Nagole police investigate after advocate’s identity and forged signatures were used to register multiple companies, implicating her in a Rs 5.22 crore tax evasion case.

Vanshika verma | Oct 22, 2025 |

Advocate’s Identity Forged to Run Multiple Companies, Rs 5.22 Crore Tax Evasion Case Unfolds

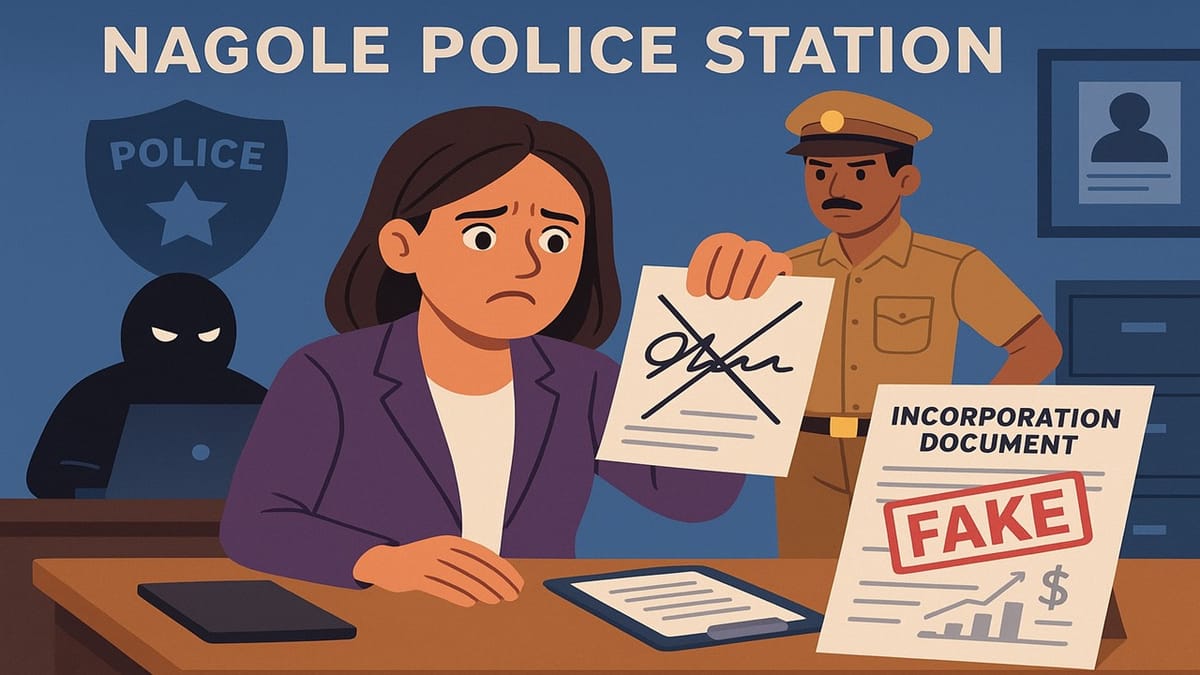

Nagole police have registered a case of cheating, forgery, and criminal conspiracy after a 43-year-old advocate from Mehdipatnam claimed that her identity and forged signatures were used to register several private companies. She alleged that this led to her being wrongly implicated in a tax evasion case worth over Rs 5.22 crore.

The case was transferred from the Hyderabad CCS to the Nagole police station after the advocate filed a detailed complaint. She told the police that she had been receiving repeated notices from the Income Tax Department, accusing her of tax evasion connected to several companies she had never heard of.

When she checked the Ministry of Corporate Affairs (MCA) portal, she found her name listed as a director and shareholder in multiple companies – Horizon Staffing Solutions Pvt. Ltd, Horizon Technical Solutions (India) Pvt. Ltd, Horizon Infra Project Avenues (India) Pvt. Ltd, Manex HR Management Solutions Pvt. Ltd. and Horizon Informatic Services (India) Pvt. Ltd.

The complainant said that all the company incorporation documents had her forged signatures and were linked to a fake email ID created in her name. Even her mother’s residential address was used without consent. She alleged that the accused, identified as M. Nizamuddin, M. Sridhara Sharma, T.V. Krishna Mohan, Ch. Pavan Kumar, and SND Associates, represented by K. Naveen Kumar, controlled the companies, managed their financial transactions, and authorised cheques without her knowledge.

She further stated that the companies were involved in financial activities but failed to file income tax returns, which led to her receiving the notices. Convinced that the act was intentional and intended to hold her responsible for evasion, she decided to take legal action against the perpetrators. The Nagole police have initiated an investigation into the identity theft and the falsification of company documents. Authorities are working closely with the Income Tax Department and the Registrar of Companies to examine filings, digital signatures, and ownership records.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"