Deepak Gupta | Dec 1, 2022 |

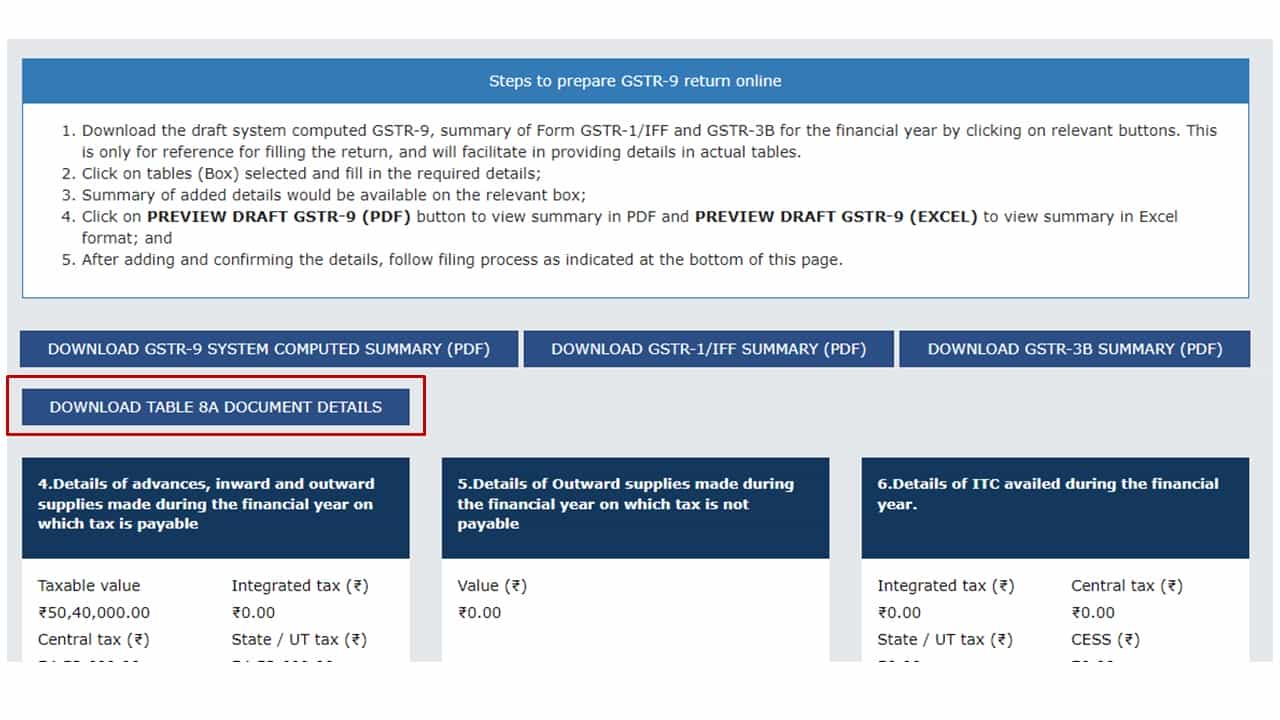

Table 8A of GSTR-9: Computation of ITC updated based on GSTR-1/IFF/GSTR-5 filed upto 30th Nov 2022

Computation of Input Tax Credit (ITC) has been updated based on GSTR-1/ Invoice Furnishing Facility (IFF)/ GSTR-5 filed by your corresponding suppliers upto 30/11/2022. GSTR-1/IFF/GSTR-5 filed after the updation date will be covered in the next updation.

You May Also Refer: List of Optional Entries made compulsory in Form GSTR-9 for FY 2021-22

Also Refer: List of Optional Entries made compulsory in Form GSTR-9C for FY 2021-22

As per Rule 80 of the CGST Rules, 2017, every registered person liable to file an Annual Return (GSTR-9) for every financial year on or before the 31st of December of the next financial year.

As per Section 44 read with rule 80 taxpayers whose, Aggregate Annual Turnover during a financial year exceeds Rs. 5 Cr is Required to file a Self-Certified Reconciliation Statement (GSTR-9C) along with GST Annual Return (GSTR-9).

Accordingly, the last date for filing the GST Annual Return & GST Reconciliation for FY 2021-22 is 31st December 2022.

Also, Refer:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"