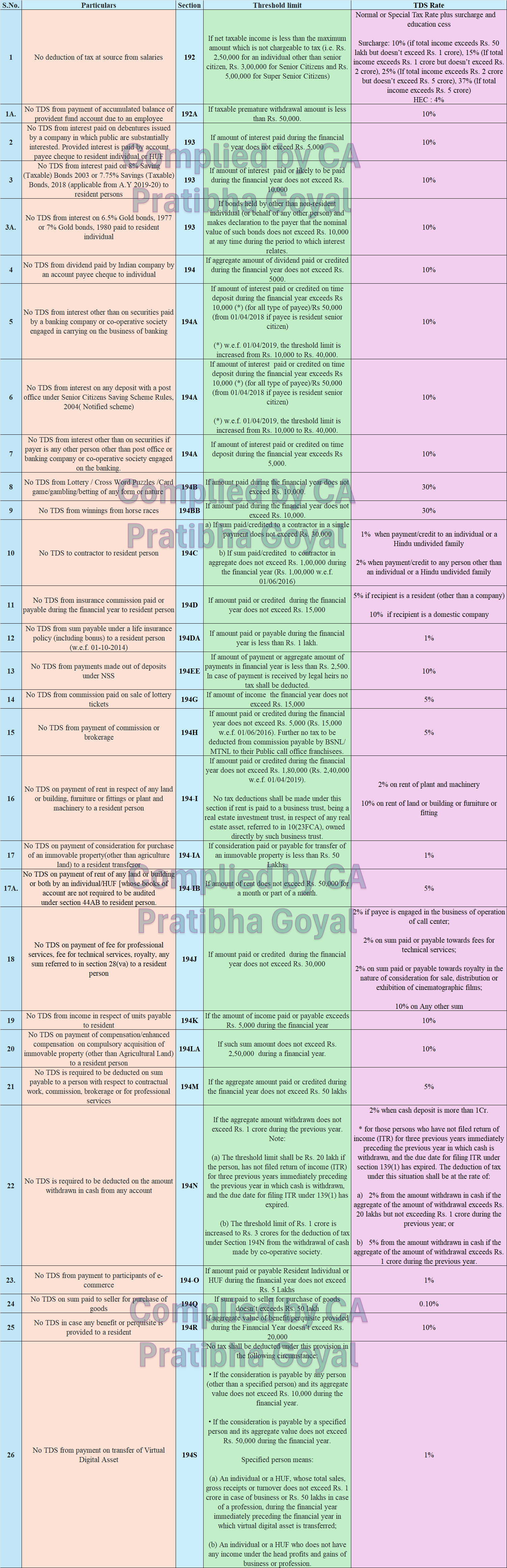

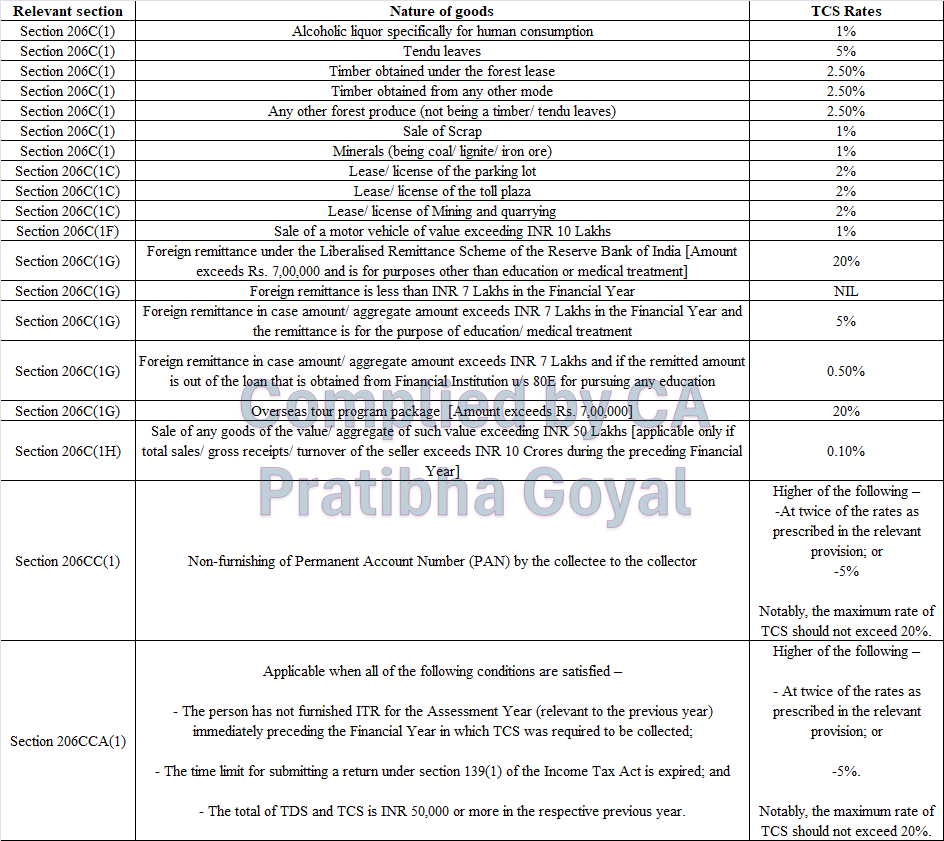

Read date chart for TDS and TCS Due Date Chart and TDS Rate Chart for FY 2024-25 or AY 2025-26.

