Finance Minister, Smt Nirmala Sitharaman, proposed several important direct tax measures in the Union Budget 2026-27. These changes focus on reducing the burden on taxpayers and improving tax compliance. Let us know about these measures one by one.

Exemption on Motor Accident Claims Interest

The interest given by the Motor Accident Claims Tribunal to individuals (natural persons) will now be exempt from income tax. Therefore, the people receiving interest for accidents will no longer need to pay tax on it.

Reduction in TCS Rate on Overseas Tour Packages

The Tax Collected at Source (TCS) rate for overseas tour packages will now be reduced from the current 5% and 20% to just 2%, without any stipulation of the amount.

TCS Reduction for Education and Medical Purposes

The TCS rate for pursuing education and medical purposes under the Liberalised Remittance Scheme (LRS) is also being reduced from 5% to 2%.

More Time to File Returns

The taxpayers are now given more time to revise tax returns, as the deadline for filing revised ITR has been extended from 31st December to 31st March, with a nominal fee payment for late revisions. Now the taxpayers can file their returns more accurately and avoid penalties.

Extension of Deadline for These ITR

For ITR-1 and ITR-2 filers, the last date for filing returns will remain 31st July. However, businesses and trusts that are not subjected to an audit will now have till 31st August to file their returns.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"