CA Pratibha Goyal | Nov 26, 2022 |

GSTR 9 MANDATORY V/S OPTIONAL TABLES FOR FY 2021-22

This Article discusses List of entries in Form GSTR-9 (GST Annual Return) that were Mandatory/ optional in FY 21-22.

You May Also Refer: List of Optional Entries made compulsory in Form GSTR-9 for FY 2021-22

Also Refer: List of Optional Entries made compulsory in Form GSTR-9C for FY 2021-22

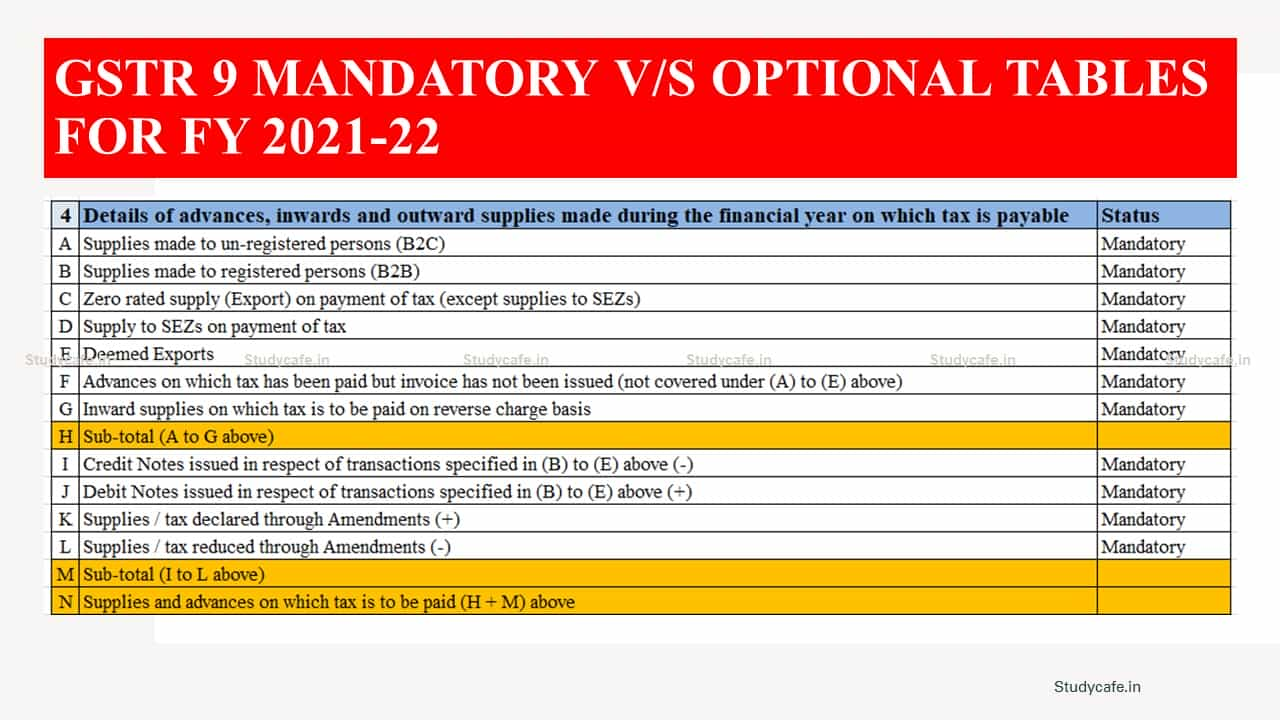

Details of advances, inwards and outward supplies made during the financial year on which tax is payable

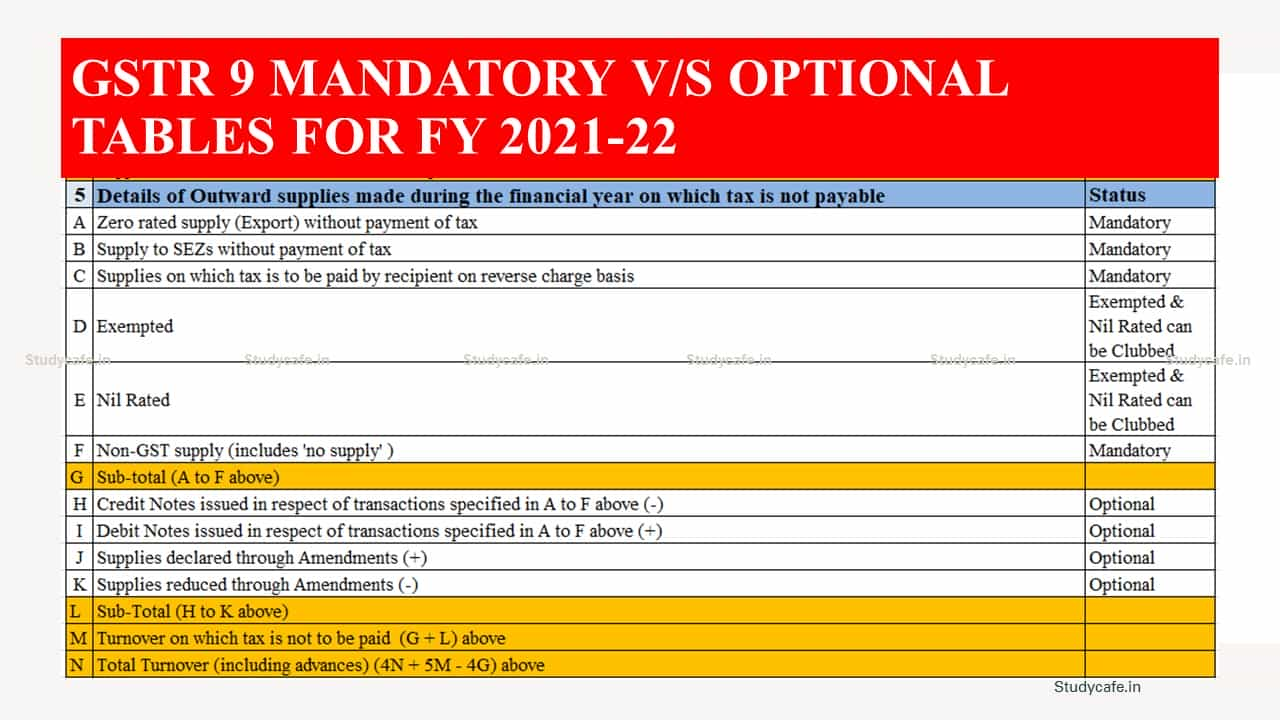

Details of Outward supplies made during the financial year on which tax is not payable

Details of ITC availed during the financial year

Details of ITC Reversed and Ineligible ITC for the financial year

Other ITC-related information and other Tables

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"