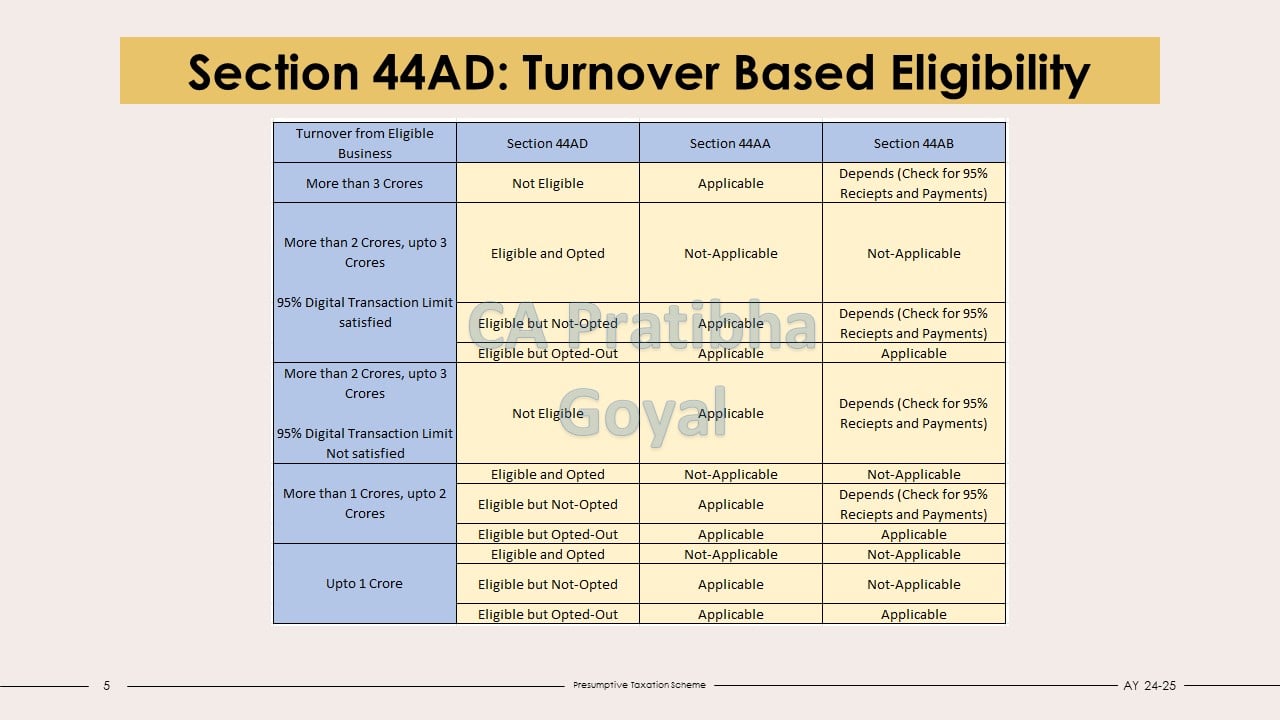

For Section 44AD, the revised limit for opting Income Tax Presumptive Taxation Scheme from Assessment Year 2024-25 is Rs. 3 crore.

CA Pratibha Goyal | Feb 20, 2024 |

All About New Limits of Income Tax Presumptive Taxation Scheme

Budget 2023 has enhanced limits for the Income Tax Presumptive Taxation Scheme for Businesses (Section 44AD) and Professionals (Section 44ADA). The new limits are applicable from Assessment Year 2024-25 (Financial Year 2023-24).

This Article discusses all about Income Tax Presumptive Taxation Scheme for Section 44 AD.

For Section 44AD, the revised limit from Assessment Year 2024-25 is Rs. 3 crore. Earlier, the same was Rs. 2 crore. For Section 44ADA, the revised limit from Assessment Year 2024-25 is Rs. 75 Lakhs Earlier, the same was Rs. 50 lakh.

