Reetu | Dec 9, 2021 |

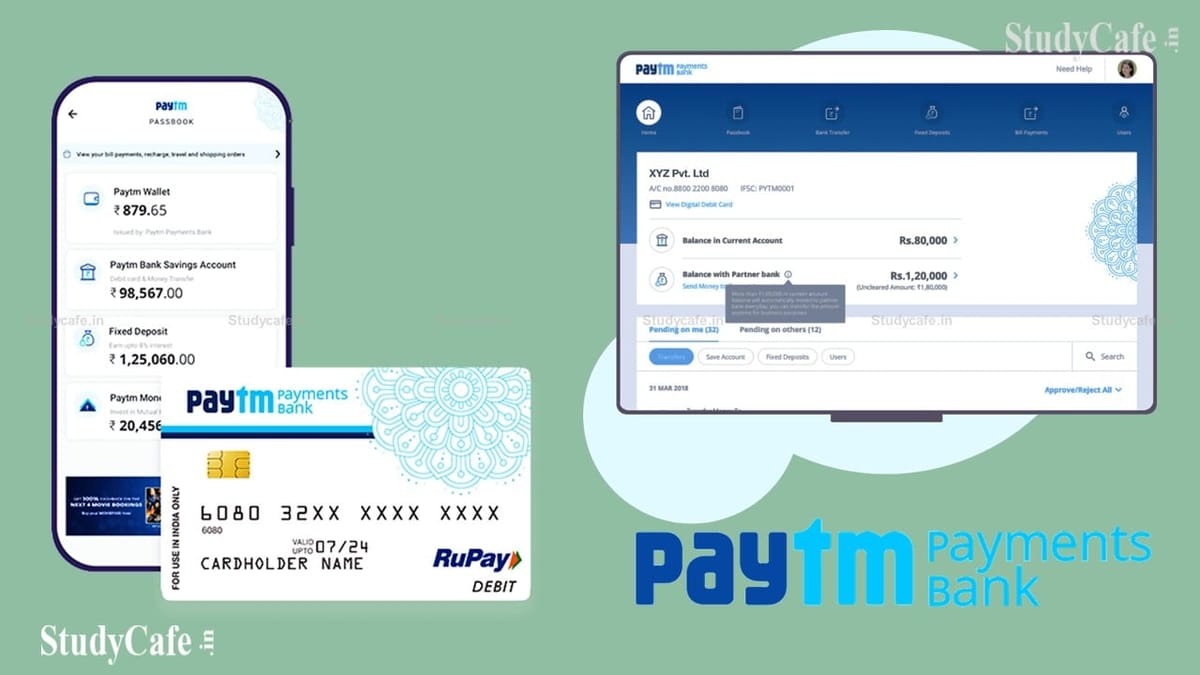

Paytm Payments Bank receives Scheduled Bank status from RBI

Paytm Payments Bank Limited (PPBL), a Paytm subsidiary, has been granted Scheduled Bank status by the Reserve Bank of India (RBI) and is now included in the Second Schedule to the Reserve Bank of India Act, 1934.

It has emerged as one of the country’s leading enablers of digital payments.

Paytm Payments Bank, as a Scheduled Payments Bank, can now pursue new business options. The bank can participate in RFPs issued by the government and other big enterprises, primary auctions, fixed-rate and variable-rate repos, and reverse repos, as well as the Marginal Standing Facility. Paytm Payments Bank is now eligible to participate in government-run financial inclusion initiatives.

“We have seen a rapid acceptance of digital banking services, with customers loving the new era of banking in India,” Satish Kumar Gupta, MD & CEO of Paytm Payments Bank Ltd, said. “The inclusion of Paytm Payments Bank under the Reserve Bank of India Act, 1934’s Second Schedule would enable us to innovate even more and provide more financial services and products to India’s underserved and unserved population.”

The second schedule of the RBI Act 1934 includes banks that satisfy the central bank that their businesses are not being conducted in a manner that is damaging to the interests of their depositors.

With payment tools including Paytm Wallet, Paytm FASTag, net banking, and Paytm UPI, Paytm Payments Bank has become one of the country’s leading enablers of digital payments.

Consumers may make payments at over 87,000 online retailers and 2.11 crore in-store merchants thanks to the bank’s 33.3 crore Paytm Wallets.

Paytm Payments Bank is the largest beneficiary bank and one of the top remitter banks for UPI transactions in the country, with over 15.5 crore Paytm UPI handles generated and utilised to send and receive payments.

Paytm Payments Bank also became the country’s largest issuer and acquirer of FASTags in the previous fiscal year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"