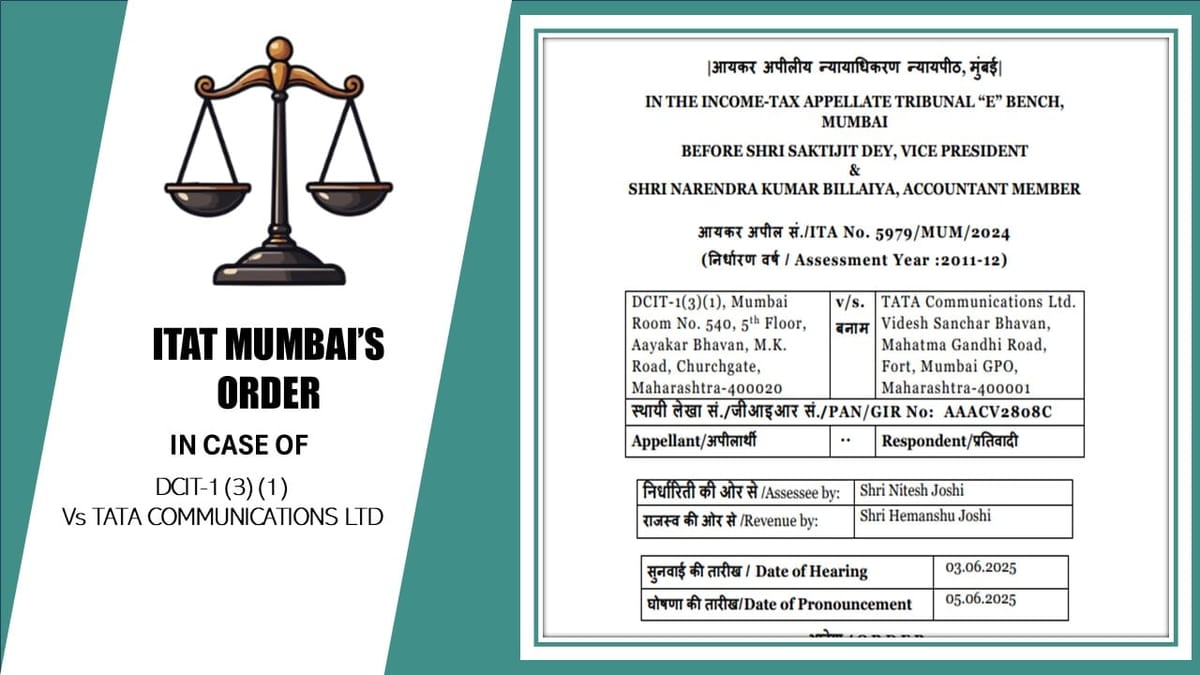

ITAT holds that TDS credit supported by physical certificates cannot be allowed automatically without verification by the Assessing Officer.

CA Pratibha Goyal | Jun 7, 2025 |

TDS Credit Cannot be Allowed Automatically on Basis of Physical Certificates without Verification: ITAT

Briefly stated facts of the case are that an assessment was framed u/s 143(3) r.w.s. 92CB(3) of the Act vide order dated 21.03.2018. While allowing tax credit, AO denied the TDS credit, which was supported by physical certificates amounting to Rs 4,87,05,943/-. The assessee agitated the matter before CIT(A), and the CIT(A) drawing support from the decision of the Hon’ble Delhi High Court in the case of Court On Its Own Motion v/s CIT in WP (Civil) 2659/2012 order dated 14.03.2013 held that once a valid TDS certificate had been produced, the AO is directed to give the credit to TDS as claimed by the assessee.

The DR strongly contended that without verifying the facts, the TDS credit cannot be allowed and prayed for the modification of the finding of the CIT(A).

Per contra, the counsel strongly stated that once the tax credit is supported by a valid TDS certificate, there is no question of any verification and denial. In support of his contention, strong reliance was placed on the decision of the coordinate bench in ITA Nos. 852 and 853/Mum/2014 for AY 2010-11 and 2011-12. The counsel pointed out that the said order of the coordinate bench has been upheld by the Hon’ble High Court of Bombay in ITA Nos. 1745 & 1746 of 2016 by order dated 22.01.2019.

The tribunal noticed that the Hon’ble High Court held that, “Resultantly, the Tribunal only directed the AO to verify the correct facts and give credit of TDS to the assessee. No question of law arises.”

In line of the findings given by the Hon’ble jurisdictional High Court (supra), the Tribunal directed the AO to allow full credit of TDS supported by the physical certificates, but after verifying the correct facts.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"