The last date to file ITR is July 31, 2024. As the season of ITR Filing is coming to an end still taxpayers are facing problems with their filings.

Reetu | Jul 17, 2024 |

Rebate u/s 87A of Income Tax: New Challange faced by ITR Filers

The Income Tax Return (ITR) filing deadline is approaching soon. The last date to file ITR is July 31, 2024. As, the season of ITR Filing is coming to an end, still taxpayers are facing problems with their filings.

Rebate under Section 87A is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers. Section 87A provides a tax rebate of up to Rs. 12,500 for people with taxable incomes up to Rs.5,00,000 (FY 2023-24) under the old tax regime.

In Budget 2023, an Amendment was made in Section 87A to bring a special rebate for the new tax regime. As per the amendment if the Income of Taxpayer who has opted for New Tax regime, does not exceed Rs. 700,000, the Taxpayer will be allowed Rebate of Rs. 25000. This would make his Tax Liability Zero.

On 5th July, ITR online utility was updated, and after the update the utility stopped giving the benefit of Section 87A rebate for STCG u/s 111A and other special rate income. Before 5th July, IT Utility and Calculator were allowing 87A rebate against STCG u/s 111A and other special rate incomes other than Long Term Capital Gain (LTCG) u/s 112A where such rebate is specifically barred by Section 112A itself.

Now there are 2 interpretations of this section.

Interpretation 1 (Same is being followed by Income Tax Portal)

It was provided that where the total income of the assessee is chargeable to tax under sub-section (1A) of section 115BAC, and the total income does not exceed Rs. 700,000, the assessee shall be entitled to a rebate, of an amount equal to 100% of such income-tax or aRs. 25000, whichever is less.

This would mean that in case the assessee has opted for the New Tax Regime, then the rebate shall be available for those income chargeable to tax u/s 115BAC. Income Chargeable under other sections like Short Term Capital Gain (STCG) u/s 111A, 115BBH etc. will not get benefit of Rebate.

Interpretation 2

Section of the rebate talks about rebate against tax on “total income” and total income includes income that is taxable at special rates. It nowhere states that the rebate shall be restricted to tax payable under 115BAC.

Dilemma

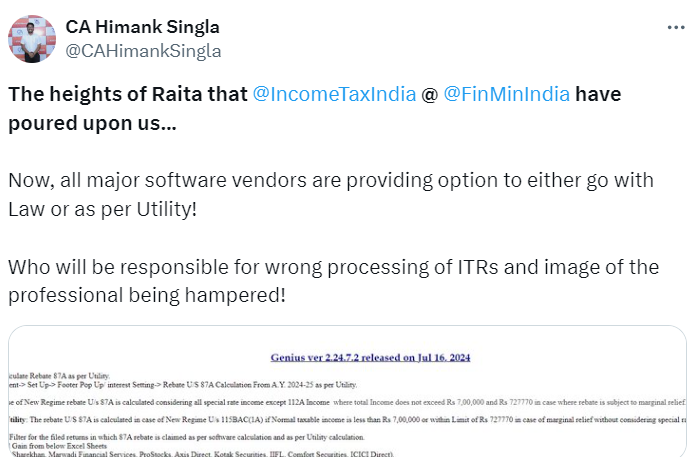

CA Himank Singla wrote on his Twitter handle “Now, all major software vendors are providing an option to either go with Law or as per Utility. The question is now – who will be responsible for the wrong processing of ITRs and the image of the professional being hampered?

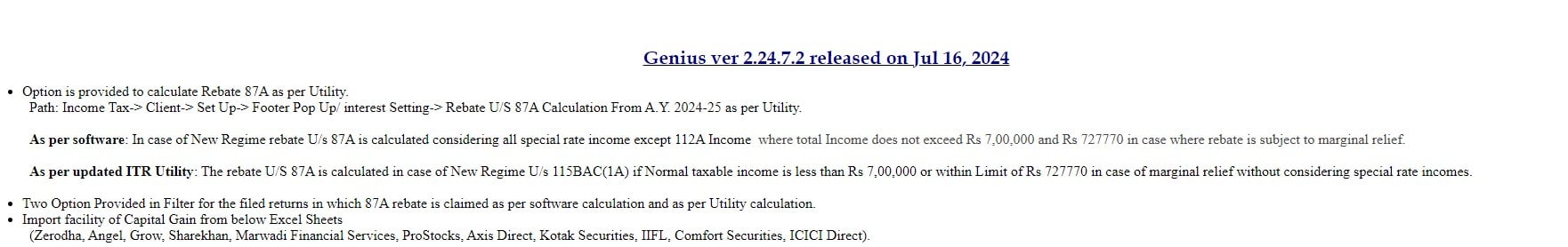

On Genius ver 2.24.7.2 which was released on July 16, 2024, it shows that:

An option is provided to calculate Rebate 87 A as per Utility.

Path: Income Tax-> Client-> Set Up-> Footer Pop-Up/Interest Setting-> Rebate U/S 87A Calculation From A.Y 2024-25 as per Utility.

As per software: In case of New Regime rebate U/s 87 A is calculated considering all special rate income except 112A Income where total Income does not exceed Rs.7,00,000 and Rs.7,27,770 in case where rebate is subject to marginal relief.

As per updated ITR Utility: The rebate U/S 87A is calculated in case of New Regime U/s 115BAC(1A) if Normal taxable income is less than Rs.7,00,000 or within Limit of Rs.7,27,770 in case of marginal relief without considering special rate incomes.

Two Options are Provided in the Filter for the filed returns in which the 87A rebate is claimed as per software calculation and as per Utility calculation.

It’s High time that we get a clarification from the Income Tax Department to resolve future litigations.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"