New ITR Excel utilities for FY 2024-25 require detailed information for deductions to ensure accurate and faster tax filing.

Deepak Gupta | Jun 3, 2025 |

Salaried Taxpayers Beware: How Income Tax Quietly bought Significant Changes in ITR Excel Utilities Introduced for FY 2024-25

The Income Tax Department has introduced several significant amendments to the ITR (Income Tax Return) validation rules for AS 2025-26 (income earned in the financial year 2024-25). So far, only the Excel-based ITR forms for ITR-1 and ITR-4 have been released.

A quick look at these forms shows that most of the changes affect salaried individuals or those who have taken loans for electric vehicles or homes, or are paying house rent. These taxpayers usually file ITR-1.

The changes mainly ask for more detailed information (extra declarations). Various experts say these amendments are introduced to reduce the cases of bogus income tax deduction claims at the time of filing ITR. Previously, the task of checking the authenticity of tax deductions was done by the Income Tax Department itself while processing ITR. Now, the system checks them automatically when you file the return. This means fewer mistakes and faster ITR processing.

Amendments Introduced in ITR Validation Rules for AY 2025-26 (FY 2024-25)

Most of the rule changes relate to deductions under the old tax regime. Here are seven key changes made in the ITR filing utilities for FY 2024-25 (AY 2025-26):

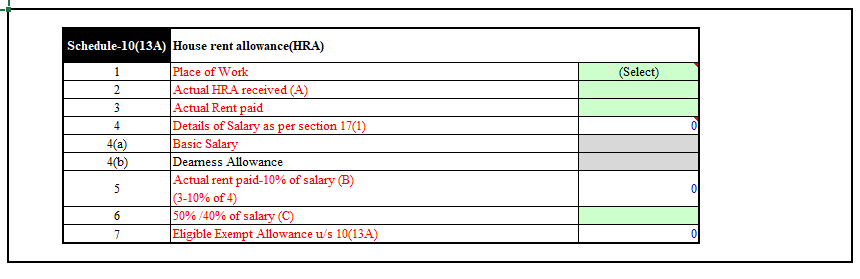

Taxpayers who claim HRA exemptions are now required to provide detailed information on the following:

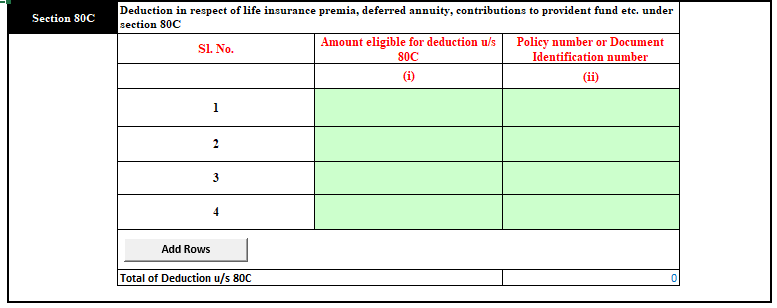

Taxpayers claiming Section 80C deduction are now required to disclose their police number or document identification number. Taxpayers eligible for Section 80C can claim an amount of Rs. 1.5 lakhs for tax deductions for making investments in instruments such as PPF, tax-saving FDs, life insurance policies, etc.

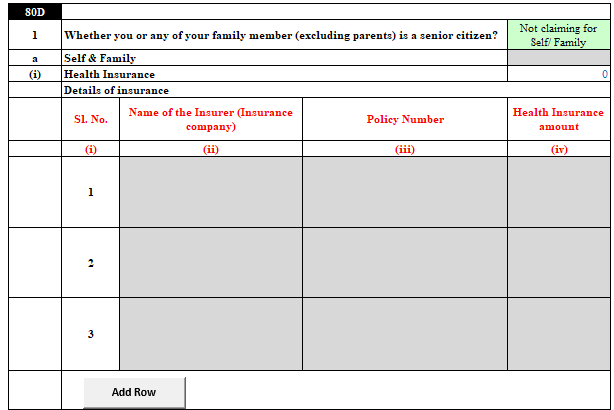

Taxpayers of health insurance claiming deductions under section 80D for the purpose of medical insurance are required to provide the following details:

The below-mentioned information is compulsory to be provided for education loan interest deductions on interest paid on education loans under Section 80E:

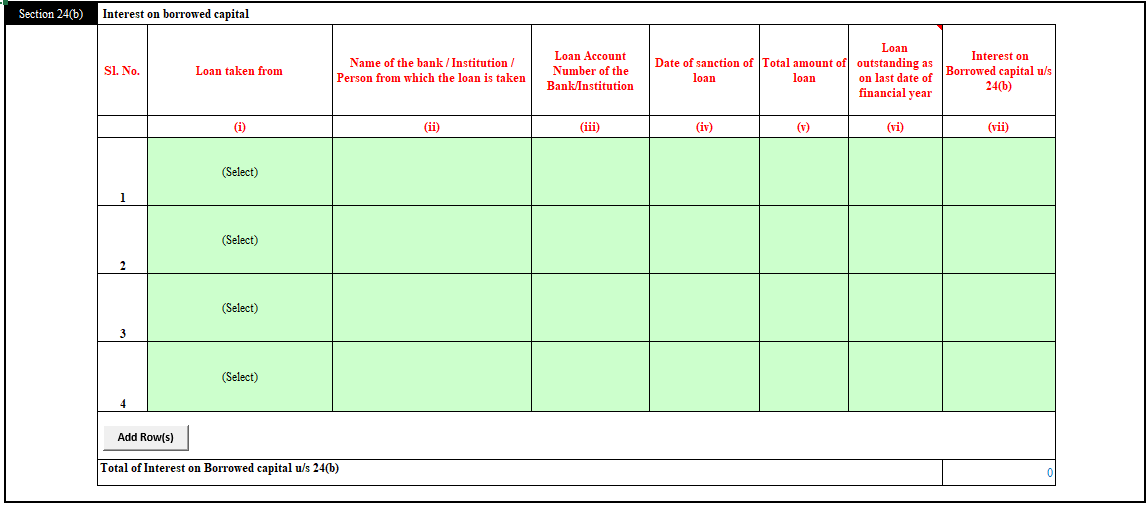

If a taxpayer is claiming a tax deduction on home loan interest under Section 80EE or 80EEA for a residential property, then he/she needs to provide the below details or disclosures.

If taxpayers paid interest on a loan to buy an electric vehicle, he/she can claim a tax deduction under Section 80EEB, but he/she will need to provide certain details.

If taxpayers are claiming deductions on treatment of specified diseases under Section 80DDB for medical treatment of a few specified diseases, then he/she will need to provide:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"