Deepak Gupta | Mar 4, 2022 |

Taxpayers can check eligibility of E-Invoice on Portal; Check Complete Details

As per the Goods & Service Tax (GST) Notification Number 01/2022 dated 24th February 2022 issued by the Central Board of Indirect Taxes and Customs (CBIC), E-Invoicing is mandatory for taxpayers with an annual turnover of more than Rs. 20 crores from 1st April 2022.

You May Also Refer: Breaking: E-Invoicing Mandatory from 1st April 2022 for Turnover 20 Crore

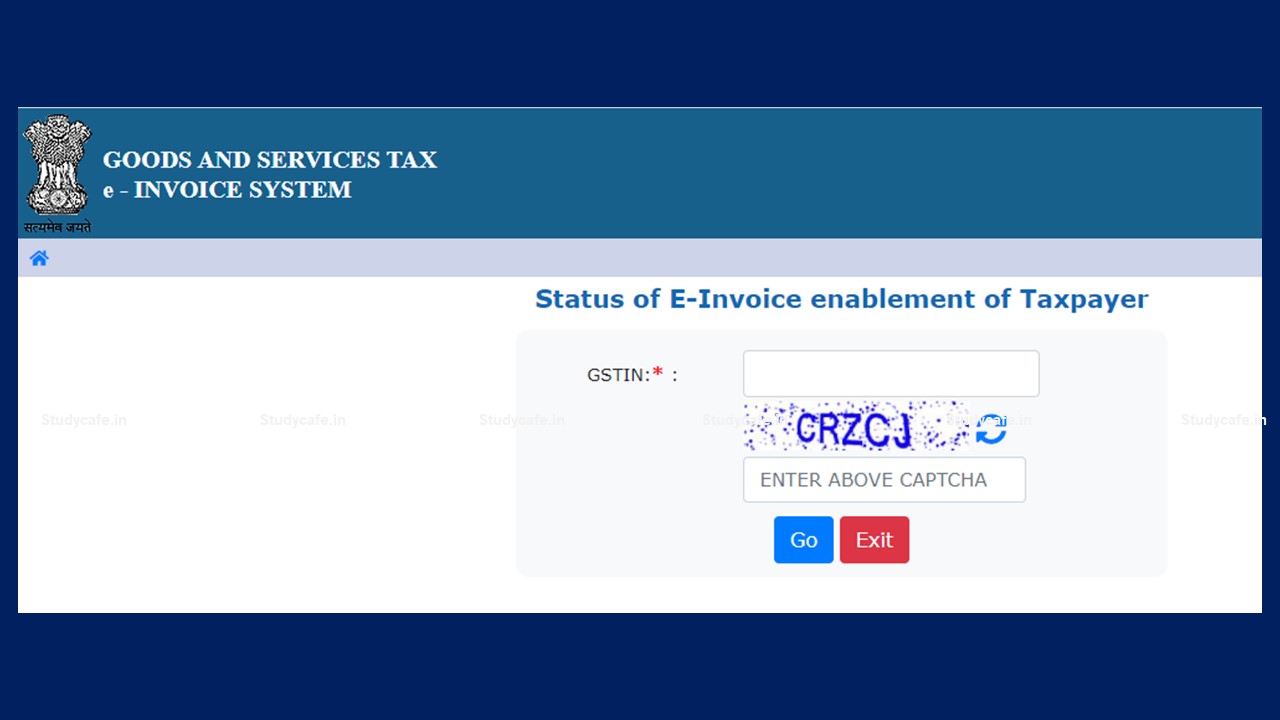

The taxpayer can check his eligibility for e-Invoicing by following the below mentioned process:

Now Taxpayers can check eligibility of E-Invoice on Portal

The eligible taxpayers are enabled presently on the sandbox for testing.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"