Reetu | May 5, 2023 |

Ministry of Finance notifies Custom Duty Rates on Saturated Fatty Alcohol of Carbon Chain

The Department of Revenue under Ministry of Finance has notified Custom Duty Rates on Saturated Fatty Alcohol of Carbon Chain via issuing Notification.

The Notifications Stated, “Whereas, in the matter of “Saturated Fatty Alcohol of Carbon chain length C10 to C18 and their blends” (hereinafter referred to as the subject goods) falling under sub-headings 2905 17, 2905 19 and 3823 70 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act), originating in or exported from Indonesia, Malaysia and Thailand (hereinafter referred to as the subject countries), and imported into India, the Designated Authority in its final findings, published in the Gazette of India, Extraordinary, Part I, Section 1, vide notification No. 6/18/2021-DGTR, dated the 7th February, 2023, has come to the conclusion that-

(i) the subject goods have been exported to India from the subject countries at subsidized prices;

(ii) the domestic industry has suffered material injury due to subsidisation of the subject goods;

(iii) the material injury has been caused by the subsidised imports of the subject goods originating in or exported from the subject country,

and has recommended the imposition of definitive countervailing duty on imports of the subject goods originating in or exported from the subject countries.”

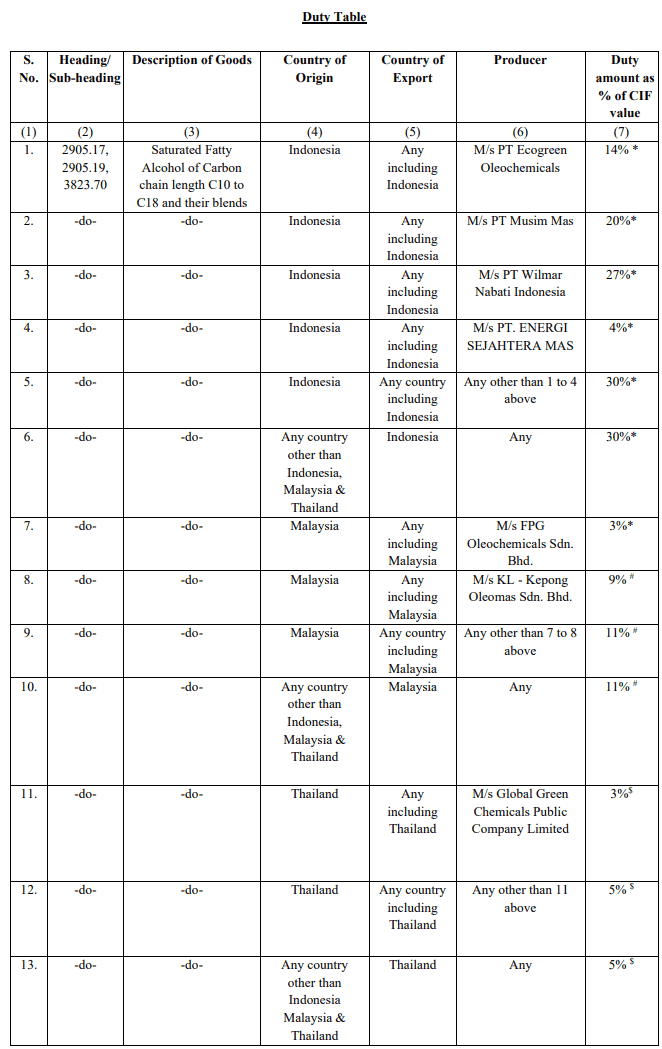

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (6) of section 9 of the Customs Tariff Act, read with rules 20 and 22 of the Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the Designated Authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under sub-heading of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the producers as specified in the corresponding entry in column (6), and imported into India, countervailing duty calculated at the rate mentioned in the corresponding entry in column (7) of the said Table, namely:-

The countervailing duty imposed under this notification shall be levied for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette and shall be payable in Indian currency.

Explanation: – For the purposes of this notification,

(a) the rate of exchange applicable for the purposes of calculation of such countervailing duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Act.

(b) “CIF value” means the assessable value as determined under section 14 of the Customs Act, 1962 (52 of 1962).

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"