Reetu | Dec 15, 2023 |

No Instruction to get CA Certification for KYC: RBI

The Reserve Bank of India (RBI) in the response of RTI made by NITIN PANDURANG HARGUDE on 03rd April 2021, stated that No Instruction to get CA Certification for KYC.

The applicant is seeking certain information under the Right to Information Act, 2005. The First Appellate Authority in Reserve Bank of India is Shri P Vijaya Kumar, Executive Director, Reserve Bank of India, Department of Regulation is the authoritative person to give replies on the queries.

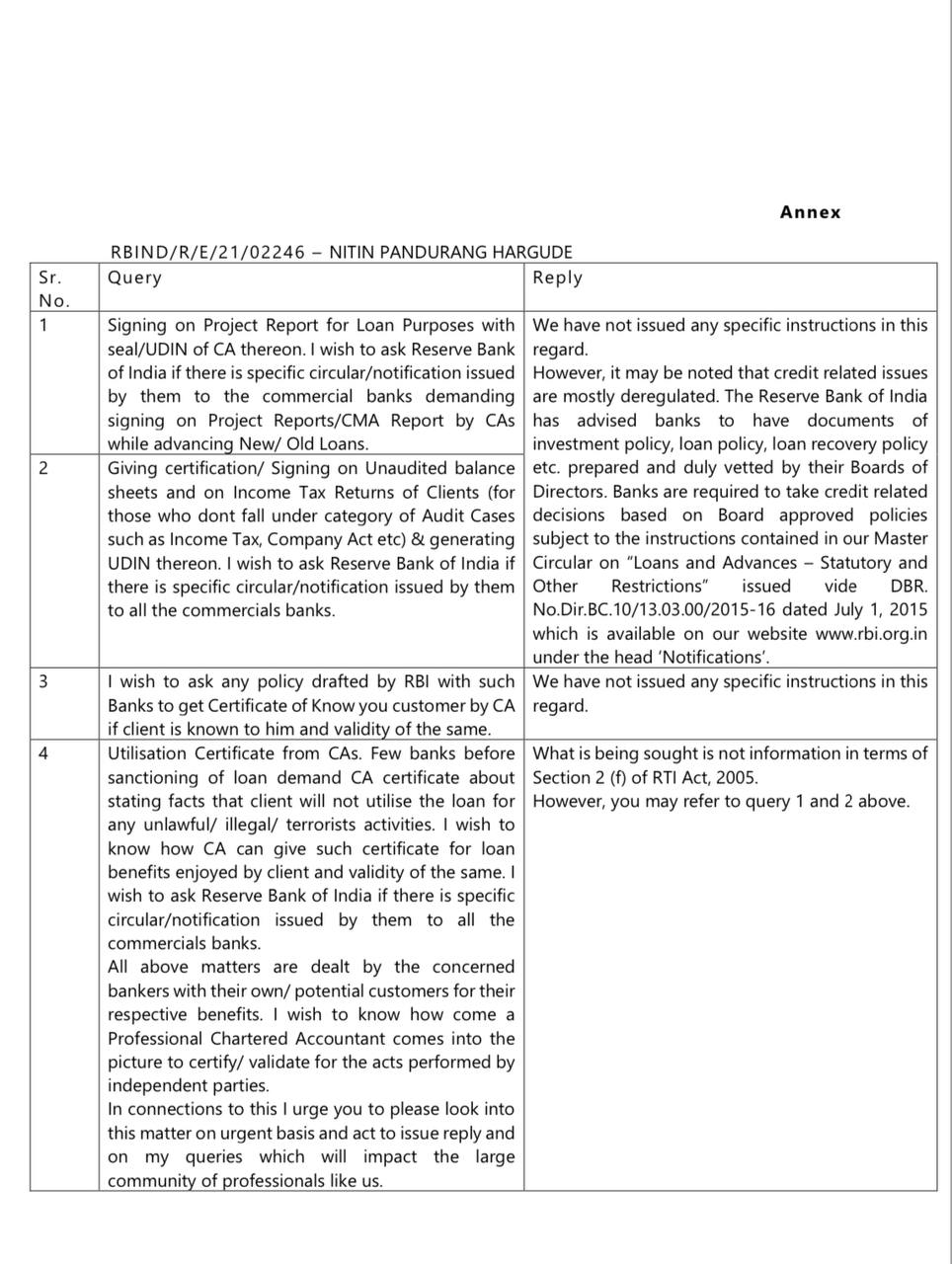

1. Signing on Project Report for Loan Purposes with seal/ UDIN of CA thereon. I wish to ask the Reserve Bank of India if there is a specific circular/ notification issued by them to the commercial banks demanding signing on Project Reports/ CMA Reports by CAs while advancing New/ Old Loans.

2. Giving certification/ Signing on Unaudited balance sheets and on Income Tax Returns of Clients (for those who don’t fall under the category of Audit Cases such as Income Tax, Company Act etc) and generating UDIN thereon. I wish to ask the Reserve Bank of India if there is a specific circular/ notification issued by them to all the commercial banks.

3. I wish to ask any policy drafted by RBI with such Banks to get a Certificate of Know You customer by CA if the client is known to him and the validity of the same.

4. Utilisation Certificate from CAs. Few banks before sanctioning of loan demand a CA certificate about stating facts that the client will not utilise the loan for any unlawful/ illegal/terrorist activities. I wish to know how CA can give such a certificate for loan benefits enjoyed by the client and the validity of the same. I wish to ask the Reserve Bank of India if there is a specific circular/notification issued by them to all the commercial banks.

All the above matters are dealt with by the concerned bankers with their own/ potential customers for their respective benefits. I wish to know how a Professional Chartered Accountant comes into the picture to certify/ validate the acts performed by independent parties.

In connection to this, I urge you to please look into this matter on an urgent basis and act to issue a reply to my queries which will impact the large community of professionals like us.

1 and 2. We have not issued any specific instructions in this regard.

However, it may be noted that credit related issues are mostly deregulated. The Reserve Bank of India has advised banks to have documents of investment policy, loan policy, loan recovery policy etc. prepared and duly vetted by their Boards of Directors. Banks are required to take credit related decisions based on Board approved policies subject to the instructions contained in our Master Circular on “Loans and Advances – Statutory and Other Restrictions” issued vide DBR.No.Dir.BC.10/13.03.00/2015-16 dated July 1, 2015 which is available on our official website under the head ‘Notifications’.

3. We have not issued any specific instructions in this regard.

4. What is being sought is not information in terms of Section 2 (f) of RTI Act, 2005. However, you may refer to query 1 and 2 above.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"