Read All About New Limits of Income Tax Presumptive Taxation Scheme for Professionals: Section 44ADA

The Increased Limits are subject to the condition that 95% of receipts should be through Onlinemode other than cash/ bearer or crossed cheque/ draft.

The Assessee shall be eligible assessee if he is an individual, Hindu undivided family or a partnership firm, who is a resident, but not a limited liability partnership firm as defined under clause (n) of sub-section (1) of section 2 of the Limited Liability Partnership Act, 2008 (6 of 2009).

The Assessee Opting for Presumptive Taxation Scheme u/s Section 44AD in relevant AY cannot claim deduction under any of the sections 10A, 10AA, 10B, 10BA, 80HH to 80RRB.

Any business other than the following is eligible business:

a. Business of plying, hiring or leasing goods carriages referred to in section 44AE.

b. Business of Agency.

c. Bussiness of Commission or Brokerage.

d. Profession u/s 44AA(1)

If the above conditions are satisfied, a sum equal to eight percent or more of the total turnover or gross receipts of the assessee has to be declared as the income of the assessee.

The limit of 8% is reduced to 6% in respect of the amount of total turnover or gross receipts which is received by an account payee cheque or an account payee bank draft or use of an electronic clearing system through a bank account or through such other electronic mode.

All deductions allowable under the provisions of sections 30 to 38 including Depreciation shall, are deemed to have been already given full effect to and no further deduction under those sections shall be allowed.

Further, it will be assumed that disallowance if any u/s 40, 40A and 43Bhas been considered while calculating the estimated Income u/s 44AD.

Yes, the assessee opting for Section 44AD can voluntarily declare higher income in the ITR.

The Assessee opting for Presumptive Taxation Scheme is required to Pay Advance Tax during the Financial Year. The Due Date for payment of Advance Tax is on or before 15th March.

Maintenance of Books of Accounts:

Assessee opting for Presumptive Taxation Scheme is exempted from maintaining Books of accounts.

