The CBDT has authorised select Commissioners of Income Tax to correct apparent tax errors, issue demands, and delegate powers for faster refund and assessment processing.

Saloni Kumari | Oct 28, 2025 |

CBDT Empowers CPC Bangalore to Rectify and Issue Income Tax Demand in certain cases

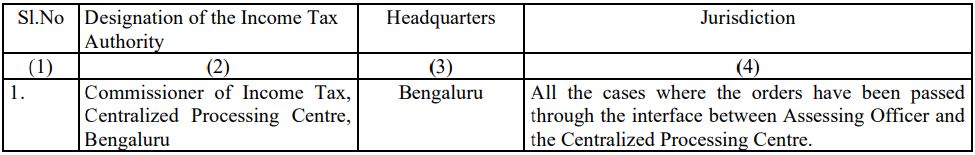

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance (Department of Revenue) has issued an official notification (No. 155/2025), dated October 27, 2025, specifying powers to certain Commissioners of Income Tax (CITs) (details of CITs and their areas or jurisdictions are given below) and allowing them to further pass on these powers to officers working under them, to make the handling of mistakes refunds, and demands quicker and smoother. Here’s the comprehensive guide on their concurrent powers:

(i) According to the notification, the Commissioner of Income-tax (mentioned below) is now permitted to exercise their concurrent powers.

1. These powers include correcting mistakes under Section 154 of the Income Tax Act 1961 that are clearly visible from the records. These include:

2. They are now permitted to issue demand notices under section 156 of the Income-tax Act, 1961, in cases mentioned above.

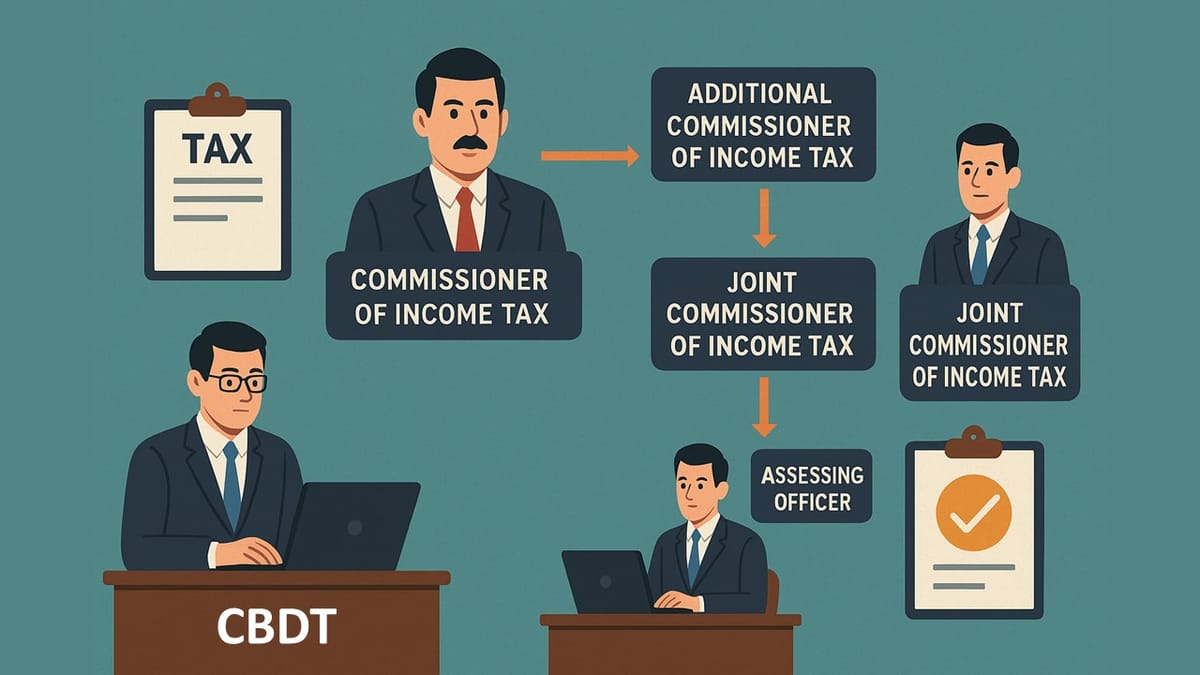

(ii) These Commissioners of Income-tax are also authorised to delegate these powers to Additional Commissioners or Joint Commissioners of Income-tax who operate under them by simply issuing orders in writing, and the delegation will apply only to the same area, persons, or types of cases mentioned in the Schedule.

(iii) After receiving these written orders from the Commissioner of Income Tax, the Additional or Joint Commissioners can then further authorise their subordinate Assessing Officers (again, through written orders) to exercise the same functions.

Refer to the official notification for complete information.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"