Reetu | Aug 12, 2024 |

GST Portal Important Update: GSTR-1A Activated

GSTR 1A is now active on the GST Portal; any error or mistake in GSTR1 can be corrected using GSTR1A.

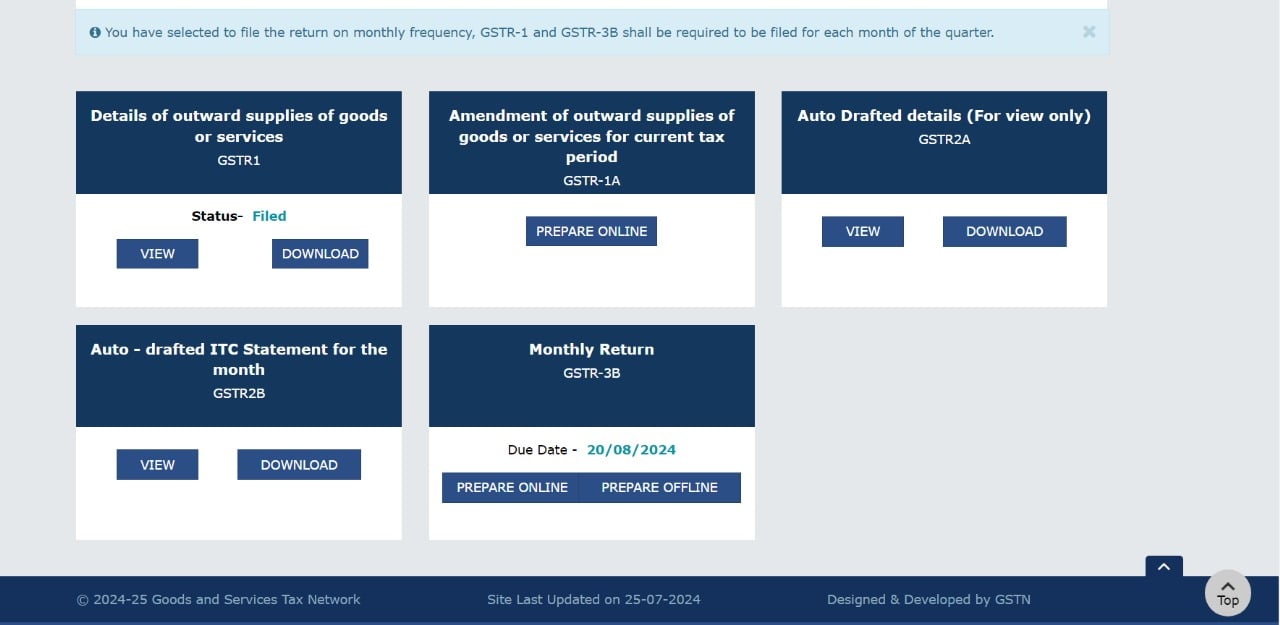

Form GSTR-1A has been made available to taxpayers for the July 2024 tax period. GSTR-1A is an optional capability to add, alter, or rectify any particulars of a supply reported/missed in the current Tax period’s GSTR-1 before filing the GSTR-3B return for the same tax period.

GSTR-1A will be available to taxpayers following the filing of GSTR-1 for a tax period or the due date of GSTR-1, whichever is later.

GSTR-1A was first introduced with the GST rollout in July 2017. It was created to track changes to the sales invoices recorded in GSTR-1. However, after only a few months of introduction, the form was discontinued due to operational issues and the shifting structure of the GST framework.

Reintroduction in 2024

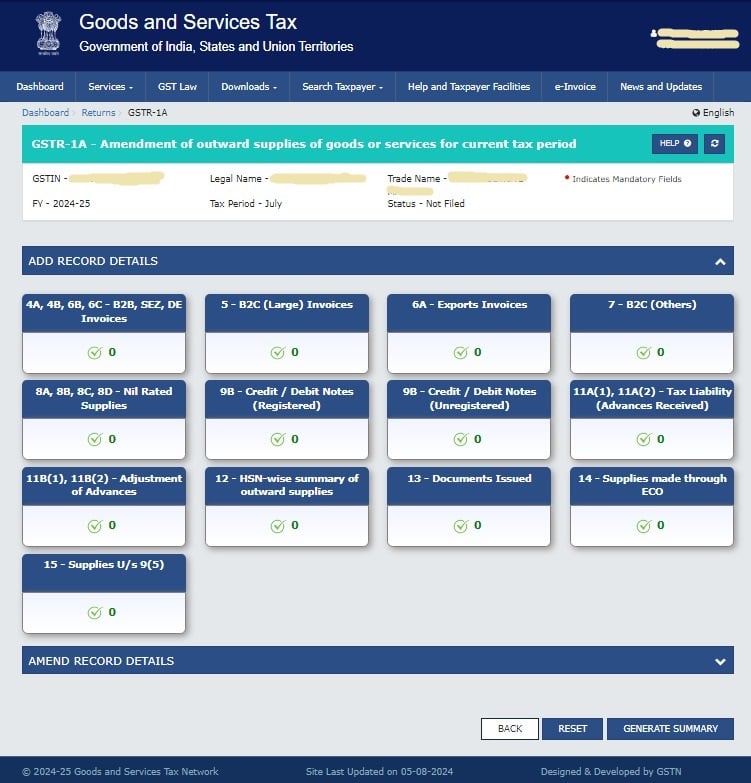

Recognizing the need for an effective process to modify and submit extra facts on sales returns, the GST Council suggested restoring FORM GSTR-1A during its 53rd meeting on June 22, 2024. This reintroduction has a more specific purpose: it allows taxpayers to alter details in FORM GSTR-1 for a tax period and/or declare new details before filing the return in FORM GSTR-3B for the same tax period.

Key Features of the New GSTR-1A

Filing Timeline for GSTR-1A

GSTR-1A is available for filing after the taxpayer has submitted GSTR-1 for the applicable tax period but before GSTR-3B. The process involves the following steps:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"