Deepak Gupta | Nov 22, 2022 |

List of Optional Entries made compulsory in Form GSTR-9C for FY 2021-22

This Article discusses List of entries in Form GSTR-9C (GST Reconcilliation Statement) that were optional before FY 21-22 and have been made compulsory in Form GSTR-9C for FY 2021-22.

You May Also Like: List of Optional Entries made compulsory in Form GSTR-9 for FY 2021-22

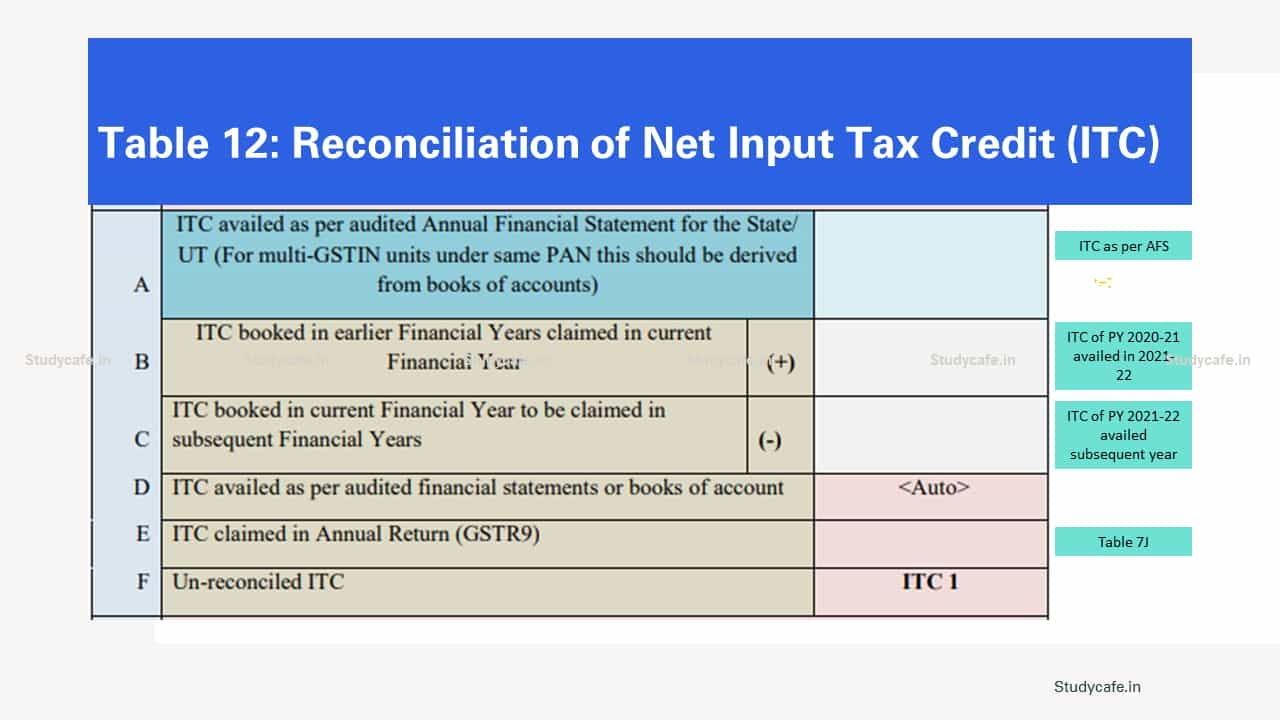

Table 12B

Any ITC which was booked in the audited Annual Financial Statement of earlier financial year(s) but availed in the ITC ledger in the financial year for which the reconciliation statement is being filed for shall be declared here. This shall include transitional credit which was booked in earlier years but availed during Financial Year 2017-18.

For FY 2017-18, 2018-19, 2019-20 and 2020-21, the registered person shall have an option to not fill this Table. This Table has been made compulsory in FY 2021-22.

Table 12C

Any ITC which has been booked in the audited Annual Financial Statement of the current financial year but the same has not been credited to the ITC ledger for the said financial year shall be declared here.

For FY 2017-18, 2018-19, 2019-20 and 2020-21, the registered person shall have an option to not fill this Table. This Table has been made compulsory in FY 2021-22.

Benefits that are continuing:

Consolidated Reporting of all Adjustments from 5B to 5N can be done in Row 5O

Reporting in Table 14 is Optional

The Following is Summarised in below-mentioned Table:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"