Reetu | Dec 20, 2022 |

DGFT issued Guidelines for import of Pet Animals

The Directorate General of Foreign Trade(DGFT) has issued Guidelines for import of Pet Animals via issuing Trade Notice.

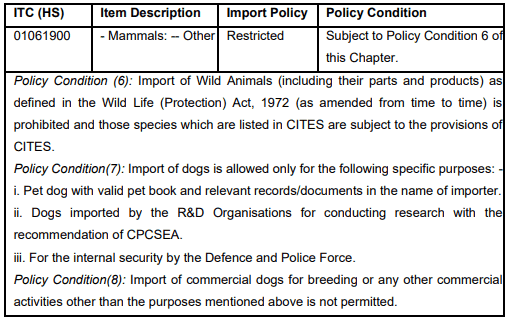

The Notice Stated, “Several requests are being received for clarifications regarding the import of Pet animals (cats/dogs). In this regard, it is submitted that the import policy provisions for ‘other’ mammals including pet animals (cats/dogs).”

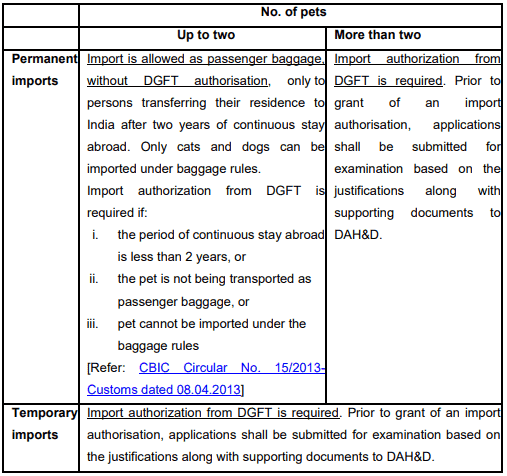

Imports of Pet Animals may be through Cargo as well as part of Passenger baggage. Reference the above-mentioned Import Policy provisions and in accordance with the CBIC Circular No. 15/2013 Customs dated 08.04.2013, requirement of import authorization is summarized as follows –

Steps to Apply for an import authorisation to DGFT are as follows:

An application for grant of an Import Authorisation may be submitted (as per ANF-2M of the FTP) along with documents enlisted under Para 3. The application may be submitted against their Importer Exporter Code (IEC), if the applicant has one. Alternatively, they may apply against the permanent IEC No. IIHIE0153E, i.e., IEC for ‘Persons /Institutions /Hospitals importing or exporting goods for personal use, not connected with trade or manufacture or agriculture’.

This online application may be submitted on the DGFT Website (https://dgft.gov.in) by navigating to → Services → Import Management System → Import Authorisation of Restricted Items → Apply for a new Authorization

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"