The legal case consists of Manish Maheshwari, who is a Chartered Accountant and the Registrar of Companies, regarding violations of the Companies Act, 2013.

Janvi | Jun 17, 2025 |

RD Confirms penalty on Chartered Accountant for Violations Under Companies Act 2013

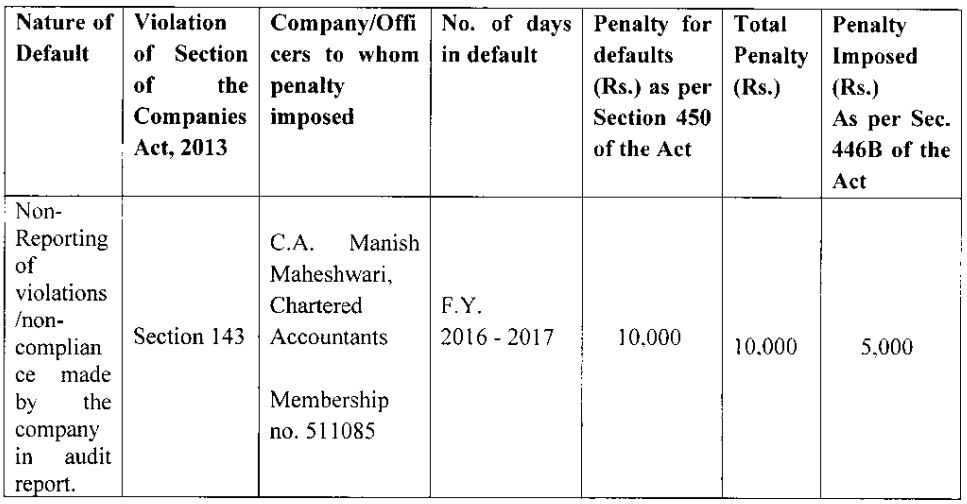

The legal case consists of Manish Maheshwari, who is a Chartered Accountant and the Registrar of Companies, regarding violations of the Companies Act, 2013. The registrar of Companies, Patna, issued an adjudication notice in respect of the violation of provisions of Section 143 of the Companies Act 2013 vide letter no. ROC/PAT/SCN/Sec-143/14515/1270 dated 22 December 2023 to the Auditor of Syndrome Pharmaceuticals Private Limited.

The company filed a reply dated 5th January 2024 and stated that an inadvertent error was made on the audit of Syndrome Pharmaceuticals Pvt. Ltd. in respect of the Financial Year 2016-17. Even though the defence was made, the Registrar of Companies, Patna, issued the Adjudication order on 24 January 2024, for Non-reporting of violations /non-compliance by the company in the audit report under Section 143 of the Companies Act, 2013.

Key Decisions that were taken by the Registrar of Companies are mentioned below:

This case demonstrates the enforcement of compliance requirements under the Companies Act, 2013, in relation to the auditor’s obligations and duties to report a company’s violation.

Refer to the Official PDF for More Details

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"