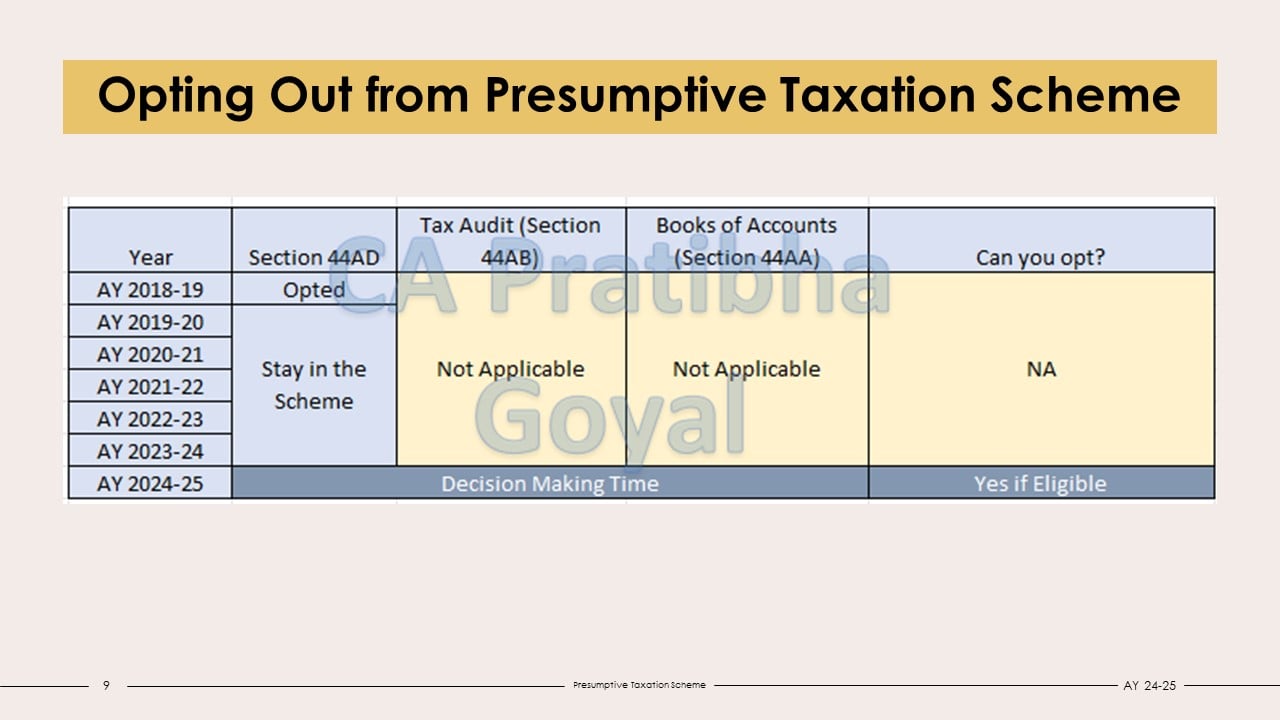

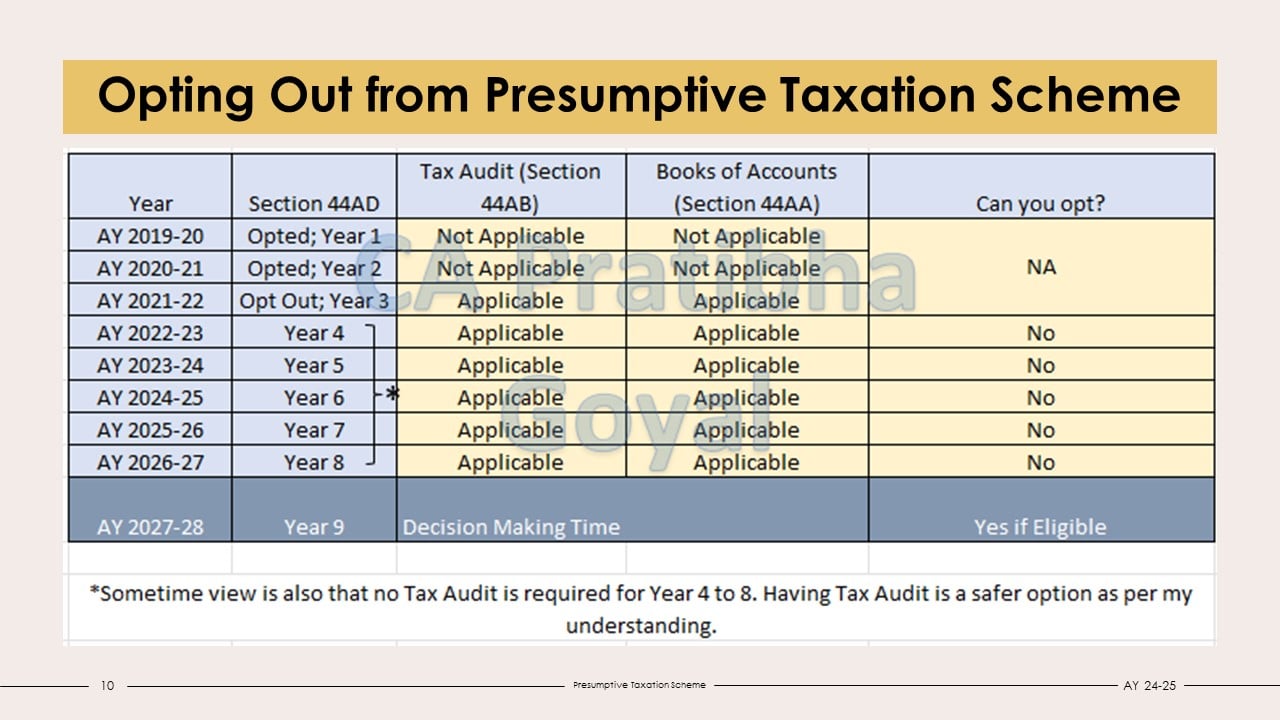

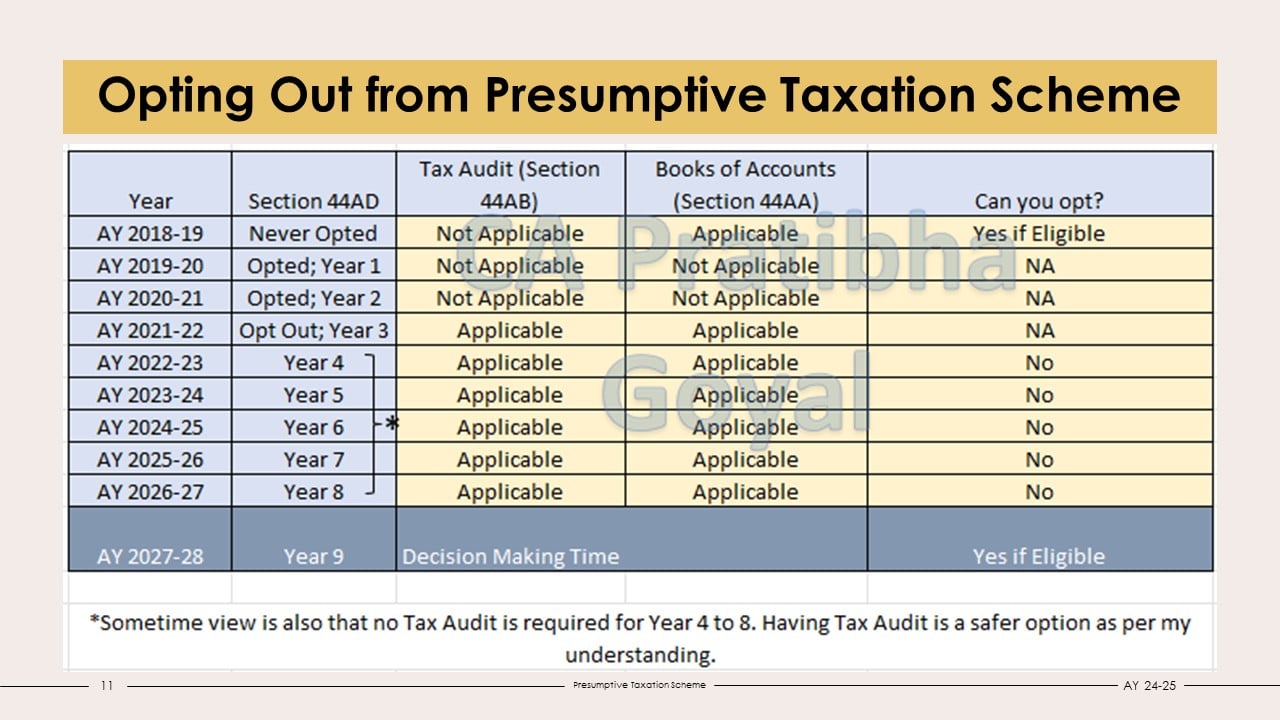

Where an eligible Assessee declares profit for any Previous year under u/s 44AD and he opts out from the presumptive Taxation Scheme in any of the 5 consecutive subsequent Assessment years, he shall not be eligible to claim the benefit of this scheme for 5 consecutive subsequent Assessment years.

Once an assessee opts out from Presumptive Taxation Scheme, for 5 consecutive subsequent Assessment years, he is required to:

a.) Maintain Books of Accounts u/s 44AA,

b.) Get his Books of Accounts audited u/s 44AB.

Example 1

Example 2

Example 3

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"