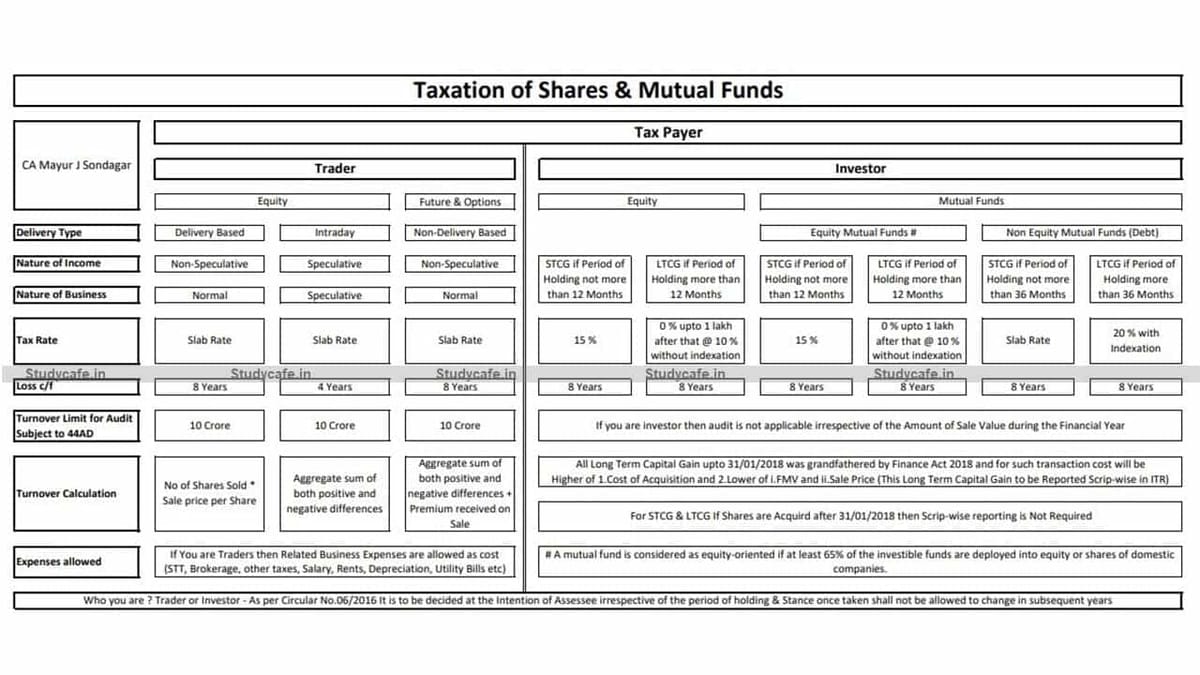

Summary Chart showing Taxation of Shares and Mutual Funds

CA Mayur J Sondagar | Jul 3, 2021 |

Summary Chart showing Taxation of Shares and Mutual Funds

Situation I: When Taxpayer is a Trader

| Particulars | Equity | Future & Options | |

| Delivery Type | Delivery Based | Intraday | Non-Delivery Based |

| Nature of Income | Non-Speculative | Speculative | Non-Speculative |

| Nature of Business | Normal | Speculative | Normal |

| Tax Rate | Slab Rate | Slab Rate | Slab Rate |

| Loss c/f | 8 Years | 4 Years | 8 Years |

| Turnover Limit for Audit Subject to 44AD $ | 10 Crore | 10 Crore | 10 Crore |

| Turnover Calculation | No of Shares Sold * Sale price per Share | Aggregate sum of absolute differences of positive and negative amounts | Aggregate sum of absolute differences of positive and negative amounts + Premium received on Sale |

| Expenses allowed | If You are Traders then Related Business Expenses are allowed as cost (STT, Brokerage, other taxes, Salary, Rents, Depreciation, Utility Bills etc) | ||

| As per Section 73 Speculation Loss can be set off against Speculation Profit only | |||

Situation II: When Taxpayer is an Investor

| Particulars | Equity | Mutual Funds | ||||

| Equity Mutual Funds # | Non Equity Mutual Funds (Debt) | |||||

| Holding | STCG if Period of Holding not more than 12 Months | LTCG if Period of Holding more than 12 Months | STCG if Period of Holding not more than 12 Months | LTCG if Period of Holding more than 12 Months | STCG if Period of Holding not more than 36 Months | LTCG if Period of Holding more than 36 Months |

| Tax Rate | 15% | 0 % upto 1 lakh after that @ 10 % without indexation | 15% | 0 % upto 1 lakh after that @ 10 % without indexation | Slab Rate | 20 % with Indexation |

| Loss c/f | 8 Years | 8 Years | 8 Years | 8 Years | 8 Years | 8 Years |

| Turnover Limit for Audit Subject to 44AD | If you are investor then audit is not applicable irrespective of the Amount of Sale Value during the Financial Year | |||||

| Turnover Calculation | All Long Term Capital Gain upto 31/01/2018 was grandfathered by Finance Act 2018 and for such transaction cost will be Higher of 1.Cost of Acquisition and 2.Lower of i.FMV and ii.Sale Price (This Long Term Capital Gain to be Reported Scrip-wise in ITR) For STCG & LTCG If Shares are Acquird after 31/01/2018 then Scrip-wise reporting is Not Required | |||||

| As per Section 73 Speculation Loss can be set off against Speculation Profit only | As per Section 74 Long Term Capital Loss can be set off against Long Term Capital Gain only | |||||

# A mutual fund is considered as equity-oriented if at least 65% of the investible funds are deployed into equity or shares of domestic companies.

Trader or Investor – As per Circular No.06/2016 It is to be decided at the Intention of Assessee irrespective of the period of holding & Stance once taken shall not be allowed to change in subsequent years

Note:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"