Updated RPU/FVU of Form 26Q, 27Q & 27EQ to be made available shortly: Taxpayers to check before filing TDS Return

CA Pratibha Goyal | Jul 4, 2023 |

Updated RPU/FVU of Form 26Q, 27Q & 27EQ to be made available shortly: Taxpayers to check before filing TDS Return

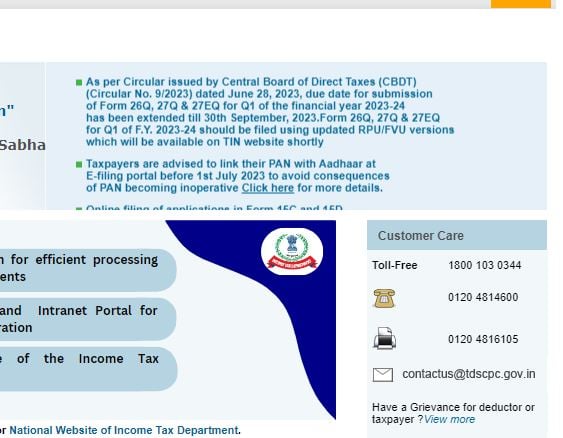

As per the Income Tax Circular issued by the Central Board of Direct Taxes (CBDT) (Circular Number 9/2023) dated June 28, 2023, the due date for submission of the TDS Return in Form 26Q, 27Q & 27EQ for Q1 of the financial year 2023-24 has been extended till 30th September 2023. Earlier the due date for the Quarter was 31st July 2023.

Form 26Q, 27Q & 27EQ for Q1 of F.Y. 2023-24 should be filed using updated RPU/FVU versions which will be available on the TIN website shortly.

Please note that statements filed before the release of the new utility might be rejected by traces and taxpayers might be required to file the TDS Return once again when the updated utility is released.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"