CA Pratibha Goyal | Nov 26, 2022 |

GSTR 9C MANDATORY V/S OPTIONAL TABLES FOR FY 2021-22

This Article discusses a List of entries in Form GSTR-9C (GST Reconciliation Statement) that were Mandatory/ optional in FY 21-22.

You May Also Refer: List of Optional Entries made compulsory in Form GSTR-9 for FY 2021-22

Also Refer: List of Optional Entries made compulsory in Form GSTR-9C for FY 2021-22

Also Refer: GSTR 9 MANDATORY V/S OPTIONAL TABLES FOR FY 2021-22

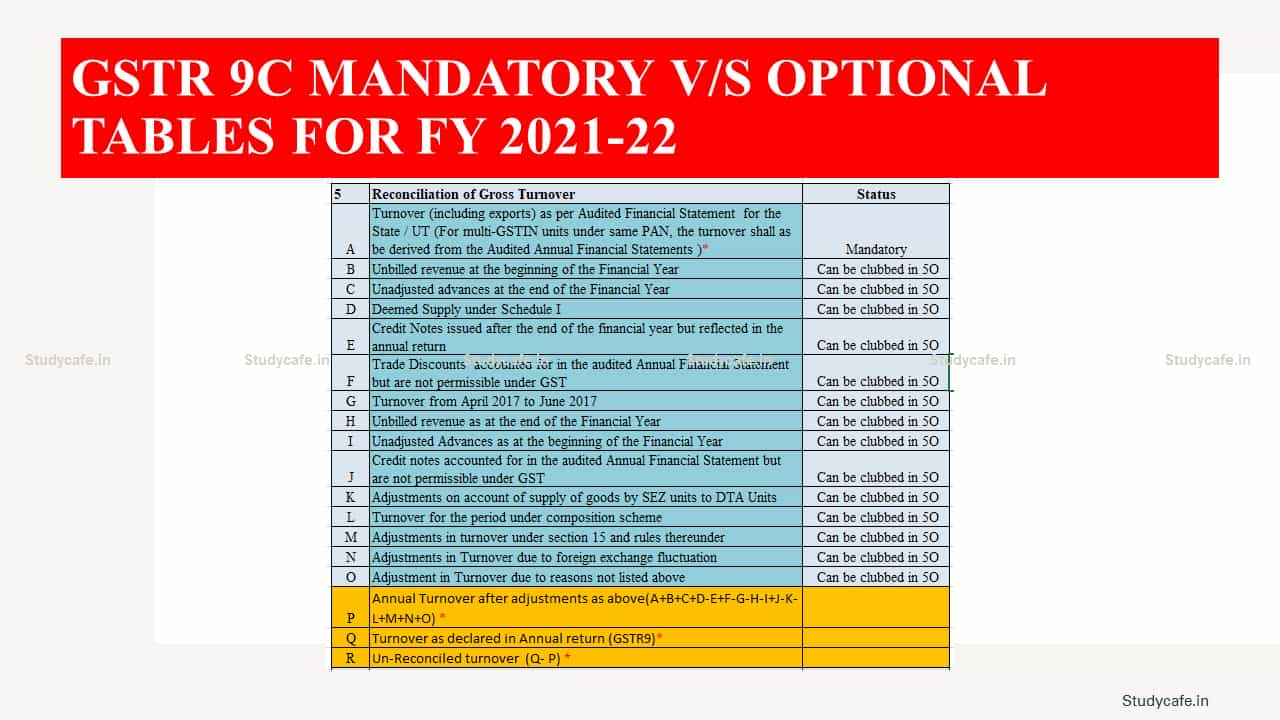

Reconciliation of Gross Turnover

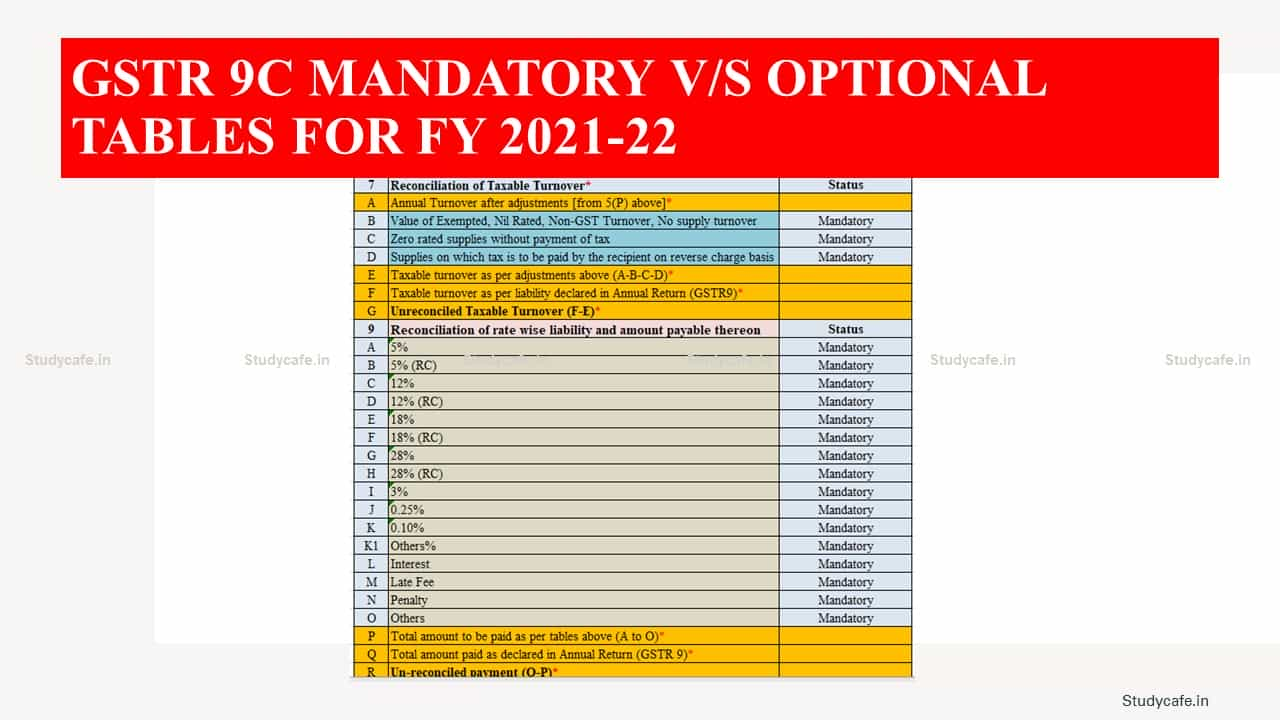

Reconciliation of Taxable Turnover

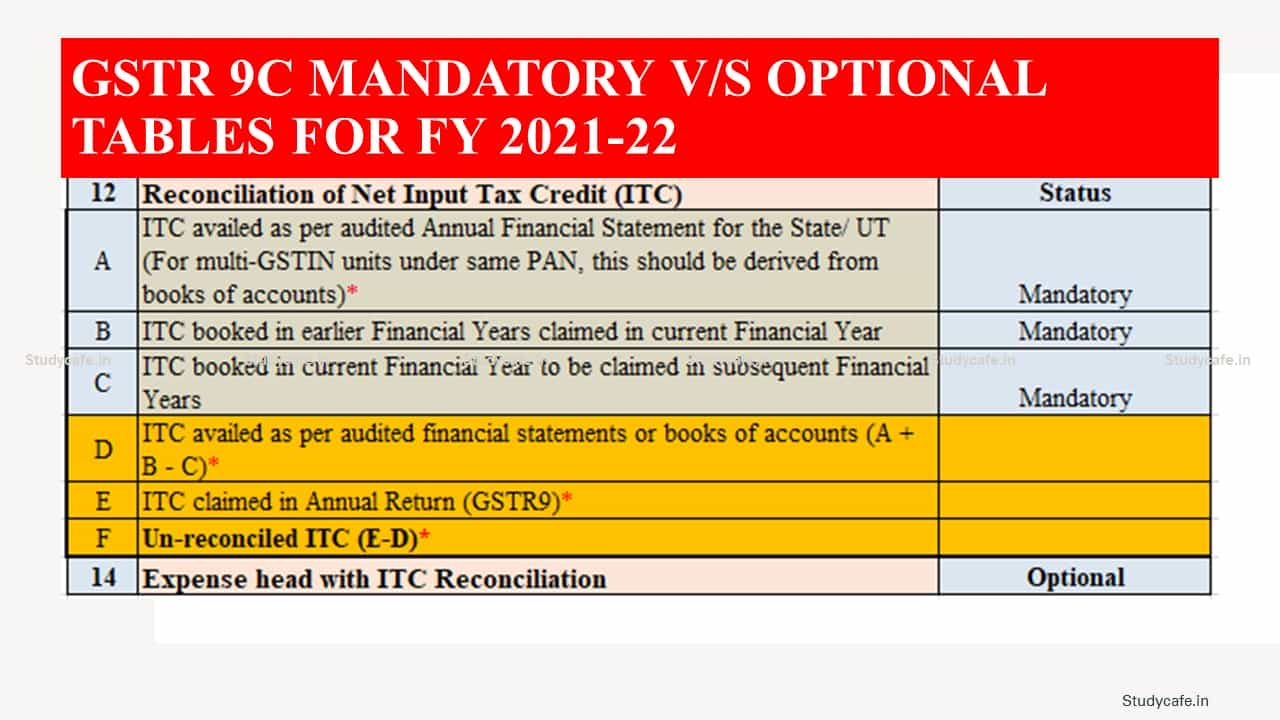

Reconciliation of Net Input Tax Credit (ITC)

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"