CA Pratibha Goyal | Apr 5, 2024 |

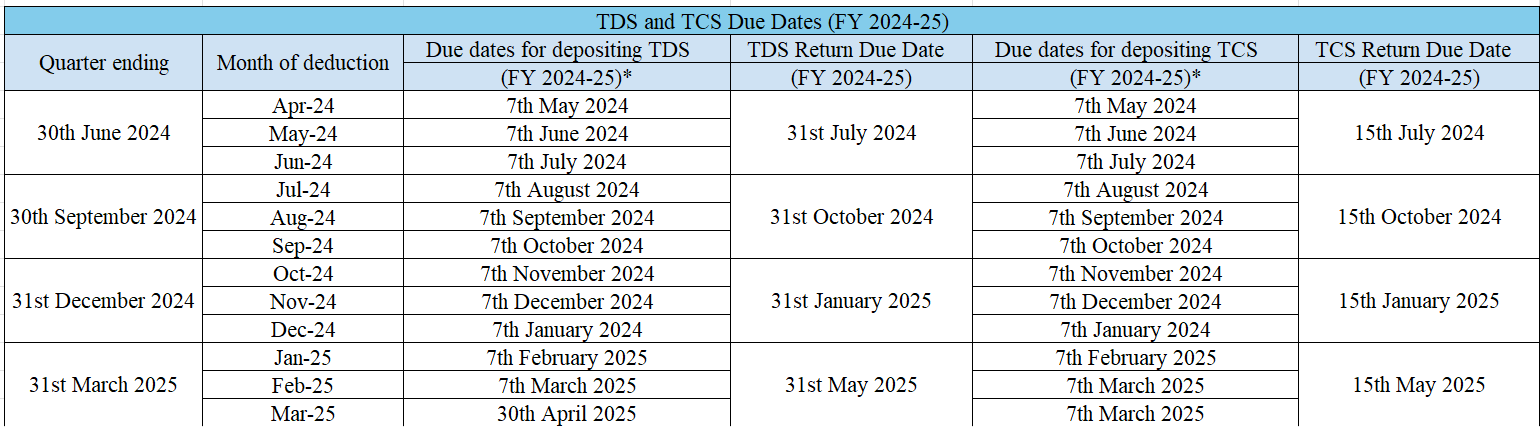

TDS and TCS Due Date Chart for FY 2024-25 | AY 2025-26

Tax Deducted at source (TDS) and Tax Collected at source (TCS) plays an important source of Tax collection for the Income Tax Department. Thus delay in collection or deduction of tax, delay in payment of TDS/TCS and filing TDS and TCS Return, leads to good quantum of Interest and Late fees.

Here is a due date chart for TDS and TCS Due Date Chart for FY 2024-25 | AY 2025-26

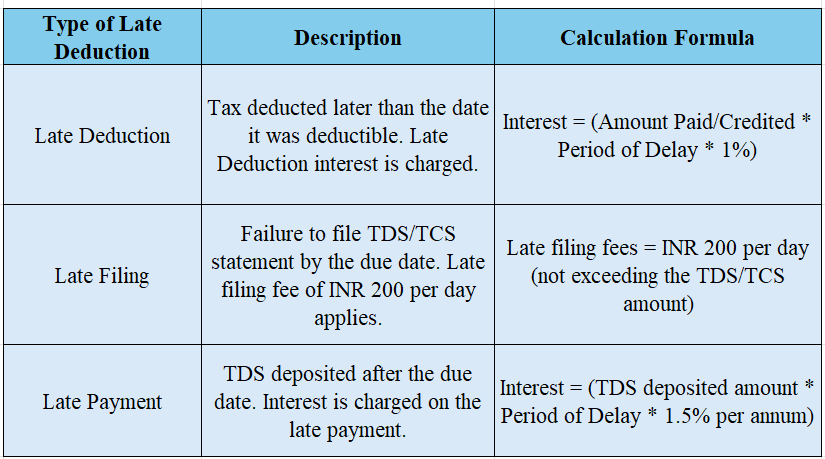

Interest applicable on Non-Deduction/ Collection or Late Deduction/ Collection of TDS and TCS

Non-Deduction/Collection of TDS/TCS

The interest of 1% is applicable on Non-Deduction/ Collection of TDS/TCS for the month or part of the month.

Non-payment to government after Deduction/Collection of TDS/TCS

The interest of 1.5% is applicable on Non-payment to government after Deduction/Collection of TDS/TCS for the month or part of the month.

Meaning of the month or part of the month:

Let’s understand this with the help of an example. M/S ABC Limited made a payment of Rs. 45000 as professional Fees to Mr X. Payment was made on 6th April without deduction of TDS. Later on TDS of Rs was deducted on 3rd May and paid to the government on 10th August.

Interest for Non-Deduction between 6th April to 3rd May will be calculated as 4500 X 1% X 2 Months.

Interest for Non-payment between 3rd May to 10th August will be calculated as 4500 X 1.5% X 4 Months.

Late Filing fees of TDS and TCS returns

According to section 234E, if an individual does not submit the TDS/TCS statement by the deadline specified by the Income Tax Act of 1961, they will be responsible for paying INR 200 for each day that the failure persists.

Maximum of Late Filing fees which can be charged

The total amount of TDS/TCS deducted or collected cannot be greater than the amount of late filing costs.

So basically we need to take care of Late deduction, Late Payment and Late Filing Fees:

Click here to Download the Chart in Pdf. Form

Hope you find this material helpful.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"