As per the CBDT order for waiver of Demand dated 13th February no remission will be made for Outstanding TDS/TCS Demands.

CA Pratibha Goyal | Feb 21, 2024 |

Settlement of Outstanding Income Tax Demand as per Budget 2024: Know the Process

The income Tax Department has started closing the old demands from Income Tax Portal, as committed in the Interim Budget 2024. This Article deals with the process of settlement of old Income Tax Demand as per Budget 2024.

In the budget speech, Hon’ble Finance Minister proposed to withdraw or waive off the small, unresolved, unverified, or disputed direct tax demands pertaining to the financial years up to 2014-15.

As per the announcement recovery of the old outstanding demands up to INR 25,000 for the period up to financial year 2009-10 and up to INR 10,000 for financial years 2010-11 to 2014-15 shall be waived off.

The tax demand shall be waived off subject to maximum ceiling of Rs. 1 lakh for any specific taxpayer.

CBDT to waive off tax demand capped at Rs. 1 lakh outstanding as of Jan 31, 2024 [Read Order]

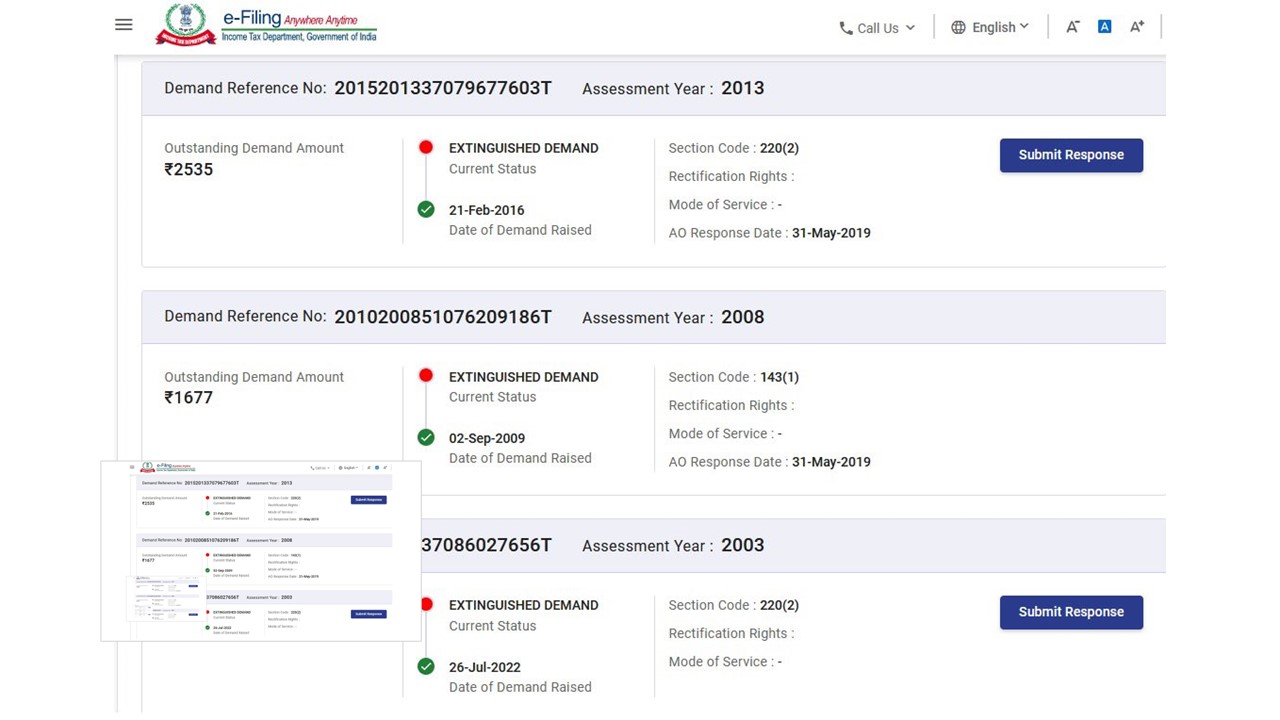

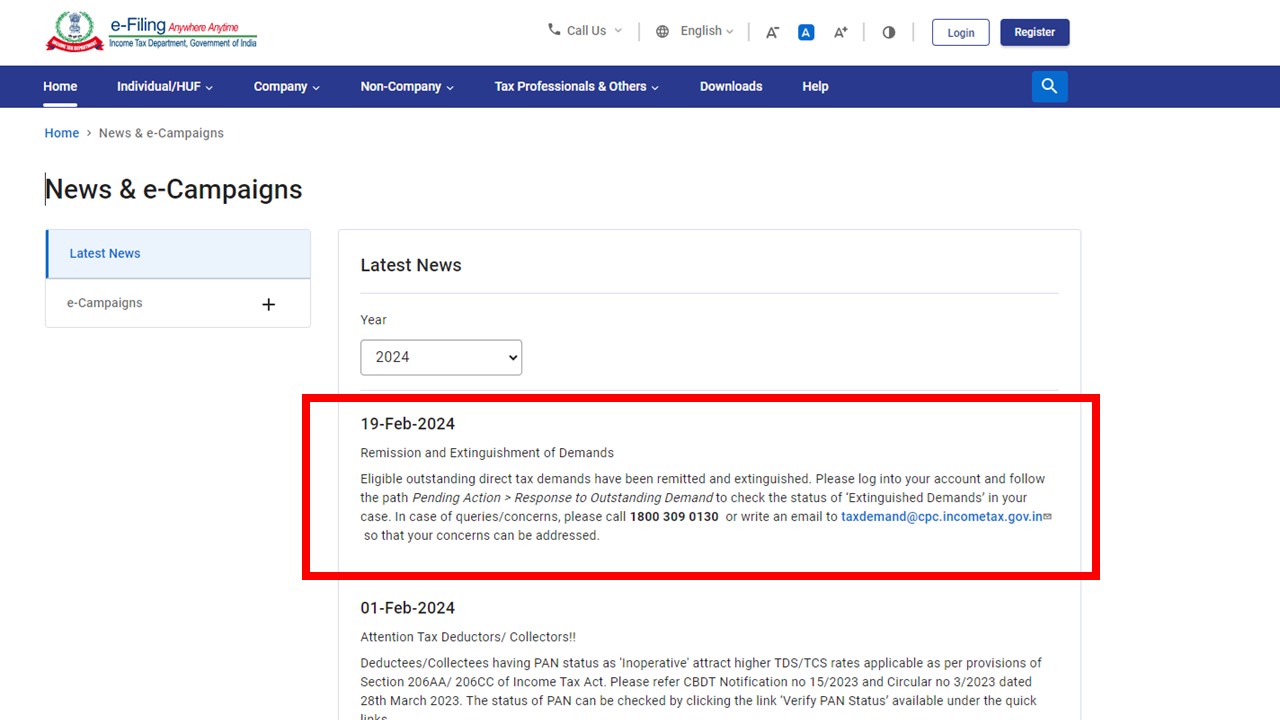

How to check Remission and Extinguishment of Demands?

Eligible outstanding direct tax demands have been remitted and extinguished. Please log into your account and follow the path Pending Action > Response to Outstanding Demand to check the status of ‘Extinguished Demands’ in your case. In case of queries/concerns, please call 1800 309 0130 or write an email to [email protected] so that your concerns can be addressed.

Above Remission not applicable on TDS Demands:

As per the CBDT order dated 13th February, the waiver of demand will not be made in case of TDS/TCS Demands. [Read Circular]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"