ROC penalised a small company and its directors for incorrect PAS-3 filing and missing private placement documents

Meetu Kumari | Jan 28, 2026 |

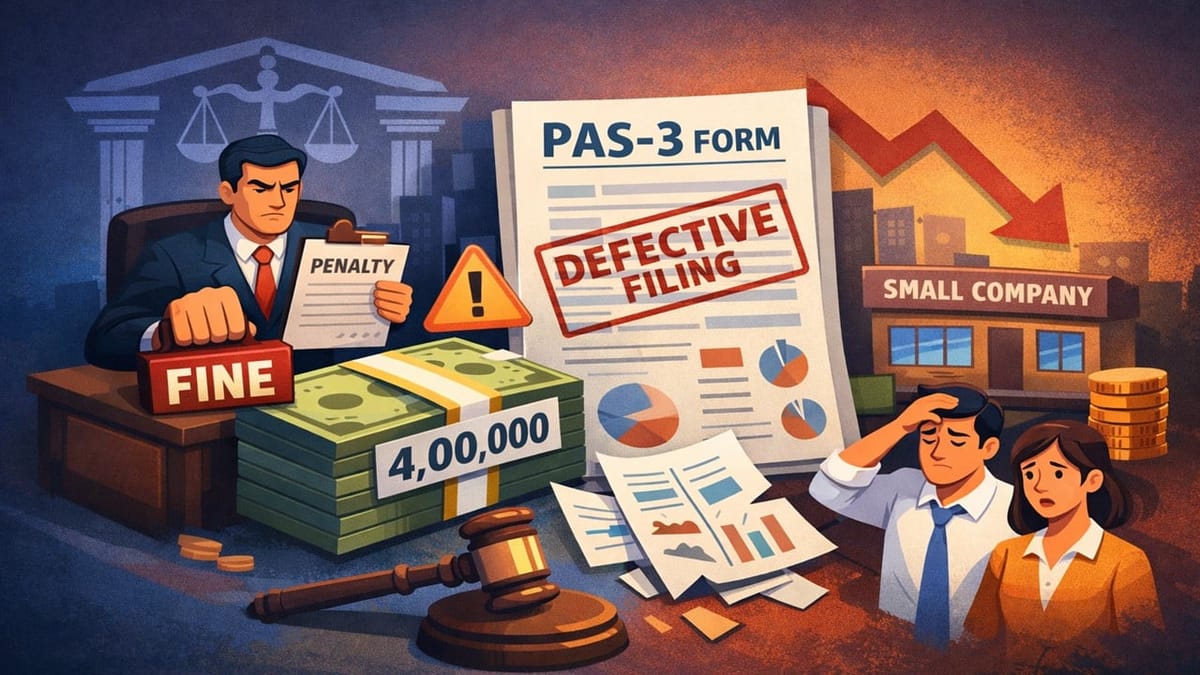

ROC Slaps Rs. 4 Lakh Penalty for Defective PAS-3 Filing in Private Placement by Small Company

Mumbai Furniture Uduog Pvt. Ltd. made a private placement of optionally convertible preference shares in October 2025 and filed e-Form PAS-3. The company later filed a suo motu adjudication application admitting multiple lapses.

The ROC found incorrect disclosure of the number of securities, non-attachment of mandatory documents, and a mismatch between actual allotment and disclosure in PAS-3. A show-cause notice under Section 454 was issued. The company filed a written reply citing clerical errors but did not seek a personal hearing.

Main Issue: Whether incorrect and incomplete PAS-3 filings in a private placement attract penalty under Section 42(10) of the Companies Act, and whether a small company is entitled to reduced penalty under Section 446B.

ROC’s Decision: The ROC Mumbai held that the company had materially contravened Section 42 read with Rule 14(6) of the Companies (Prospectus and Allotment of Securities) Rules, 2014. The defects were held to be substantive violations of private placement compliance and not mere technical or clerical errors.

Since the company qualified as a “small company” under Section 2(85), the benefit of reduced penalty under Section 446B was granted. Therefore, a penalty of Rs. 2,00,000 was imposed on the company and Rs. 1,00,000 each on both directors, aggregating to Rs. 4,00,000. The company was directed to file a corrected PAS-3, and the directors were specifically directed to pay their penalties from personal funds.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"