The central government is warning citizens against misleading messages, but IT Department clarifies that applying PAN through Form 49A is authentic.

Reetu | Aug 12, 2023 |

Message Received for applying PAN through Form 49A is authentic: IT Department

The central government is warning citizens against misleading messages about refunds and customs duty payment.

Following that, the Income Tax Department sent messages to individual taxpayers about applying for a Permanent Account Number (PAN) or submitting a PAN before the Reporting Entity and a considerable number of recipients wrongly identified such messages as fake.

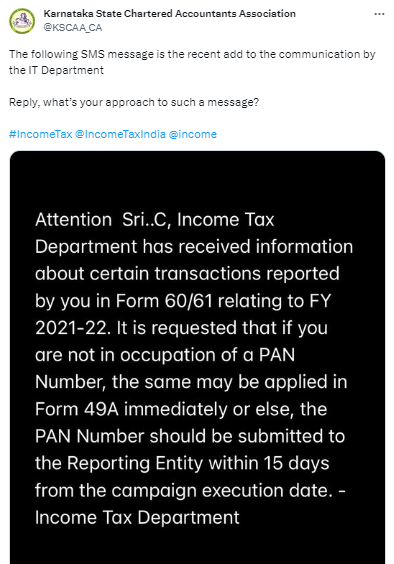

The message stated as, “Attention Sri…., Income Tax Department has received information about certain transactions reported by you in Form 60/61 relating to FY 2021-22. It is requested that if you are not in occupation of a PAN Number, the same may be applied in Form 49A immediately or else, the PAN Number should be submitted to the Reporting Entity within 15 days from the campaign execution date. – Income Tax Department”.

Notably Association also posted about the received message on their twitter. They actively engage in and contribute to major tax-related decisions that are subject to public comment.

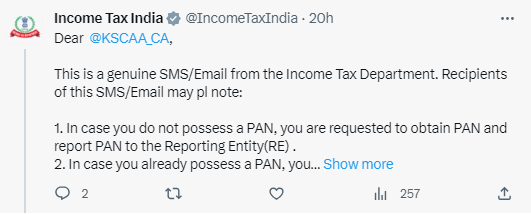

The Income Tax Department responded to the statement released by the association, saying, “This is a genuine SMS/Email from the Income Tax Department.”

The department further stated that recipients of this SMS/Email should take note:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"