The Department of Trade and Taxes has notified Time barring of Scrutiny of GST Returns taxpayers for the FY 2017-18, 2018-19 & 2019-20 via issuing Circular.

Reetu | May 10, 2023 |

Time barring of Scrutiny of GST Returns taxpayers for the FY 2017-18, 2018-19 & 2019-20

The Department of Trade and Taxes has notified Time barring of Scrutiny of GST Returns taxpayers for the FY 2017-18, 2018-19 & 2019-20 via issuing Circular.

Under the provisions of Section 73(10) of DGST Act, the Proper Officer shall issue the order under sub-section (9) within three years from the due date For furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilized relates to or within three years from the date of erroneous refund. The provision of scrutiny returns are specified under Section-61 of DGST act, 2017 and Rule 99 of DGST Rules, 2017.

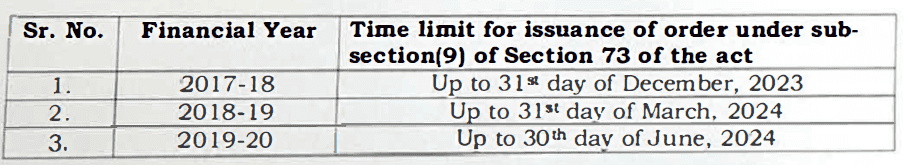

The Central Board of Indirect Taxes & Customs (CBIC), Ministry of Finance, GoI vide notification No. 9/2023 Central Tax dated 31.03.2023 has extended the time limit specified u/s 73(10) for issuance of order u/s 73(9) of CGST Act, 2017 for recovery of tax not paid or short paid or input tax credit wrongly availed or utilized for any reason other than reason of fraud or any willful misstatement or suppression of facts to evade tax relating to the period as specified below:-

The whole process of scrutiny of return u/s 61 and rule 99 of DGST Act takes around 5 to 6 months, hence, all Ward lncharges/Proper Officers are hereby advised to ensure timely issuance of order u/s 73(9) for the scrutiny of returns for periods as mentioned in the CBIC vide Notification No. 9 /2023 Central Tax dated 31.03.2023.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"