CA Pratibha Goyal | Jun 4, 2025 |

Income Tax Breaking: ITR Forms 1 and 4 now enabled in Online mode

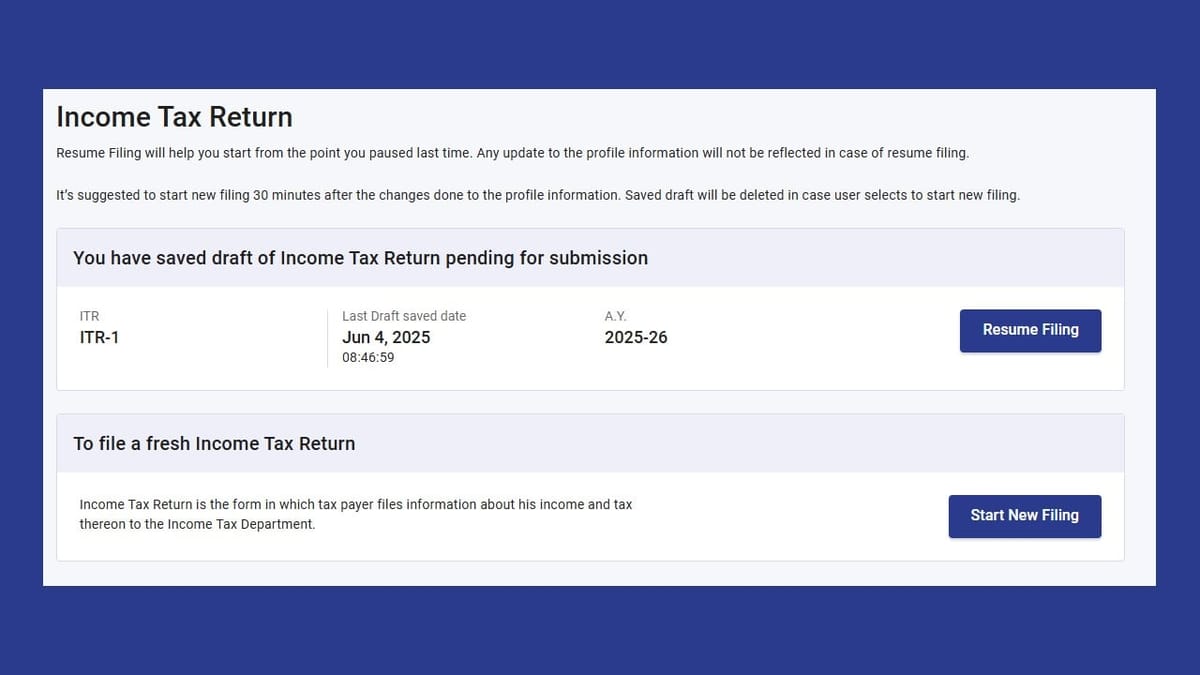

We have some good news for Income Tax Return (ITR) filers. ITR Forms 1 and 4 are now enabled to file through the online mode with prefilled data for the assessment year 2025-26 (financial year 2024-25) for taxpayers.

Income Tax Forms Available as of Now:

| ITR Form | Date of Notification | Offline | Online | |

| JSON Utility | Excel | |||

| 1 | 29.04.2025 | Common Offline Utility has not been released | Released on 29.05.2025 | Released on 04.06.2025 |

| 2 | 03.05.2025 | Not released | Not released | |

| 3 | 30.04.2025 | Not released | Not released | |

| 4 | 29.04.2025 | Released on 29.05.2025 | Released on 04.06.2025 | |

| 5 | 01.05.2025 | Not released | Not released | Not released |

| 6 | 06.05.2025 | Not released | Not released | Not released |

| 7 | 09.05.2025 | Not released | Not released | Not released |

Last week, ITR Filing Excel Utilities for ITR-1 and ITR-4 were enabled for the relevant year, and now online utilities have been enabled.

Who Can File ITR-1?

Who cannot file ITR-1?

When the above conditions are fulfilled and person has income from business and profession which is computed under sections 44AD, 44ADA or 44AE, you can file ITR-4.

Persons means Individuals, HUFs and Firms (other than LLP).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"