The MCA has directed all the stakeholders to manually enter the values for "Trade Payables" and "Other Income" in Form AOC-4.

Nidhi | Oct 15, 2025 |

Manual Entry Required for ‘Trade Payables’ and ‘Other Income’ in Form AOC-4

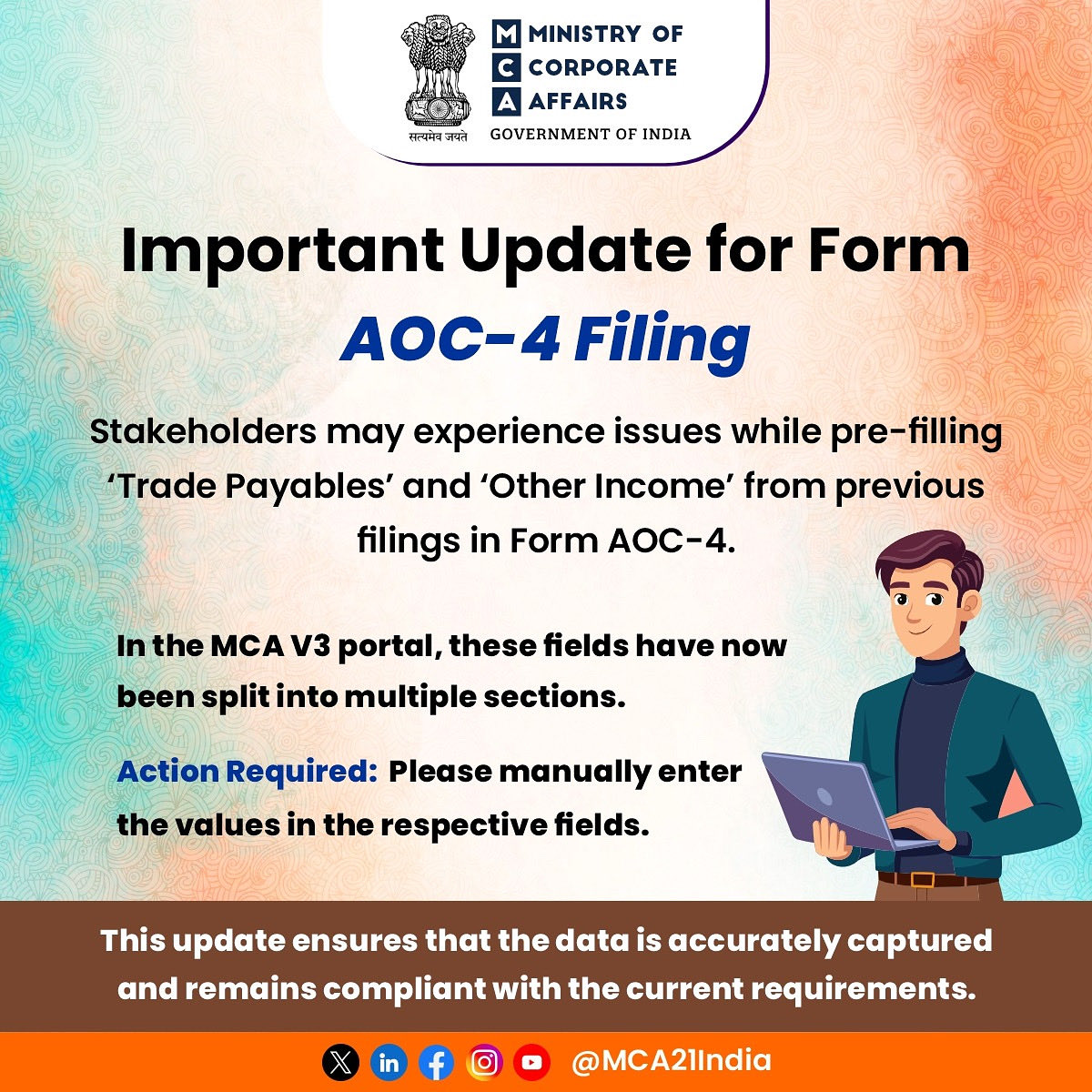

The Ministry of Corporate Affairs (MCA) has shared an important update for the stakeholders filing Form AOC-4 on the MCA V3 portal. As per the post shared by MCA on platform X (Previously known as Twitter), the Form AOC-4 has been updated especially for the “Trade Payable” and “Other Income“.

As a part of this change, the Stakeholders are expected to face some issues while pre-filling “Trade Payables” and ‘Other Income” from previous filings in Form AOC-4. earlier, these two fields were pre-filled using data from the previous filing. However, due to the recent changes in the MCA V3 portal, these two fields have now been divided into multiple sections.

Therefore, the MCA has directed all the stakeholders to manually enter the values for “Trade Payables” and “Other Income” in Form AOC-4. The stakeholders must make sure that the data they enter is correct and matches the financial record.

This manual entry will help maintain data accuracy and compliance with the latest disclosure requirements introduced by MCA.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"